What Is A High Deductible

A high deductible is a type of health insurance plan that requires the policyholder to pay a significant amount of money out-of-pocket before the insurance coverage kicks in. This amount is known as the deductible, and it can range from a few thousand dollars to tens of thousands of dollars per year, depending on the specific plan.

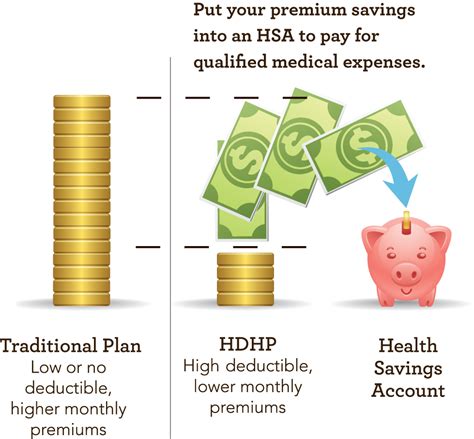

High deductible health plans (HDHPs) are often paired with a health savings account (HSA), which allows individuals to set aside pre-tax dollars to pay for medical expenses. The idea behind HDHPs is that by requiring policyholders to pay more upfront, they will be more incentivized to make cost-conscious decisions about their healthcare.

For example, let’s say an individual has an HDHP with a deductible of 5,000. If they need to undergo a surgical procedure that costs 20,000, they will need to pay the first 5,000 out-of-pocket. After that, the insurance company will cover the remaining 15,000.

HDHPs can be attractive to individuals who are relatively healthy and don’t expect to incur significant medical expenses. By choosing a plan with a higher deductible, they may be able to lower their monthly premiums. However, for individuals with chronic health conditions or those who require frequent medical care, an HDHP may not be the best option.

How High Deductible Health Plans Work

High deductible health plans typically work as follows:

- Deductible: The policyholder pays a certain amount of money out-of-pocket before the insurance coverage kicks in.

- Co-insurance: After the deductible is met, the insurance company pays a percentage of the medical expenses, and the policyholder pays the remaining percentage.

- Co-payment: The policyholder may also be required to pay a fixed amount for certain medical services, such as doctor visits or prescription medications.

- Out-of-pocket maximum: The policyholder’s total out-of-pocket expenses, including the deductible, co-insurance, and co-payments, are capped at a certain amount.

Pros and Cons of High Deductible Health Plans

Pros:

- Lower monthly premiums

- Ability to pair with a health savings account (HSA)

- Encourages cost-conscious decisions about healthcare

- Can be a good option for relatively healthy individuals

Cons:

- High upfront costs

- May not be suitable for individuals with chronic health conditions

- Can be challenging to budget for unexpected medical expenses

- May lead to delayed or foregone medical care due to cost concerns

It's essential to carefully consider your individual circumstances and healthcare needs before choosing a high deductible health plan. While HDHPs can be a cost-effective option for some, they may not be the best choice for others.

Types of High Deductible Health Plans

There are several types of HDHPs available, including:

- Individual HDHPs: Designed for individuals and families

- Group HDHPs: Offered by employers to their employees

- Catastrophic HDHPs: Designed for young adults and those who cannot afford other types of coverage

- Short-term HDHPs: Temporary coverage for individuals who are between jobs or waiting for other coverage to start

Key Takeaways

- High deductible health plans require policyholders to pay a significant amount of money out-of-pocket before insurance coverage kicks in.

- HDHPs can be paired with a health savings account (HSA) to set aside pre-tax dollars for medical expenses.

- HDHPs may be a good option for relatively healthy individuals, but may not be suitable for those with chronic health conditions.

- It’s essential to carefully consider your individual circumstances and healthcare needs before choosing an HDHP.

Steps to Consider When Choosing a High Deductible Health Plan

- Assess your individual circumstances and healthcare needs

- Consider your budget and ability to pay upfront costs

- Research different types of HDHPs and their features

- Compare prices and coverage options

- Consult with a healthcare professional or insurance expert if needed

Frequently Asked Questions

What is a high deductible health plan?

+A high deductible health plan is a type of health insurance plan that requires the policyholder to pay a significant amount of money out-of-pocket before the insurance coverage kicks in.

How do high deductible health plans work?

+High deductible health plans typically require the policyholder to pay a deductible, co-insurance, and co-payments, with an out-of-pocket maximum to cap total expenses.

Are high deductible health plans a good option for everyone?

+No, high deductible health plans may not be suitable for individuals with chronic health conditions or those who require frequent medical care.