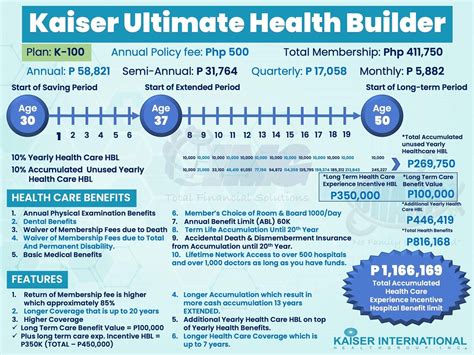

Get Kaiser Coverage: Affordable Health Benefits

Navigating the complex landscape of health insurance can be a daunting task, especially for individuals and families seeking comprehensive coverage without breaking the bank. Kaiser Permanente, one of the nation’s leading health plans, offers a unique approach to healthcare that combines high-quality medical services with affordable health benefits. For those looking to get Kaiser coverage, understanding the ins and outs of their health plans, benefits, and enrollment processes is crucial.

Understanding Kaiser Permanente

Kaiser Permanente is more than just a health insurance provider; it’s an integrated health system that includes hospitals, medical offices, and a wide range of health professionals all working together to provide coordinated care. This model allows for a more holistic approach to healthcare, focusing on prevention, diagnosis, treatment, and ongoing management of health conditions. Member satisfaction and health outcomes are consistently high, making Kaiser a popular choice for those seeking reliable health coverage.

Types of Health Plans

Kaiser Permanente offers a diverse range of health plans designed to cater to different needs and budgets. From individual and family plans to group and Medicare plans, there’s an option for nearly everyone. Their health plans typically include comprehensive benefits such as:

- Medical Coverage: Access to a broad network of doctors, hospitals, and other healthcare providers.

- Pharmacy Services: Coverage for prescription medications, often with a wide selection of generic and brand-name drugs.

- Dental and Vision: Many plans include or offer optional dental and vision coverage for additional comprehensive care.

- Preventive Care: Routine check-ups, screenings, and vaccinations are usually covered without additional cost, emphasizing preventive health practices.

Affordability and Savings

For many, affordability is the key factor in selecting a health plan. Kaiser Permanente’s integrated care model can lead to cost savings through efficient, coordinated care. Furthermore, certain plans may qualify for subsidies or discounts, especially for individuals and families with lower incomes. Those eligible can significantly reduce their monthly premium costs, making comprehensive health coverage more accessible.

Enrollment Process

Enrolling in a Kaiser Permanente health plan can be straightforward, especially with the guidance of their customer service team or through authorized agents. The process typically involves:

- Checking Eligibility: Determining if you qualify for a special enrollment period or must enroll during the open enrollment period.

- Comparing Plans: Reviewing the different health plans offered by Kaiser Permanente to find the one that best fits your needs and budget.

- Applying: Submitting your application, either online, over the phone, or through the mail, and providing necessary documentation.

- Finalizing Coverage: Once approved, setting up your premium payments and learning more about your benefits and how to access care.

Benefits of Choosing Kaiser

- Coordinated Care: The integrated model of Kaiser Permanente ensures that your healthcare team works together, providing you with comprehensive and personalized care.

- Preventive Focus: By emphasizing preventive care, members can potentially avoid more severe health issues down the line.

- Accessibility: With medical facilities and many services available, getting the care you need is often more convenient than with other providers.

- Quality: Kaiser Permanente is renowned for its high standards of care and patient satisfaction, providing peace of mind for its members.

Overcoming Common Challenges

While Kaiser Permanente offers many benefits, some may face challenges during the enrollment process or when accessing care. Common hurdles include navigating the complex healthcare system, understanding plan benefits, and managing out-of-pocket costs. To overcome these, it’s essential to:

- Stay Informed: Educate yourself about your health plan, including what’s covered, how to access care, and any costs associated with services.

- Seek Support: Reach out to Kaiser Permanente’s customer service or your healthcare team for guidance and assistance.

- Plan Ahead: Regularly review your health plan to ensure it continues to meet your needs, and make adjustments as necessary during open enrollment periods.

Conclusion

Getting Kaiser coverage is a significant step towards securing your health and well-being. With its emphasis on coordinated care, preventive services, and comprehensive benefits, Kaiser Permanente stands out as a provider that prioritizes member health. By understanding the types of plans available, the enrollment process, and the benefits of choosing Kaiser, individuals and families can make informed decisions about their health insurance needs. As the healthcare landscape continues to evolve, providers like Kaiser Permanente are at the forefront, offering innovative solutions for affordable, high-quality health benefits.

What types of health plans does Kaiser Permanente offer?

+Kaiser Permanente offers a variety of health plans, including individual and family plans, group plans for employers, and Medicare plans for seniors and those with disabilities. Each plan type is designed to meet different needs and budgets, ensuring comprehensive coverage for medical, pharmacy, dental, and vision services.

How do I enroll in a Kaiser Permanente health plan?

+Enrollment in a Kaiser Permanente health plan can be completed during an open enrollment period or a special enrollment period if you qualify. You can apply online through their website, by phone, or in person with the assistance of a licensed agent. It’s essential to compare plans, check your eligibility, and understand the application process to ensure a smooth enrollment.

What are the benefits of choosing Kaiser Permanente for health coverage?

+Choosing Kaiser Permanente offers several benefits, including coordinated care through their integrated health system, a focus on preventive care to potentially reduce future health issues, and accessibility to a wide range of healthcare services. Additionally, Kaiser Permanente is known for its high-quality care and patient satisfaction, making it a trusted choice for health coverage.