Does Medical Cover Ozempic

The landscape of medical coverage for medications like Ozempic (semaglutide) can be complex, varying significantly depending on the specific insurance provider, the patient’s health conditions, and the intended use of the medication. Ozempic is primarily known for its application in managing type 2 diabetes, helping to improve blood sugar control, support weight loss, and potentially reduce the risk of major adverse cardiovascular events in adults with established cardiovascular disease. However, its use has also been explored for weight management in obese individuals without diabetes, following the approval of a higher-dose version called Wegovy for this indication.

Medical Coverage for Type 2 Diabetes Management

For patients with type 2 diabetes, Ozempic is often covered by medical insurance plans, including Medicare and Medicaid, as well as private insurance providers. The coverage can depend on several factors:

- Formulary Status: Insurance companies maintain formularies, which are lists of medications they cover. Ozempic must be on the formulary for a patient’s specific insurance plan to be covered.

- Prior Authorization: Some insurance plans require prior authorization, meaning the patient’s healthcare provider must demonstrate a medical necessity for Ozempic before the insurance company will cover it.

- Step Therapy: Patients might be required to try other diabetes medications before Ozempic is covered, a process known as step therapy.

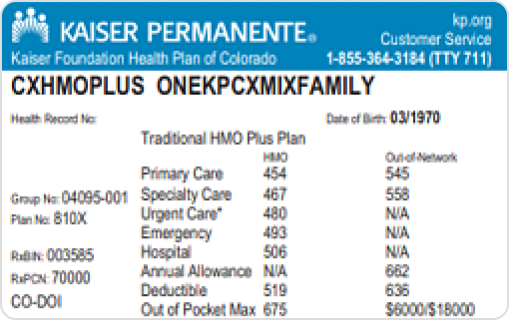

- Copays and Coinsurance: Once Ozempic is approved for coverage, patients typically face out-of-pocket costs in the form of copays or coinsurance, which can vary widely.

Coverage for Weight Loss

The coverage scenario changes for patients seeking Ozempic for weight loss without a diagnosis of type 2 diabetes. As of my last update, the FDA-approved version of semaglutide for weight management, Wegovy, might have different coverage rules:

- Specific Indications: Insurance plans might cover Wegovy for obesity if certain criteria are met, such as a body mass index (BMI) of 30 or higher, or a BMI of 27 or higher with at least one weight-related condition.

- Limited Coverage: Some insurance plans might not cover semaglutide for weight loss at all, or they might require significant out-of-pocket costs from the patient.

- Off-Label Use: Using Ozempic specifically for weight loss in individuals without diabetes would be considered off-label use. Insurance coverage for off-label use can be highly variable and often is not covered.

Patient Assistance Programs

Both the manufacturers of Ozempic (Novo Nordisk) and generic or biosimilar versions, if available, often provide patient assistance programs to help reduce costs for eligible patients. These programs can include discounts, free trials, or other forms of financial assistance.

Conclusion

The extent of medical coverage for Ozempic depends on the patient’s specific situation, including their health conditions, insurance plan details, and the intended use of the medication. Patients should consult with their healthcare provider and insurance company to understand the coverage and any potential out-of-pocket costs associated with Ozempic or Wegovy.

FAQs

Will my insurance cover Ozempic for type 2 diabetes?

+Most insurance plans, including Medicare and Medicaid, cover Ozempic for managing type 2 diabetes, but check your specific plan for details on copays, prior authorization, or step therapy requirements.

Is Ozempic covered for weight loss without diabetes?

+Coverage for weight loss without diabetes can be limited and varies by insurance plan. The FDA-approved version for weight management, Wegovy, may have specific criteria for coverage.

How can I reduce the cost of Ozempic?

+Manufacturer patient assistance programs, discount cards, and generic or biosimilar versions (if available) can help reduce costs. Consult with your healthcare provider and pharmacist for options.