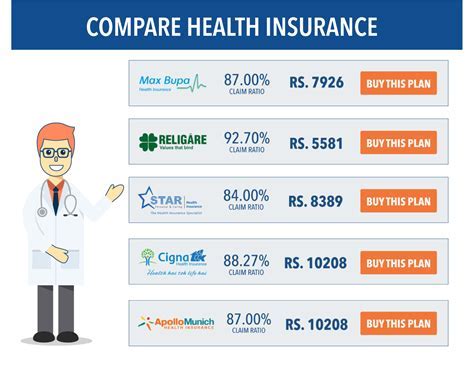

Cheapest Health Insurance

Navigating the complex world of health insurance can be a daunting task, especially when budget is a concern. The quest for the cheapest health insurance options often leads individuals and families to scrutinize plans carefully, weighing premiums against coverage and potential out-of-pocket expenses. It’s essential to understand that while cost is a significant factor, it shouldn’t be the only consideration. The goal is to find a balance between affordability and comprehensive coverage that meets your health care needs.

Understanding Health Insurance Basics

Before diving into the cheapest options, it’s crucial to grasp the fundamental elements of health insurance plans. These include premiums (the monthly cost of your insurance), deductibles (the amount you must pay out-of-pocket before your insurance kicks in), copays (fixed amounts you pay for specific services), and coinsurance (the percentage of costs you pay after meeting your deductible). Additionally, understanding the network of providers your plan covers is vital, as seeing out-of-network doctors can significantly increase your costs.

Affordable Health Insurance Options

Several avenues can lead to finding affordable health insurance:

Marketplace Plans: The Affordable Care Act (ACA) marketplace offers a range of plans categorized into metal tiers: Bronze, Silver, Gold, and Platinum. Bronze plans are typically the cheapest but come with higher deductibles and out-of-pocket costs. Silver and Gold plans offer more comprehensive coverage at a higher premium.

Short-Term Health Insurance: These plans provide temporary coverage for a limited period (usually up to 12 months) and can be cheaper. However, they often don’t cover pre-existing conditions, essential health benefits, or preventive care, making them less desirable for long-term health security.

Medicaid and CHIP: For low-income individuals and families, Medicaid and the Children’s Health Insurance Program (CHIP) offer free or low-cost health coverage. Eligibility varies by state, so it’s essential to check your local guidelines.

Employer-Sponsored Plans: If available, these plans are often more affordable than individual market plans because the employer contributes to the premiums.

Association Health Plans (AHPs): AHPs allow small businesses and self-employed individuals to band together to purchase health insurance. They can be cheaper than individual plans but may not offer all the protections of ACA-compliant plans.

Tips for Finding the Cheapest Health Insurance

- Compare Plans: Utilize online health insurance marketplaces or work with a licensed insurance agent to compare different plans based on your specific needs and budget.

- Subsidies and Discounts: If you’re eligible, subsidies can significantly reduce your premium costs. Check if you qualify based on your income level.

- Network Providers: Choosing a plan with a narrower network of providers can lower your premiums but ensure your primary care physician and any specialists you see are included.

- Deductible and Out-of-Pocket Maximums: While a higher deductible might lower your premium, consider whether you can afford the out-of-pocket expenses if you need medical care.

- Preventive Care: Even the cheapest plans must cover certain preventive services without charging you a copayment or coinsurance, so take advantage of these to stay healthy and avoid more costly treatments down the line.

FAQ Section

What is the cheapest type of health insurance?

+The cheapest type of health insurance often depends on your individual or family circumstances, including income level, health status, and specific needs. However, Bronze plans on the ACA marketplace and short-term health insurance plans are typically among the most affordable options.

How can I get cheap health insurance?

+To get cheap health insurance, consider comparing plans on the health insurance marketplace, looking into Medicaid or CHIP if you're eligible, and exploring short-term health insurance plans for temporary coverage. Additionally, working with a licensed insurance agent can help you find the most affordable options tailored to your situation.

Is cheap health insurance worth it?

+While affordability is essential, the value of cheap health insurance depends on its ability to provide adequate coverage when you need it. Plans with very low premiums might come with high deductibles, limited provider networks, or lack coverage for essential health benefits. It's crucial to balance cost with the level of coverage and care you might require.

Conclusion

Finding the cheapest health insurance that meets your needs requires careful consideration of several factors, including your health status, financial situation, and the level of coverage you’re comfortable with. By understanding the basics of health insurance, exploring available options, and utilizing tools like the health insurance marketplace, you can make an informed decision that balances affordability with comprehensive coverage. Remember, the cheapest option might not always be the best value in the long run, so it’s essential to weigh all aspects before making your choice.