10+ Out Of Pocket Maximum Secrets For Lower Bills

Navigating the complexities of health insurance can be a daunting task, especially when it comes to understanding out-of-pocket maximums. The out-of-pocket maximum, often abbreviated as MOOP (Maximum Out of Pocket), is the maximum amount you’ll have to pay for healthcare expenses in a year, excluding premiums. This threshold includes deductibles, copays, and coinsurance, but not premiums. Once you reach this limit, your insurance plan covers 100% of eligible expenses for the remainder of the year. Here are over 10 secrets to help you maneuver through the out-of-pocket maximum landscape, potentially leading to lower bills and a more manageable healthcare budget.

1. Understand Your Insurance Plan

Knowing the details of your health insurance plan is crucial. Review your policy documents or consult with your insurer to understand what expenses count towards your out-of-pocket maximum. Some plans may not include certain services, like dental or vision care, in the MOOP calculation.

2. Track Your Expenses

Keep a detailed record of your medical expenses throughout the year. This includes receipts for prescriptions, doctor visits, hospital stays, and any other healthcare-related costs. Many insurance companies provide online tools or mobile apps to help you track these expenses.

3. Preventive Care is Free

Under the Affordable Care Act (ACA), many preventive services are covered without any out-of-pocket costs. Taking advantage of these services can help prevent health issues that might lead to costly medical bills later on.

4. Negotiate Medical Bills

If you receive a bill that you believe is too high, don’t hesitate to negotiate. Many hospitals and healthcare providers are willing to work with patients to adjust bills, especially if you’re paying out of pocket.

5. Use In-Network Providers

Sticking to healthcare providers within your insurance network can significantly reduce your out-of-pocket costs. Out-of-network care often comes with higher copays, coinsurance, or even non-covered services.

6. Maximize Your Health Savings Account (HSA)

If you have a high-deductible health plan (HDHP), you might be eligible for an HSA. Contributions to an HSA are tax-deductible, and the funds can be used tax-free for qualified medical expenses, helping you save for healthcare costs and reduce your taxable income.

7. Leverage Flexible Spending Accounts (FSAs)

FSAs allow you to set aside pre-tax dollars for healthcare expenses. While they have a “use it or lose it” rule, some employers offer a carryover or grace period, allowing you to retain some of your unused balance for the next year.

8. Consider a Limit on Family Out-of-Pocket Maximums

For family plans, there’s often a separate out-of-pocket maximum for the entire family in addition to individual limits. Understanding how these work can help you plan your healthcare expenses more effectively.

9. Appeal Denied Claims

If your insurance company denies a claim, you have the right to appeal. Understand your insurer’s appeal process and be prepared to provide detailed documentation to support your case.

10. Stay Informed About Plan Changes

Health insurance plans can change from year to year, including out-of-pocket maximums, deductibles, and covered services. Stay informed about any changes to your plan to avoid unexpected expenses.

11. Utilize Patient Advocacy Services

Many hospitals and some insurance plans offer patient advocacy services. These advocates can help navigate the billing process, explain your insurance benefits, and sometimes assist in negotiating medical bills.

12. Schedule Procedures Strategically

If you have procedures scheduled that will push you over your out-of-pocket maximum, consider scheduling them as early in the year as possible. This way, you’ll reach your MOOP sooner and enjoy full coverage for the rest of the year.

Advanced Strategies for Managing Out-of-Pocket Maximums

Technical Breakdown: Understanding the Components of Your MOOP

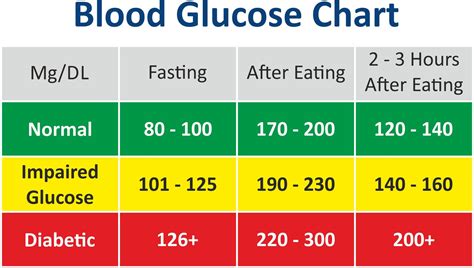

- Deductibles: The amount you must pay each year before your health plan starts to pay its share of costs.

- Copays: A fixed amount you pay for a healthcare service, usually when you receive the service.

- Coinsurance: The percentage of costs you pay after meeting your deductible. Understanding these components can help you predict your expenses and manage your out-of-pocket maximum more effectively.

Comparative Analysis: Reviewing Insurance Plans for the Best MOOP

When selecting or switching health insurance plans, it’s crucial to compare the out-of-pocket maximums. Lower MOOP does not always mean the plan is better, as premiums, deductibles, and the network of providers must also be considered.

Decision Framework: Evaluating the Financial Impact of MOOP on Healthcare Choices

- Assess Your Health Needs: Consider your anticipated healthcare expenses for the year.

- Calculate Potential Savings: Evaluate how reaching your MOOP might affect your budget for the remainder of the year.

- Review Plan Details: Understand what is covered, the cost-sharing structure, and any limitations.

By applying these strategies and staying informed, you can better navigate the complexities of out-of-pocket maximums and potentially reduce your healthcare bills.

What is the out-of-pocket maximum in health insurance, and how does it work?

+The out-of-pocket maximum is the maximum amount you’ll pay for healthcare expenses in a year, excluding premiums. It includes deductibles, copays, and coinsurance. Once you reach this limit, your insurance plan covers 100% of eligible expenses for the remainder of the year.

How do I track my out-of-pocket expenses to ensure I reach my MOOP efficiently?

+Keep detailed records of your medical expenses. Many insurance companies offer online tools or mobile apps to help track these expenses. Regularly reviewing your statements and asking your healthcare providers about costs can also help.

What is the difference between an HSA and an FSA, and how can they help with my out-of-pocket maximum?

+HSAs (Health Savings Accounts) and FSAs (Flexible Spending Accounts) are both tax-advantaged accounts for healthcare expenses. HSAs are for those with high-deductible health plans and offer more flexibility in terms of rolling over funds. FSAs allow you to set aside pre-tax dollars for healthcare expenses but have a “use it or lose it” rule. Both can help save for out-of-pocket expenses, potentially reducing your financial burden when approaching your MOOP.