Hmo Guide: Choose Best Health Plans

Health Maintenance Organizations (HMOs) have been a cornerstone of healthcare delivery for decades, offering a unique blend of comprehensive care and cost management. For individuals and families seeking to navigate the complex landscape of health insurance, understanding how to choose the best HMO plan is crucial. This guide is designed to provide a comprehensive overview of HMOs, including their structure, benefits, and how to select the most suitable plan based on individual needs.

Understanding HMOs

At their core, HMOs are a type of health insurance plan that limits coverage to care from doctors who work for or contract with the HMO. This network of healthcare providers offers a range of services, from routine check-ups and preventive care to specialized treatments and surgeries. One of the defining features of HMOs is their emphasis on preventive care, aiming to reduce healthcare costs over time by managing health issues before they become severe.

Benefits of HMOs

- Cost-Effective: HMOs are often more affordable than other types of health insurance plans because they negotiate lower rates with the healthcare providers within their network.

- Comprehensive Care: Beyond covering essential health benefits, many HMOs offer additional services like dental and vision care, highlighting their focus on overall wellness.

- Preventive Care: The emphasis on preventive care can lead to better health outcomes and lower costs in the long run.

- Managed Care: HMOs manage care through primary care physicians (PCPs) who coordinate patient care, ensuring that treatments are necessary and cost-effective.

Drawbacks of HMOs

- Limited Network: Patients are generally required to receive medical care and services from providers within the HMO’s network, except in emergency situations.

- Referrals: To see a specialist, patients usually need a referral from their primary care physician, which can delay treatment.

- Out-of-Pocket Costs: While premiums might be lower, out-of-pocket costs for services outside the network or without a referral can be high.

Choosing the Best HMO Plan

Selecting the right HMO plan involves careful consideration of several factors:

- Network: Ensure your current healthcare providers are part of the HMO’s network. If not, consider the quality and convenience of the providers within the network.

- Coverage: Assess the plan’s coverage of essential health benefits, including preventive services, prescription drugs, and any additional benefits that are important to you.

- Cost: Evaluate the total cost of the plan, including premiums, deductibles, copays, and coinsurance. Consider how these costs align with your budget and healthcare needs.

- Quality of Care: Research the HMO’s reputation and the quality ratings of its healthcare providers. Look for plans with high patient satisfaction scores and good health outcomes.

- Referral Policy: Understand the referral process for seeing specialists. Some HMOs may have more flexible policies than others.

Steps to Enroll in an HMO Plan

- Research Available Plans: Look at the HMO plans available in your area. Compare their networks, coverage, and costs.

- Check Eligibility: Confirm you are eligible for the plan. Some HMOs might have specific enrollment periods or requirements.

- Apply: Once you’ve selected a plan, apply through the insurer’s website, by phone, or through a licensed insurance agent.

- Review and Understand Your Plan: After enrollment, carefully review your plan documents to understand what is covered, how to access care, and what your financial responsibilities are.

FAQs

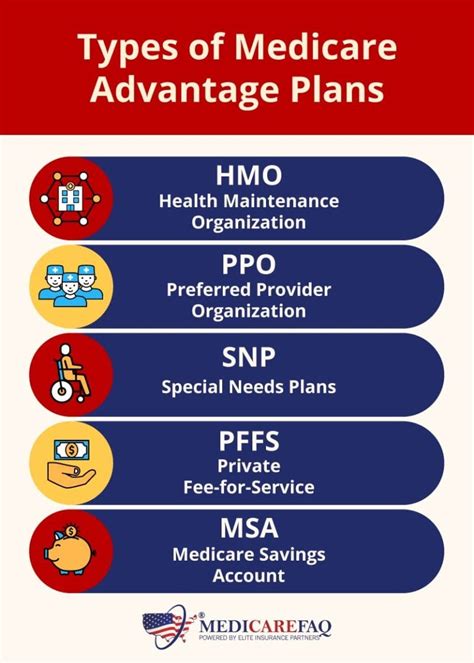

What is the main difference between an HMO and a PPO?

+The primary difference lies in flexibility and cost. HMOs require you to receive care from providers within their network (except in emergencies) and often at a lower cost. PPOs (Preferred Provider Organizations) offer more flexibility to see any healthcare provider, both in and out of network, but at a potentially higher cost.

Can I change my HMO plan outside of the open enrollment period?

+Generally, you can only change plans during the open enrollment period or if you qualify for a special enrollment period due to certain life events, such as marriage, divorce, or the birth of a child. Check with your insurer for specific rules.

How do I find out if my doctor is part of an HMO's network?

+You can usually find this information on the HMO's website by searching their provider directory. Alternatively, you can contact your doctor's office to ask if they participate in the HMO, or call the HMO's customer service number for assistance.

In conclusion, choosing the best HMO plan requires a thoughtful evaluation of your healthcare needs, financial situation, and the specifics of the plans available to you. By understanding how HMOs work, their benefits and drawbacks, and carefully considering your options, you can make an informed decision that provides you with comprehensive and affordable healthcare coverage.