How Does Cigna Work? Plans And Benefits Explained

Navigating the complex world of health insurance can be daunting, but understanding how a specific provider operates is crucial for making informed decisions about your healthcare coverage. Cigna, one of the largest health insurance companies in the United States, offers a wide range of plans designed to cater to various needs and budgets. In this comprehensive overview, we’ll delve into the inner workings of Cigna, exploring its plans, benefits, and what you can expect as a policyholder.

Understanding Cigna’s Network

At the heart of any health insurance provider is its network of healthcare professionals and facilities. Cigna boasts an extensive network that spans across the globe, covering over 200 countries. This vast coverage ensures that whether you’re at home or traveling abroad, you have access to quality healthcare services.

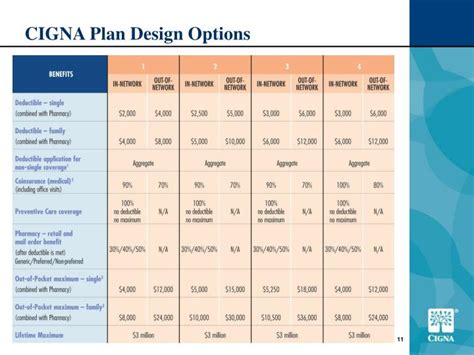

Cigna’s network can be categorized into different tiers based on the level of coverage and the out-of-pocket costs associated with each tier. For instance:

- In-Network Care: These are healthcare providers who have contracted with Cigna to provide services at a negotiated rate. Visiting an in-network provider typically results in lower out-of-pocket costs compared to seeing an out-of-network provider.

- Out-of-Network Care: While more expensive, Cigna also offers coverage for out-of-network care. This can be particularly beneficial in emergencies or when specialized care is needed from a provider not within Cigna’s network.

Plans Offered by Cigna

Cigna provides a diverse array of health insurance plans tailored to meet different needs, including individual, family, and group plans. Some of the key types of plans include:

- Individual and Family Plans: Designed for those not covered by an employer, these plans offer flexible options, including catastrophic plans for those under 30 or exempt from the monthly fee and bronze, silver, gold, and platinum plans that vary in premium costs and out-of-pocket expenses.

- Group Plans: Typically offered through employers, these plans can provide comprehensive coverage for employees and their families, often at a lower cost than individual plans.

- Medicare Plans: For seniors and individuals with disabilities, Cigna offers Medicare Advantage Plans, Medicare Supplement Insurance, and Part D Prescription Drug Plans, helping to cover the gaps in Original Medicare.

- Dental and Vision Plans: In addition to health insurance, Cigna also offers separate dental and vision plans, emphasizing the importance of preventive care in overall health.

Benefits of Choosing Cigna

One of the standout features of Cigna is its commitment to providing holistic healthcare solutions. Some of the key benefits include:

- Preventive Care: Cigna places a strong emphasis on preventive care, covering routine check-ups, screenings, and vaccinations without additional costs, helping to prevent illnesses before they become severe.

- 24⁄7 Customer Service: Policyholders have access to round-the-clock customer support, ensuring that any questions or concerns about their coverage can be addressed promptly.

- Health and Wellness Programs: Cigna offers various programs aimed at promoting healthy living, including discounts on gym memberships, resources for managing chronic conditions, and incentives for engaging in healthy behaviors.

- Global Coverage: For those who travel frequently, Cigna’s global network provides peace of mind, knowing that quality healthcare is accessible almost anywhere in the world.

How to Choose the Right Plan

Selecting the right health insurance plan from Cigna involves considering several factors, including:

- Budget: Your premium budget will significantly influence your plan choice. Bronze plans, for example, have lower premiums but higher deductibles, while gold and platinum plans offer more comprehensive coverage at a higher premium cost.

- Healthcare Needs: If you have ongoing medical needs or anticipate significant healthcare expenses, a plan with lower out-of-pocket costs might be more beneficial, despite a higher monthly premium.

- Provider Network: Ensure that your primary care physician and any specialists you see regularly are part of Cigna’s network to maximize your benefits.

- Additional Benefits: Consider whether you need dental, vision, or supplemental insurance in addition to health insurance.

Conclusion

Navigating the complexities of health insurance can be overwhelming, but with a deeper understanding of how providers like Cigna operate, you’re better equipped to make informed decisions about your healthcare coverage. By considering your financial situation, healthcare needs, and the network and benefits offered by Cigna, you can choose a plan that not only protects your health but also fits within your budget.

FAQ Section

What types of health insurance plans does Cigna offer?

+Cigna offers a wide range of plans including individual and family plans, group plans through employers, Medicare plans for seniors and individuals with disabilities, and separate dental and vision plans.

How does Cigna’s network work?

+Cigna has an extensive network of healthcare professionals and facilities, both in the U.S. and internationally. Policyholders can receive care from in-network providers at a negotiated rate, which typically results in lower out-of-pocket costs.

What benefits does Cigna offer beyond basic health insurance coverage?

+Cigna provides various benefits including preventive care services without additional costs, 24⁄7 customer service, health and wellness programs, and global coverage for those who travel.

How do I choose the right Cigna plan for my needs?

+Choosing the right plan involves considering your budget, healthcare needs, the provider network, and any additional benefits you might require such as dental or vision insurance. It’s essential to review the plan details carefully and potentially consult with a healthcare advisor.