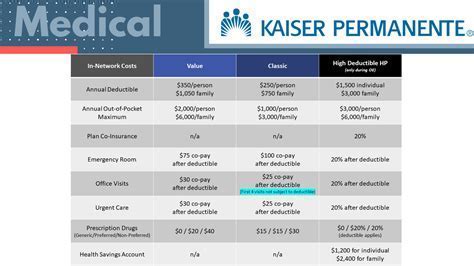

How To Choose Kaiser Health Insurance? Easy Guide

Navigating the complex world of health insurance can be a daunting task, especially when considering a provider like Kaiser Permanente, which is renowned for its integrated model of care that combines insurance coverage with medical care delivery. Kaiser Health Insurance, part of Kaiser Permanente, offers comprehensive health plans that are designed to provide high-quality, affordable care. However, selecting the right plan from Kaiser involves several key considerations to ensure that your health care needs are adequately met. Here’s an easy guide to help you make an informed decision:

Understanding Kaiser Permanente

Before diving into the selection process, it’s essential to understand the basics of how Kaiser Permanente operates. Kaiser Permanente is a not-for-profit health plan that offers comprehensive health insurance coverage. It is unique because it is both an insurer and a healthcare provider, with its own hospitals, clinics, and medical staff. This integrated approach aims to promote preventive care, reduce costs, and improve the overall quality of care.

Assessing Your Health Care Needs

The first step in choosing a Kaiser health insurance plan is to assess your health care needs and those of your family members, if applicable. Consider the following factors: - Current Health Status: If you or a family member has a pre-existing condition, you may want to prioritize plans that offer comprehensive coverage for that condition. - Health Care Usage: If you frequently visit doctors or require ongoing care, a plan with lower copays for office visits might be preferable. - Prescription Needs: If you take prescription medications regularly, look for plans that cover your medications with affordable copays or coinsurance. - Budget: Assess how much you can afford to pay each month in premiums, as well as your potential out-of-pocket costs for copays, coinsurance, and deductibles.

Exploring Kaiser Plans

Kaiser Permanente offers a variety of health plans designed to fit different needs and budgets. These plans can vary significantly in terms of premiums, deductibles, copays, and coverage levels. When exploring Kaiser plans: - Check the Network: Since Kaiser Permanente has its own network of providers, ensure that your primary care physician and any specialists you see are part of this network if you want to minimize out-of-pocket costs. - Compare Benefits: Look at what each plan covers, including preventive care, hospital stays, emergency services, and prescription drugs. - Consider the Cost: Evaluate not just the monthly premium but also the out-of-pocket costs you might face, including deductibles, copays, and coinsurance.

Evaluating Plan Types

Kaiser Permanente offers several types of plans, including: - HMO (Health Maintenance Organization) Plans: These plans require you to receive care from providers within the Kaiser Permanente network, except in emergency situations. - PPO (Preferred Provider Organization) Plans: These plans offer more flexibility, allowing you to see providers outside of the Kaiser network, though at a higher cost. - EPO (Exclusive Provider Organization) Plans: Similar to HMO plans but may offer slightly more flexibility in certain situations.

Special Considerations

- Medicare and Medicaid: If you’re eligible for Medicare or Medicaid, Kaiser Permanente offers specific plans tailored to these programs.

- Employer-Sponsored Plans: If your employer offers Kaiser Permanente as part of its benefits package, your choices and costs may be different.

- Individual and Family Plans: If you’re purchasing insurance on your own, you can choose from a variety of individual and family plans offered through the health insurance marketplace or directly from Kaiser Permanente.

Making Your Decision

Once you’ve gathered information on the available plans and considered your health care needs and budget: - Use Online Tools: Kaiser Permanente and healthcare.gov offer tools that can help you compare plans and estimate your costs. - Consult with a Licensed Agent: Sometimes, speaking with a licensed insurance agent who is familiar with Kaiser plans can provide valuable insights and help you navigate the process. - Review Plan Documents: Before making a final decision, review the plan documents carefully to understand the coverage, benefits, and any limitations.

Conclusion

Choosing a Kaiser health insurance plan requires careful consideration of your health care needs, budget, and the specifics of each plan offered by Kaiser Permanente. By taking the time to understand your options and evaluate the plans based on your individual circumstances, you can select a plan that provides you with the right balance of coverage and affordability.

What is the main difference between HMO and PPO plans offered by Kaiser Permanente?

+The primary difference between HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization) plans is the level of flexibility in choosing healthcare providers. HMO plans require you to receive care from within the Kaiser Permanente network, except in emergencies, while PPO plans allow you to see healthcare providers outside the network, though typically at a higher cost.

How do I determine which Kaiser Permanente plan is best for me?

+To determine the best Kaiser Permanente plan for you, consider your current health status, anticipated healthcare needs, budget for premiums and out-of-pocket costs, and whether your preferred healthcare providers are part of the Kaiser network. Utilizing online plan comparison tools and consulting with a licensed insurance agent can also be helpful.

Can I see any doctor I want with a Kaiser Permanente plan?

+The ability to see any doctor you want depends on the type of plan you have. With an HMO plan, you generally must receive care from within the Kaiser Permanente network, except in emergency situations. A PPO plan, on the other hand, offers more flexibility, allowing you to see healthcare providers outside the Kaiser network, though this may come at a higher cost to you.