Does Fsa Roll Over

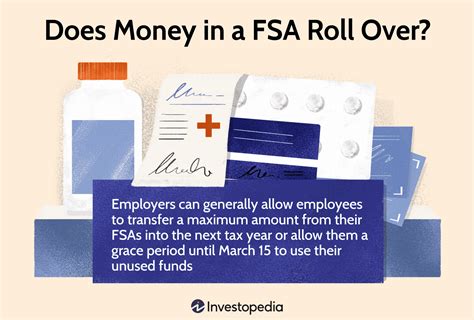

Flexible Spending Accounts (FSAs) have long been a staple of employee benefits packages, allowing individuals to set aside pre-tax dollars for healthcare and dependent care expenses. One of the most significant drawbacks of FSAs, however, has been the “use it or lose it” rule, which requires participants to incur eligible expenses by the end of the plan year or risk forfeiting any unused funds. In response to this limitation, the IRS has introduced two key provisions: the FSA rollover and the FSA grace period.

The FSA rollover, also known as the “carryover” provision, permits employers to allow participants to carry over up to $610 (in 2023) of unused FSA funds to the next plan year. This means that, if an employer opts to include this feature in their FSA plan, participants can retain a portion of their unused funds, rather than losing them entirely. It’s essential to note, however, that not all employers offer the FSA rollover option, so participants should review their plan documents to determine if this feature is available.

To illustrate the benefits of the FSA rollover, consider the example of an employee who contributes 2,500 to their healthcare FSA in a given plan year but only incurs 2,000 in eligible expenses by the end of the year. If their employer offers the FSA rollover, the employee can carry over up to 610 of the remaining 500 to the next plan year. This would allow them to apply the carried-over amount towards future expenses, such as copays, prescriptions, or medical equipment.

In addition to the FSA rollover, some employers may offer an FSA grace period, which provides a 2.5-month extension to incur eligible expenses after the end of the plan year. During this time, participants can use their remaining FSA funds for qualified expenses, thereby reducing the risk of forfeiture. However, it’s crucial to understand that the FSA grace period and the FSA rollover are mutually exclusive; employers can only offer one or the other, not both.

To maximize the benefits of an FSA, participants should carefully plan their contributions and expenses throughout the year. This might involve:

- Estimating expenses accurately: Participants should review their previous year’s expenses and adjust their contributions accordingly to minimize the risk of unused funds.

- Monitoring account balances: Regularly checking FSA account balances can help participants avoid overspending or underspending.

- Taking advantage of eligible expenses: FSA participants should familiarize themselves with the eligible expenses under their plan, such as healthcare, dependent care, or transportation costs.

- Utilizing the FSA rollover or grace period: If available, participants should consider carrying over unused funds or using the grace period to reduce the risk of forfeiture.

By understanding the intricacies of FSA rollovers and grace periods, participants can optimize their benefits and make the most of their pre-tax contributions.

It's essential for participants to review their plan documents and understand the specific rules and limitations of their FSA, including any rollover or grace period provisions. By doing so, they can make informed decisions about their contributions and expenses, ultimately maximizing the value of their FSA benefits.

In conclusion, while the FSA rollover and grace period provisions offer participants greater flexibility and reduced risk of forfeiture, it’s crucial to understand the specifics of each plan and the options available. By taking a proactive approach to FSA management, participants can optimize their benefits and enjoy greater peace of mind when it comes to their healthcare and dependent care expenses.

What is the FSA rollover, and how does it work?

+The FSA rollover allows participants to carry over up to $610 of unused FSA funds to the next plan year, if their employer offers this feature. This provision helps reduce the risk of forfeiture and provides greater flexibility in managing FSA contributions.

Can I use my FSA funds for any type of expense?

+No, FSA funds can only be used for eligible expenses, such as healthcare, dependent care, or transportation costs, as defined by the IRS and the specific FSA plan. Participants should review their plan documents to understand the eligible expenses under their plan.

How do I know if my employer offers the FSA rollover or grace period?

+Participants should review their plan documents or contact their HR representative to determine if their employer offers the FSA rollover or grace period. These provisions can vary by employer, so it’s essential to understand the specific rules and limitations of each plan.