What Is Kaiser Health Insurance? Plans Explained

Kaiser Health Insurance, officially known as Kaiser Permanente, is a nonprofit health plan provider that offers a wide range of medical services and insurance plans to its members. Founded in 1945 by Henry J. Kaiser and Sidney Garfield, Kaiser Permanente has grown to become one of the largest and most reputable health insurance providers in the United States. With a strong presence in eight states, including California, Colorado, Georgia, Hawaii, Maryland, Oregon, Virginia, and Washington, Kaiser Permanente serves over 12 million members.

How Kaiser Health Insurance Works

Kaiser Health Insurance operates on a unique model that integrates healthcare delivery and insurance coverage. This approach allows Kaiser Permanente to provide its members with comprehensive, high-quality care while controlling costs. The organization achieves this through its three main components:

- Health Plan: Kaiser Permanente offers various health insurance plans to individuals, families, and groups. These plans cover a wide range of medical services, including doctor visits, hospital stays, surgeries, and prescription medications.

- Medical Group: The Permanente Medical Groups are composed of physicians and other healthcare professionals who provide medical care to Kaiser Permanente members. These medical groups are responsible for delivering high-quality, patient-centered care.

- Hospitals and Facilities: Kaiser Permanente owns and operates a network of hospitals, medical offices, and other healthcare facilities. This integrated system enables Kaiser Permanente to provide seamless, coordinated care to its members.

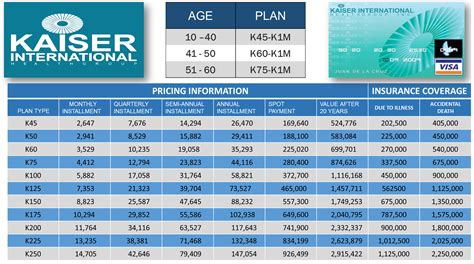

Types of Kaiser Health Insurance Plans

Kaiser Permanente offers a variety of health insurance plans to meet the diverse needs of its members. Some of the most popular plans include:

- HMO (Health Maintenance Organization) Plans: These plans provide comprehensive coverage for medical services, including doctor visits, hospital stays, and prescription medications. HMO plans often have lower premiums, but members are typically required to receive care from Kaiser Permanente’s network of providers.

- PPO (Preferred Provider Organization) Plans: PPO plans offer more flexibility than HMO plans, allowing members to receive care from both in-network and out-of-network providers. However, out-of-network care is often more expensive.

- EPO (Exclusive Provider Organization) Plans: EPO plans combine the benefits of HMO and PPO plans. Members can receive care from Kaiser Permanente’s network of providers, and in some cases, out-of-network care may be covered.

- Medicare Advantage Plans: Kaiser Permanente offers Medicare Advantage plans to seniors and individuals with disabilities. These plans provide comprehensive coverage for medical services, including doctor visits, hospital stays, and prescription medications.

Benefits of Kaiser Health Insurance

Kaiser Permanente’s integrated healthcare delivery system provides numerous benefits to its members, including:

- Comprehensive Coverage: Kaiser Permanente’s health insurance plans cover a wide range of medical services, including preventive care, chronic disease management, and specialty care.

- High-Quality Care: Kaiser Permanente’s medical groups and hospitals are committed to providing high-quality, patient-centered care.

- Convenience: Kaiser Permanente’s integrated system enables members to access medical services, including doctor visits, lab tests, and prescription medications, in a single location.

- Cost Control: Kaiser Permanente’s unique model helps control costs by reducing administrative expenses and promoting preventive care.

Kaiser Permanente's emphasis on preventive care and chronic disease management has led to improved health outcomes and reduced healthcare costs for its members. By providing comprehensive coverage and promoting healthy behaviors, Kaiser Permanente has established itself as a leader in the healthcare industry.

Eligibility and Enrollment

To be eligible for Kaiser Permanente’s health insurance plans, individuals and families must meet certain requirements, including:

- Residency: Members must reside in one of the eight states where Kaiser Permanente operates.

- Age: There are no age restrictions for Kaiser Permanente’s health insurance plans, although some plans may have specific requirements for seniors or individuals with disabilities.

- Income: Kaiser Permanente offers a range of plans with varying premium costs, making its coverage accessible to individuals and families with different income levels.

FAQs

What is the difference between an HMO and a PPO plan?

+HMO plans provide comprehensive coverage for medical services, but members are typically required to receive care from the plan's network of providers. PPO plans offer more flexibility, allowing members to receive care from both in-network and out-of-network providers, although out-of-network care is often more expensive.

Can I see any doctor I want with a Kaiser Permanente plan?

+With an HMO plan, you are typically required to receive care from Kaiser Permanente's network of providers. However, with a PPO or EPO plan, you may have the option to see out-of-network providers, although this care may be more expensive.

How do I enroll in a Kaiser Permanente health insurance plan?

+You can enroll in a Kaiser Permanente health insurance plan during the annual open enrollment period or during a special enrollment period if you experience a qualifying life event. You can apply online, by phone, or in person at a Kaiser Permanente location.

In conclusion, Kaiser Health Insurance, or Kaiser Permanente, is a reputable health plan provider that offers comprehensive coverage and high-quality care to its members. With its unique integrated healthcare delivery system, Kaiser Permanente has established itself as a leader in the healthcare industry. By understanding the different types of plans, benefits, and eligibility requirements, individuals and families can make informed decisions about their healthcare coverage and choose the plan that best meets their needs.