What Is Ppo Plan

The Preferred Provider Organization (PPO) plan is a type of health insurance plan that offers a balance between flexibility and cost savings. In a PPO plan, the insurer contracts with a network of healthcare providers, including doctors, hospitals, and other medical professionals, to provide discounted services to plan members.

Key Characteristics of a PPO Plan:

- Network of Providers: PPO plans have a network of participating providers who have agreed to offer discounted rates to plan members. This network can include primary care physicians, specialists, hospitals, and other healthcare facilities.

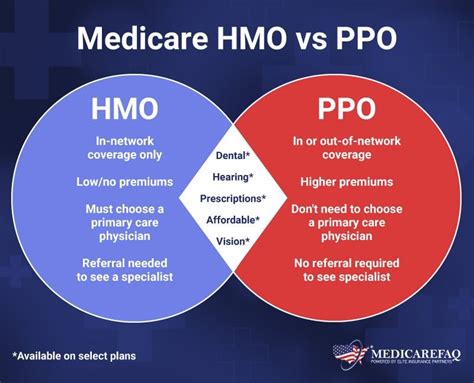

- Out-of-Network Coverage: Unlike Health Maintenance Organization (HMO) plans, PPO plans offer some level of coverage for out-of-network care. However, the cost-sharing for out-of-network care is typically higher than for in-network care.

- No Referrals Needed: In a PPO plan, members do not need a referral from a primary care physician to see a specialist. They can choose to see any specialist within the network without a referral.

- Cost-Sharing: PPO plans typically require members to pay a deductible, copayment, or coinsurance for healthcare services. The cost-sharing amounts vary depending on the plan and the type of service.

- Premiums: PPO plans often have higher premiums than HMO plans, but they offer more flexibility and a wider range of provider choices.

How PPO Plans Work:

- Choosing a Provider: Plan members can choose to see any provider within the network, including primary care physicians and specialists.

- Receiving Care: When a member receives care from an in-network provider, the provider bills the insurer directly, and the member pays the applicable copayment or coinsurance.

- Out-of-Network Care: If a member receives care from an out-of-network provider, the provider may bill the member directly, and the member may need to submit a claim to the insurer for reimbursement.

- Claims Processing: The insurer processes the claim and applies the applicable cost-sharing amounts, such as deductibles, copayments, or coinsurance.

Benefits of PPO Plans:

- Flexibility: PPO plans offer members the flexibility to choose their own healthcare providers, both in-network and out-of-network.

- Wide Range of Providers: PPO plans typically have a large network of participating providers, giving members a wide range of choices for their healthcare needs.

- No Referrals Needed: Members do not need a referral to see a specialist, making it easier to access specialized care.

- Out-of-Network Coverage: PPO plans offer some level of coverage for out-of-network care, providing members with financial protection in case they need to see a provider outside of the network.

Drawbacks of PPO Plans:

- Higher Premiums: PPO plans often have higher premiums than HMO plans, making them more expensive for members.

- Higher Out-of-Pocket Costs: PPO plans typically have higher deductibles, copayments, and coinsurance amounts than HMO plans, which can increase out-of-pocket costs for members.

- Complexity: PPO plans can be more complex than HMO plans, with multiple cost-sharing amounts and network rules to navigate.

When choosing a PPO plan, it's essential to carefully review the plan's network, cost-sharing amounts, and coverage rules to ensure it meets your healthcare needs and budget.

Comparison of PPO Plans:

| Plan Feature | PPO Plan | HMO Plan |

|---|---|---|

| Network of Providers | Large network of participating providers | Restricted network of participating providers |

| Out-of-Network Coverage | Some level of coverage for out-of-network care | Typically no coverage for out-of-network care |

| Referrals Needed | No referrals needed to see a specialist | Referrals often required to see a specialist |

| Cost-Sharing | Higher deductibles, copayments, and coinsurance amounts | Lower deductibles, copayments, and coinsurance amounts |

| Premiums | Higher premiums | Lower premiums |

What is the main difference between a PPO plan and an HMO plan?

+The main difference between a PPO plan and an HMO plan is the level of flexibility and choice in healthcare providers. PPO plans offer a wider range of provider choices and more flexibility in receiving care, while HMO plans have a more restricted network of providers and often require referrals to see specialists.

Do PPO plans cover out-of-network care?

+PPO plans typically offer some level of coverage for out-of-network care, but the cost-sharing amounts are usually higher than for in-network care. Members may need to pay a higher deductible, copayment, or coinsurance amount for out-of-network care.

How do I choose a PPO plan that's right for me?

+When choosing a PPO plan, consider your healthcare needs, budget, and preferences. Review the plan's network, cost-sharing amounts, and coverage rules to ensure they meet your needs. You may also want to research the plan's reputation, customer service, and quality of care.

In conclusion, PPO plans offer a balance between flexibility and cost savings, making them a popular choice for individuals and families. While they may have higher premiums and out-of-pocket costs than HMO plans, they provide a wider range of provider choices and more flexibility in receiving care. By understanding the key characteristics, benefits, and drawbacks of PPO plans, you can make an informed decision when choosing a healthcare plan that meets your needs.