What Is Ppo Vs Hmo

When it comes to navigating the complex world of health insurance, two of the most common types of plans are Preferred Provider Organizations (PPOs) and Health Maintenance Organizations (HMOs). While both types of plans have their advantages and disadvantages, they differ significantly in terms of coverage, cost, and flexibility. In this article, we’ll delve into the details of PPOs and HMOs, exploring their key features, benefits, and drawbacks to help you make an informed decision about which type of plan is best for you.

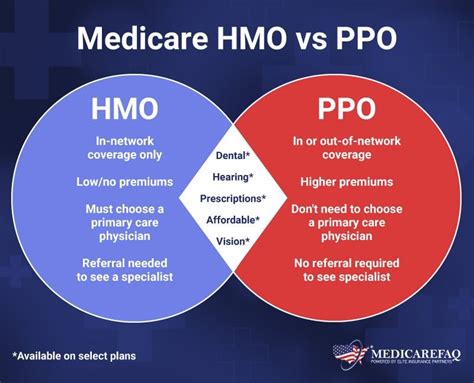

Understanding PPOs

A Preferred Provider Organization (PPO) is a type of health insurance plan that offers a network of healthcare providers who have agreed to provide discounted services to plan members. With a PPO, you have the flexibility to choose any doctor or hospital within the network, and you also have the option to seek care outside of the network, although at a higher cost. PPOs typically require you to pay a deductible, copay, or coinsurance for services, and they often have an out-of-pocket maximum to limit your expenses.

Pros of PPOs:

- Flexibility: PPOs offer more flexibility than HMOs, as you can choose any doctor or hospital within the network, and you also have the option to seek care outside of the network.

- No primary care physician (PCP) required: With a PPO, you don’t need to choose a primary care physician to coordinate your care.

- Out-of-network coverage: PPOs typically offer some level of coverage for out-of-network care, although at a higher cost.

Cons of PPOs:

- Higher premiums: PPOs often have higher premiums than HMOs, as they offer more flexibility and out-of-network coverage.

- More expensive out-of-network care: While PPOs offer some level of coverage for out-of-network care, it can be more expensive than in-network care.

Understanding HMOs

A Health Maintenance Organization (HMO) is a type of health insurance plan that requires you to receive medical care from a specific network of providers. With an HMO, you typically need to choose a primary care physician (PCP) who coordinates your care and refers you to specialists within the network. HMOs often have lower premiums than PPOs, but they also have more restrictions on care.

Pros of HMOs:

- Lower premiums: HMOs often have lower premiums than PPOs, as they have more restrictions on care and a narrower network of providers.

- Preventive care focus: HMOs often emphasize preventive care, which can help you stay healthy and avoid costly medical treatments.

- Coordination of care: With an HMO, your PCP coordinates your care and refers you to specialists within the network, which can help ensure that you receive comprehensive and coordinated care.

Cons of HMOs:

- Less flexibility: HMOs have more restrictions on care than PPOs, as you need to choose a PCP and receive care from within the network.

- No out-of-network coverage: HMOs typically do not offer coverage for out-of-network care, except in emergency situations.

- Referrals required: With an HMO, you often need a referral from your PCP to see a specialist, which can delay care.

Comparison of PPOs and HMOs

| PPO | HMO | |

|---|---|---|

| Network | Larger network of providers | Smaller network of providers |

| Out-of-network coverage | Offers some level of coverage | Typically no coverage, except in emergency situations |

| PCP required | No | Yes |

| Referrals | Not required | Often required |

| Premiums | Higher | Lower |

| Deductible | Often higher | Often lower |

| Out-of-pocket maximum | Often higher | Often lower |

Which type of plan is right for you?

When deciding between a PPO and an HMO, consider your individual needs and circumstances. If you:

- Value flexibility and the ability to choose any doctor or hospital, a PPO may be the better choice.

- Are willing to choose a PCP and receive care from within a network, an HMO may be the better choice.

- Have a chronic condition or require frequent medical care, a PPO may be the better choice, as it offers more flexibility and out-of-network coverage.

- Are looking for a lower-premium option and are willing to accept more restrictions on care, an HMO may be the better choice.

Ultimately, the decision between a PPO and an HMO depends on your individual circumstances, preferences, and priorities. By understanding the key features, benefits, and drawbacks of each type of plan, you can make an informed decision and choose the plan that best meets your needs.

What is the main difference between a PPO and an HMO?

+The main difference between a PPO and an HMO is the level of flexibility and out-of-network coverage. A PPO offers more flexibility and out-of-network coverage, while an HMO has more restrictions on care and a narrower network of providers.

Do PPOs and HMOs offer preventive care services?

+Yes, both PPOs and HMOs typically offer preventive care services, such as routine check-ups, screenings, and vaccinations. However, HMOs often emphasize preventive care and may offer more comprehensive preventive care services.

Can I switch from a PPO to an HMO or vice versa?

+Yes, you can switch from a PPO to an HMO or vice versa during open enrollment or if you experience a qualifying life event. However, you should carefully review the benefits and drawbacks of each type of plan before making a decision.

In conclusion, PPOs and HMOs are two distinct types of health insurance plans that cater to different needs and preferences. By understanding the key features, benefits, and drawbacks of each type of plan, you can make an informed decision and choose the plan that best meets your needs. Remember to consider your individual circumstances, priorities, and preferences when deciding between a PPO and an HMO.