Hdhp Plan: Save Up To 30% On Premiums

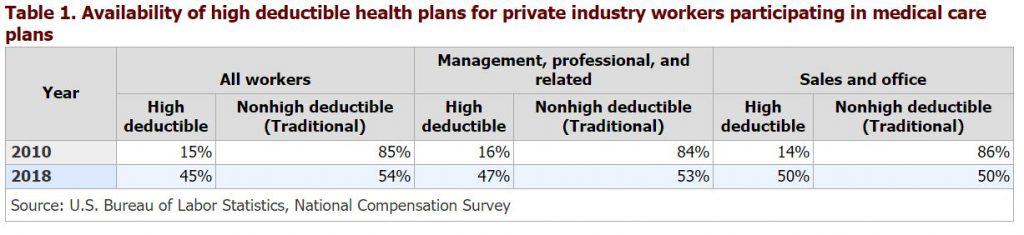

The quest for affordable healthcare has led many to explore various health insurance plans, and one option that stands out for its potential to save on premiums is the High Deductible Health Plan (HDHP). By understanding the intricacies of an HDHP and how it works, individuals can make informed decisions about their healthcare coverage, potentially saving up to 30% on their premiums compared to traditional health insurance plans.

At its core, an HDHP is designed to offer lower premiums in exchange for a higher deductible, which is the amount the policyholder must pay out-of-pocket before the insurance coverage kicks in. This fundamental structure is built on the principle that by shouldering a larger portion of the initial healthcare costs, individuals can significantly reduce their monthly premiums. For instance, if an individual is currently paying 500 per month for a traditional health insurance plan with a low deductible, switching to an HDHP could potentially lower their monthly premium to around 350, resulting in a savings of $150 per month, or approximately 30% of their original premium.

One of the primary advantages of an HDHP is its compatibility with Health Savings Accounts (HSAs), which are tax-advantaged accounts designed to help individuals save for medical expenses. Contributions to an HSA are tax-deductible, and the funds grow tax-free, meaning that the money saved in an HSA can be used to pay for qualified medical expenses without incurring taxes on the withdrawals. This unique combination of lower premiums and tax benefits can provide substantial financial relief for those navigating the complex landscape of healthcare costs.

However, it’s crucial to approach HDHPs with a clear understanding of their potential implications. The higher deductible associated with these plans can be a barrier for some, particularly those who require frequent medical care or have chronic conditions that necessitate regular visits to healthcare providers. For example, an individual with a chronic condition may need to pay out-of-pocket for all their medical expenses until they meet the deductible, which could be $2,000 or more, depending on the plan. In such cases, the initial savings on premiums might be offset by the increased out-of-pocket costs for healthcare services.

To fully leverage the savings potential of an HDHP, it’s essential to adopt a proactive approach to healthcare management. This includes being meticulous about tracking medical expenses, understanding what costs are eligible for reimbursement through an HSA, and making informed decisions about when to seek medical care. By taking a more engaged and strategic stance towards healthcare, individuals can better navigate the financial aspects of an HDHP, ensuring that the plan aligns with their health and financial goals.

The savings offered by HDHPs can be particularly appealing in the context of employer-sponsored health insurance. Many employers offer HDHPs as part of their benefits package, and some even contribute to employees’ HSAs to help offset the higher deductibles. This employer contribution can significantly enhance the attractiveness of an HDHP, as it reduces the financial burden on the employee while still providing comprehensive health coverage. For instance, if an employer contributes $1,000 annually to an employee’s HSA, this contribution can help cover a substantial portion of the deductible, making the HDHP more financially manageable for the employee.

In evaluating the potential savings of an HDHP, it’s also important to consider the long-term implications. Over time, the cumulative effect of lower monthly premiums can result in significant savings. Additionally, the discipline of managing an HSA can foster a more mindful approach to healthcare spending, potentially leading to more cost-effective decisions about medical care. By examining their healthcare needs, financial situation, and the specifics of the HDHP, individuals can determine whether the potential savings on premiums outweigh the potential increased out-of-pocket costs.

Ultimately, the decision to opt for an HDHP should be based on a thorough analysis of one’s healthcare needs, financial situation, and personal preferences regarding risk and financial management. While the promise of saving up to 30% on premiums is undoubtedly attractive, it’s vital to weigh this against the potential for higher out-of-pocket costs and to carefully consider how an HDHP fits into one’s overall financial and healthcare strategy.

In navigating the complex world of health insurance, understanding the nuances of HDHPs can empower individuals to make more informed decisions about their healthcare coverage. By recognizing both the potential savings and the potential challenges associated with HDHPs, individuals can better align their health insurance choices with their financial and healthcare goals, ultimately finding a plan that offers the right balance of coverage and affordability.

What is the primary benefit of an HDHP?

+The primary benefit of an HDHP is its potential to save on premiums. By shouldering a higher deductible, individuals can significantly lower their monthly healthcare costs, potentially saving up to 30% compared to traditional health insurance plans.

How do HSAs work with HDHPs?

+HSAs are tax-advantaged accounts that can be used in conjunction with HDHPs to save for medical expenses. Contributions to an HSA are tax-deductible, and the funds grow tax-free, allowing individuals to pay for qualified medical expenses without incurring taxes on the withdrawals.

What are the potential drawbacks of an HDHP?

+The higher deductible associated with HDHPs can be a significant barrier for those who require frequent medical care or have chronic conditions. The initial savings on premiums might be offset by increased out-of-pocket costs for healthcare services, making it crucial to carefully weigh the pros and cons before selecting an HDHP.

By embracing the flexibility and potential savings of HDHPs, individuals can take a proactive step towards managing their healthcare costs more effectively. Whether navigating the intricacies of personal health insurance or exploring options through an employer, understanding the benefits and challenges of HDHPs can lead to more informed, cost-effective decisions about healthcare coverage.