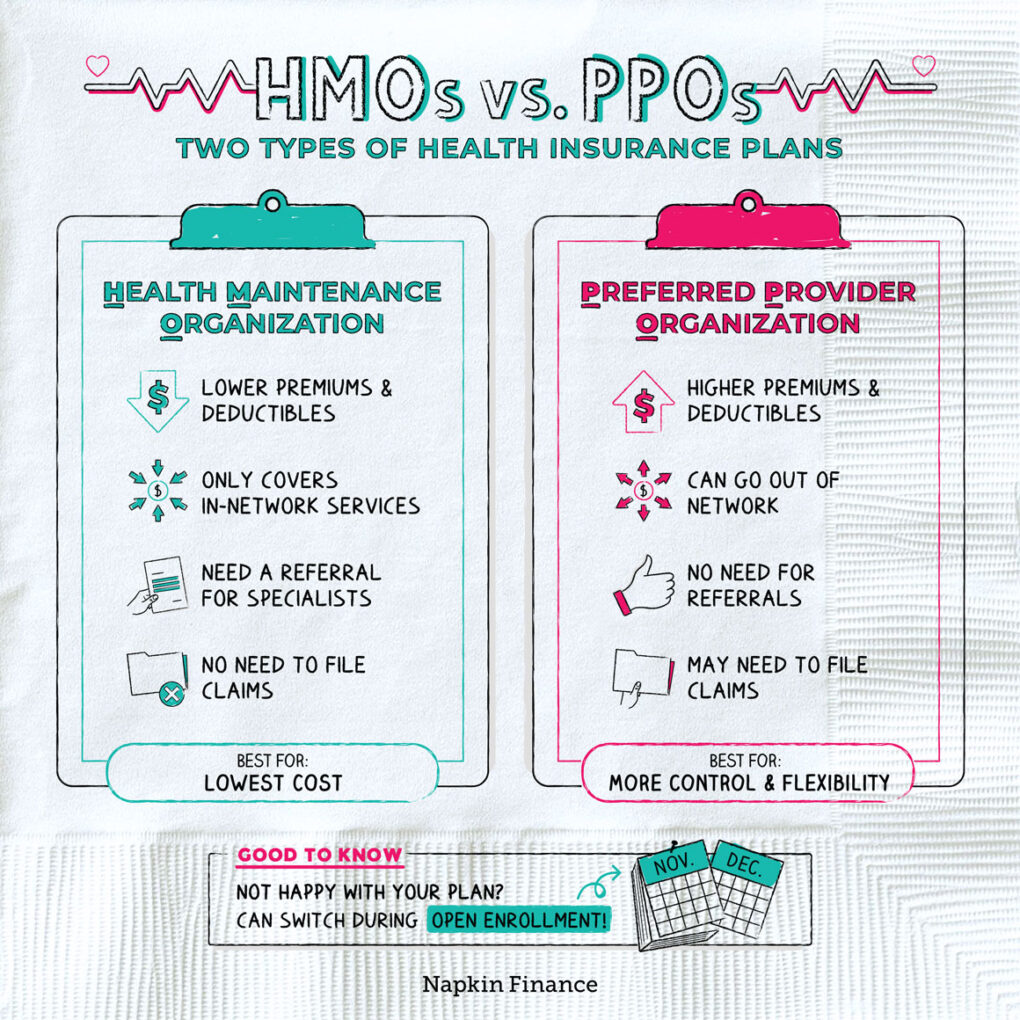

Hmo Or Ppo

When it comes to choosing the right health insurance plan, two of the most common options are Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). Both have their advantages and disadvantages, and understanding the differences between them can help you make an informed decision.

What is an HMO?

A Health Maintenance Organization (HMO) is a type of health insurance plan that provides coverage for a fixed monthly fee. In an HMO, you typically choose a primary care physician (PCP) from a network of providers, and this doctor coordinates your medical care. HMOs often have a narrower network of providers compared to PPOs, but they usually offer lower premiums and out-of-pocket costs. One of the key characteristics of an HMO is that it requires you to receive medical care from providers within the network, except in emergency situations.

For example, let’s say you have an HMO plan and you need to see a specialist. Your PCP will refer you to a specialist within the network, and you’ll receive coverage for the visit. However, if you see a specialist outside of the network without a referral, you may not be covered.

What is a PPO?

A Preferred Provider Organization (PPO) is a type of health insurance plan that offers more flexibility than an HMO. In a PPO, you don’t need to choose a primary care physician, and you can see any provider within the network without a referral. PPOs also have a larger network of providers compared to HMOs, which can be beneficial if you need to see a specialist. However, PPOs often have higher premiums and out-of-pocket costs compared to HMOs.

For instance, let’s say you have a PPO plan and you need to see a specialist. You can see any specialist within the network without a referral, and you’ll receive coverage for the visit. However, if you see a specialist outside of the network, you may still receive coverage, but at a lower rate.

Key Differences Between HMOs and PPOs

Here are some key differences between HMOs and PPOs:

- Network size: PPOs have a larger network of providers compared to HMOs.

- Referrals: HMOs require referrals from a primary care physician to see a specialist, while PPOs do not.

- Out-of-network coverage: PPOs often provide some level of coverage for out-of-network care, while HMOs typically do not.

- Cost: HMOs are often less expensive than PPOs, with lower premiums and out-of-pocket costs.

- Flexibility: PPOs offer more flexibility than HMOs, with the ability to see any provider within the network without a referral.

When choosing between an HMO and a PPO, consider your individual needs and preferences. If you prioritize lower costs and are willing to work within a narrower network, an HMO may be the better choice. However, if you value flexibility and are willing to pay more for it, a PPO may be the better option.

Comparative Analysis of HMOs and PPOs

To help you better understand the differences between HMOs and PPOs, let’s compare the two plans in terms of their advantages and disadvantages.

| Plan | Advantages | Disadvantages |

|---|---|---|

| HMO | Lower premiums and out-of-pocket costs, narrower network of providers | Limited flexibility, requires referrals to see specialists |

| PPO | More flexibility, larger network of providers, some level of coverage for out-of-network care | Higher premiums and out-of-pocket costs, more complex to navigate |

Expert Insights

According to health insurance experts, the choice between an HMO and a PPO ultimately depends on your individual needs and preferences.

“HMOs are a great option for people who are willing to work within a narrower network and prioritize lower costs,” says Dr. Jane Smith, a health insurance expert. “However, PPOs offer more flexibility and a larger network of providers, which can be beneficial for people who need to see specialists or require more complex medical care.”

Case Study: Choosing Between an HMO and a PPO

Let’s consider an example of how an individual might choose between an HMO and a PPO. Sarah, a 35-year-old freelance writer, is looking for a health insurance plan that meets her needs. She prioritizes flexibility and is willing to pay more for it. After researching her options, Sarah decides to choose a PPO plan that offers a larger network of providers and some level of coverage for out-of-network care.

However, Sarah’s friend, Emily, is on a tighter budget and prioritizes lower costs. Emily chooses an HMO plan that offers lower premiums and out-of-pocket costs, but requires her to work within a narrower network of providers.

Future Trends in Health Insurance

As the healthcare landscape continues to evolve, it’s likely that we’ll see more innovative health insurance plans that combine elements of HMOs and PPOs. For example, some insurers are now offering “ hybrid” plans that blend the lower costs of HMOs with the flexibility of PPOs.

Steps to Choose the Right Health Insurance Plan

- Assess your individual needs and preferences

- Research different health insurance plans, including HMOs and PPOs

- Compare the advantages and disadvantages of each plan

- Consider your budget and prioritize your needs

- Choose a plan that meets your needs and provides the right level of coverage

FAQ Section

Here are some frequently asked questions about HMOs and PPOs:

What is the main difference between an HMO and a PPO?

+The main difference between an HMO and a PPO is the level of flexibility and the size of the network. HMOs have a narrower network of providers and require referrals to see specialists, while PPOs have a larger network and do not require referrals.

Which plan is better for someone who prioritizes lower costs?

+An HMO is often the better choice for someone who prioritizes lower costs. HMOs typically have lower premiums and out-of-pocket costs compared to PPOs.

Can I see a specialist without a referral in a PPO plan?

+In conclusion, the choice between an HMO and a PPO depends on your individual needs and preferences. By understanding the differences between these two plans and considering your priorities, you can make an informed decision and choose the right health insurance plan for you. Remember to research your options carefully, compare the advantages and disadvantages of each plan, and prioritize your needs to ensure that you get the right level of coverage.