Providence Medicare Advantage: Comprehensive Coverage Guide

The healthcare landscape in the United States is complex, with numerous options available to individuals seeking comprehensive coverage. For those eligible for Medicare, the array of plans can be daunting, with each offering unique benefits and drawbacks. Providence Medicare Advantage plans are among the options available, promising a blend of flexibility, extensive coverage, and cost-effectiveness. This guide is designed to navigate the intricacies of Providence Medicare Advantage, providing a detailed understanding of its coverage, benefits, eligibility, and how it compares to other Medicare options.

Understanding Medicare Advantage Plans

Before diving into the specifics of Providence Medicare Advantage, it’s essential to understand what Medicare Advantage plans are. Medicare Advantage, also known as Medicare Part C, is an alternative to Original Medicare (Part A and Part B). These plans are offered by private insurance companies approved by Medicare. They must cover all the services that Original Medicare covers, but they can also offer additional benefits, such as vision, dental, and hearing services, which are not typically covered by Original Medicare.

Overview of Providence Medicare Advantage

Providence Medicare Advantage plans are designed to provide comprehensive healthcare coverage, including all Medicare Part A and Part B benefits, and often additional benefits that Original Medicare does not cover. These plans may include:

- Medical Coverage: Including doctor visits, hospital stays, and other medical services.

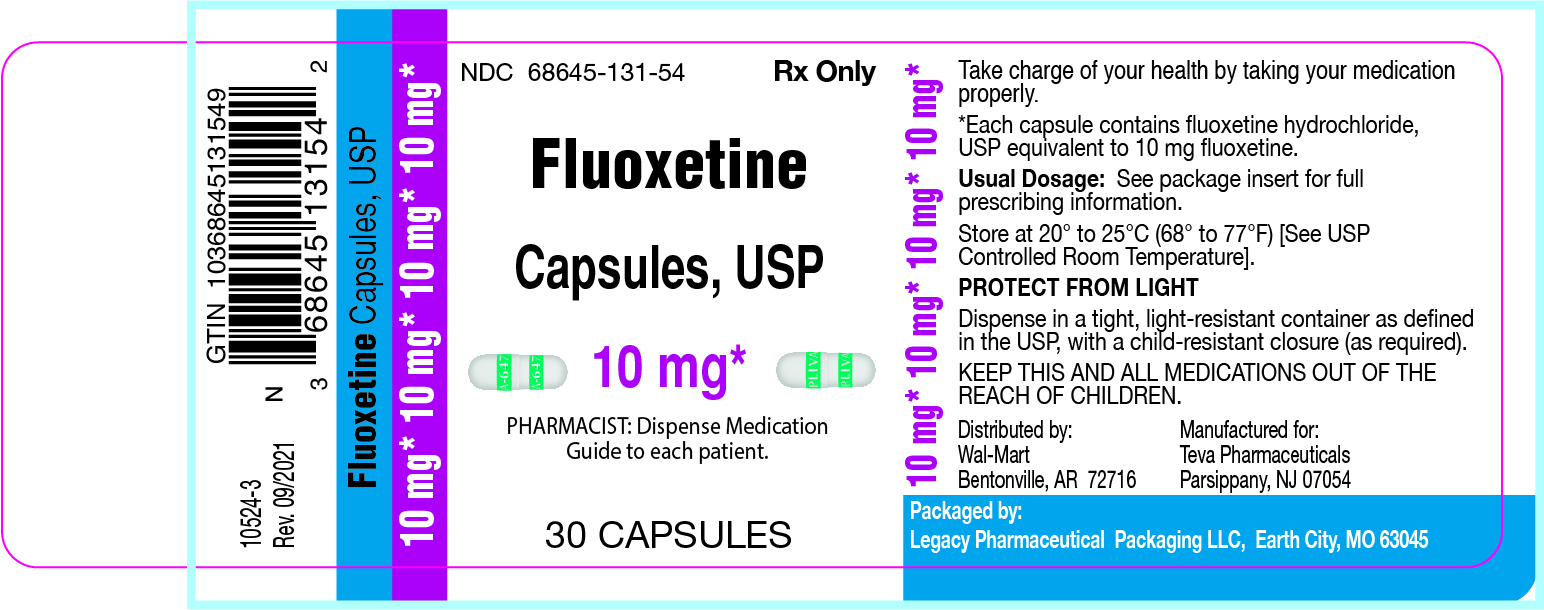

- Prescription Drug Coverage: Many Providence Medicare Advantage plans include Part D prescription drug coverage, helping to manages the costs of medications.

- Additional Benefits: Such as dental, vision, hearing, fitness programs, and transportation to medical appointments, which can vary by plan.

Eligibility for Providence Medicare Advantage

To be eligible for a Providence Medicare Advantage plan, you must:

- Be Eligible for Medicare: This typically means you are 65 or older, or you have a qualifying disability.

- Live in the Plan’s Service Area: Each Medicare Advantage plan has a specific service area. You must live in this area to be eligible.

- Not Have End-Stage Renal Disease (ESRD): With some exceptions, Medicare Advantage plans do not cover individuals with ESRD.

Enrollment Periods for Providence Medicare Advantage

Enrollment in a Medicare Advantage plan, including Providence Medicare Advantage, can occur during specific periods:

- Initial Coverage Election Period (ICEP): When you first become eligible for Medicare, you can enroll in a Medicare Advantage plan.

- Annual Election Period (AEP): Each year, from October 15 to December 7, you can change your Medicare Advantage plan or switch to Original Medicare.

- Special Election Periods (SEPs): Certain life events, like moving or losing current coverage, may qualify you for a SEP to change your plan outside of the AEP.

Benefits of Providence Medicare Advantage

The benefits of choosing a Providence Medicare Advantage plan can be significant:

- Comprehensive Coverage: Beyond the standard Medicare benefits, these plans often include additional services that can improve your overall health and quality of life.

- Predictable Costs: Many plans offer predictable copays and coinsurance, which can help you budget for healthcare expenses.

- Network Providers: Plans typically have a network of healthcare providers, which can help coordinate your care and reduce out-of-pocket costs.

Comparing Providence Medicare Advantage to Other Options

When considering Medicare coverage, it’s crucial to compare the benefits and drawbacks of Providence Medicare Advantage against other options, such as Original Medicare, Medicare Supplement Insurance (Medigap), and other Medicare Advantage plans. Factors to consider include:

- Coverage: What services are included, and are there any additional benefits?

- Cost: Premiums, deductibles, copays, and coinsurance can vary significantly between plans.

- Provider Network: If you have preferred healthcare providers, ensure they are part of the plan’s network.

- Star Ratings: Medicare rates plans based on quality and performance. Higher ratings can indicate better plan quality.

Making an Informed Decision

Choosing the right Medicare plan is a personal decision that depends on your health needs, budget, and preferences. It’s essential to research thoroughly, considering all available options and seeking advice from a licensed insurance agent or broker who is well-versed in Medicare plans. They can help you navigate the complexities and find a plan that aligns with your needs.

Conclusion

Providence Medicare Advantage plans offer a compelling option for those seeking comprehensive coverage and additional benefits beyond what Original Medicare provides. By understanding the nuances of these plans, including their coverage, eligibility requirements, and the enrollment process, you can make an informed decision about your healthcare coverage. As with any significant decision, it’s crucial to weigh the pros and cons, consider your individual circumstances, and potentially seek professional guidance to ensure you select the plan that best fits your health and financial needs.

What is the primary difference between Providence Medicare Advantage and Original Medicare?

+The primary difference is that Providence Medicare Advantage offers additional benefits not covered by Original Medicare, such as dental, vision, and hearing services, and may have different costs and provider networks.

Can I enroll in a Providence Medicare Advantage plan at any time?

+No, enrollment in a Medicare Advantage plan is typically limited to specific periods, such as the Annual Election Period or when you first become eligible for Medicare, unless you qualify for a Special Election Period.

How do I choose the right Providence Medicare Advantage plan for my needs?

+Consider your health needs, budget, and preferences. Research the coverage, costs, and provider networks of available plans. It may be helpful to consult with a licensed insurance agent or broker who specializes in Medicare plans.