10 Ppo Tips To Save Money

Navigating the world of Preferred Provider Organizations (PPOs) can be a daunting task, especially when it comes to managing healthcare costs. With the rising expenses of medical care, finding ways to save money without compromising the quality of care is essential. Below are 10 tips tailored to help you make the most out of your PPO plan, ensuring you get the best possible care while keeping your expenditures in check.

1. Understand Your PPO Plan

The first step to saving money with a PPO is understanding how your plan works. Familiarize yourself with the concepts of in-network and out-of-network care, deductibles, copays, and coinsurance. Knowing what is covered and what isn’t can help you make informed decisions about your healthcare spending.

2. Choose In-Network Providers

PPO plans offer more flexibility than HMOs by allowing you to see any healthcare provider, both in and out of network. However, seeing an in-network provider can significantly reduce your out-of-pocket costs. In-network providers have negotiated rates with your insurance company, which means you’ll pay less for their services.

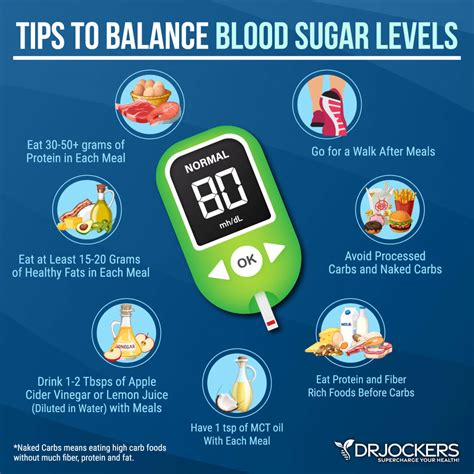

3. Maximize Your Preventive Care Benefits

Many PPO plans cover preventive care services without requiring you to meet your deductible first. These services can include annual physicals, vaccinations, and screenings for diseases like diabetes and certain types of cancer. Taking advantage of these benefits can help catch health issues early, potentially saving you money in the long run by avoiding more costly treatments.

4. Consider a Health Savings Account (HSA)

If your PPO plan is eligible, contributing to a Health Savings Account (HSA) can be a smart financial move. HSAs allow you to set aside pre-tax dollars for medical expenses, which can reduce your taxable income and help you save for future healthcare costs.

5. Shop Around for Prescription Medications

Prices for prescription medications can vary significantly between pharmacies. Use online tools or call around to compare prices. Additionally, ask your doctor if a generic version of your medication is available, as generics are often cheaper than brand-name drugs.

6. Use Telemedicine

Many PPO plans now cover telemedicine services, which allow you to consult with a healthcare provider remotely. Telemedicine can be a cost-effective option for non-emergency care, saving you time and money by avoiding unnecessary office visits.

7. Keep Track of Your Expenses

Throughout the year, keep a record of your healthcare expenses, including receipts, invoices, and explanations of benefits (EOBs) from your insurance company. This will help you stay on top of your spending and ensure you’re meeting your deductible and out-of-pocket maximum.

8. Negotiate Your Medical Bills

If you receive a bill that seems too high, don’t hesitate to negotiate. Contact the provider’s billing department to discuss possible reductions, especially if you’re paying out of pocket. Some providers may offer discounts for prompt payment or when paying cash.

9. Take Advantage of Free or Low-Cost Resources

Utilize free or low-cost resources offered by your insurance company or community, such as health coaching, fitness classes, or disease management programs. These can help you manage chronic conditions or improve your overall health without added expense.

10. Review and Adjust Your Plan Annually

Healthcare needs can change from year to year. During your plan’s open enrollment period, review your coverage to ensure it still meets your needs. Consider factors like changes in your family size, health status, or income. Adjusting your plan can help you avoid unnecessary expenses and ensure you’re getting the most value from your PPO.

FAQ Section

What is the main difference between in-network and out-of-network care in a PPO plan?

+The main difference is the cost. In-network care is provided by healthcare providers who have a contract with your insurance company, resulting in lower out-of-pocket costs for you. Out-of-network care, on the other hand, can be significantly more expensive since these providers do not have a negotiated rate with your insurer.

Can I change my PPO plan outside of the open enrollment period?

+Generally, you can only change your health insurance plan during the annual open enrollment period. However, certain life events, such as having a baby, getting married, or losing other health coverage, may qualify you for a special enrollment period, allowing you to change your plan outside of open enrollment.

How do I find out what preventive services my PPO plan covers?

+You can find out what preventive services your PPO plan covers by reviewing your plan documents or contacting your insurance company directly. Many insurance companies also provide this information on their websites or through their customer service hotlines.

In conclusion, navigating the complexities of a PPO plan requires a combination of understanding your plan’s details, making smart choices about your care, and leveraging all available resources to minimize your healthcare expenses. By following these tips and staying informed, you can ensure that you’re getting the most out of your PPO plan while keeping your costs under control.