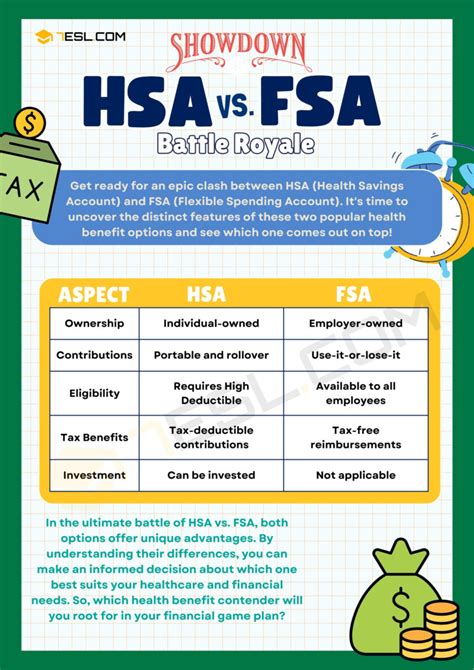

Hsa Or Fsa

When it comes to saving for medical expenses, two popular options are Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs). Both offer tax benefits and can help individuals and families manage healthcare costs, but they have distinct differences in terms of eligibility, contributions, and usage.

Understanding Health Savings Accounts (HSAs)

HSAs are designed for individuals with High-Deductible Health Plans (HDHPs), which are health insurance plans with higher deductibles and lower premiums. To be eligible for an HSA, you must have an HDHP and cannot be enrolled in any other health insurance plan, including Medicare, Medicaid, or a general purpose FSA.

The benefits of HSAs include:

- Tax-deductible contributions: Contributions to an HSA are tax-deductible, reducing your taxable income.

- Tax-free growth: The money in your HSA grows tax-free, and you won’t pay taxes on investment earnings.

- Tax-free withdrawals: You can withdraw money from your HSA tax-free to pay for qualified medical expenses.

- Portability: HSAs are portable, meaning you can take them with you if you change jobs or retire.

- No required minimum distributions: Unlike some other savings vehicles, HSAs do not have required minimum distributions (RMDs) during your lifetime.

Understanding Flexible Spending Accounts (FSAs)

FSAs, on the other hand, are employer-sponsored plans that allow you to set aside pre-tax dollars for healthcare expenses. There are two types of FSAs: healthcare FSAs and dependent care FSAs. Healthcare FSAs are used for medical expenses, while dependent care FSAs are used for childcare or adult care expenses.

The benefits of FSAs include:

- Pre-tax contributions: Contributions to an FSA are made with pre-tax dollars, reducing your taxable income.

- Tax-free reimbursements: You can receive tax-free reimbursements for qualified expenses.

- Convenience: FSAs are often administered through payroll deductions, making it easy to contribute.

However, FSAs also have some limitations:

- Use-it-or-lose-it rule: FSAs are subject to a use-it-or-lose-it rule, which means that any unused funds at the end of the plan year are forfeited.

- Limited rollover: Some FSAs may offer a limited rollover option, allowing you to carry over a small amount of unused funds to the next plan year.

- Dependence on employer: FSAs are employer-sponsored, so you may lose access to your FSA if you change jobs or retire.

Comparison of HSA and FSA

| Feature | HSA | FSA |

|---|---|---|

| Eligibility | Requires HDHP | Employer-sponsored |

| Contributions | Tax-deductible | Pre-tax |

| Growth | Tax-free | Not applicable |

| Withdrawals | Tax-free for qualified medical expenses | Tax-free for qualified expenses |

| Portability | Portable | Not portable |

| Required minimum distributions | No RMDs | Not applicable |

| Use-it-or-lose-it rule | No | Yes |

Ultimately, the choice between an HSA and an FSA depends on your individual circumstances and healthcare needs. If you have an HDHP and want a portable, tax-advantaged savings vehicle, an HSA may be the better choice. If you prefer a more traditional, employer-sponsored plan with pre-tax contributions, an FSA may be the way to go.

What is the main difference between an HSA and an FSA?

+The main difference between an HSA and an FSA is that an HSA is designed for individuals with High-Deductible Health Plans (HDHPs), while an FSA is an employer-sponsored plan that allows you to set aside pre-tax dollars for healthcare expenses.

Can I have both an HSA and an FSA?

+You can have both an HSA and an FSA, but you cannot contribute to an HSA if you have a general purpose FSA. However, you can have a limited-purpose FSA, which only covers dental and vision expenses, alongside an HSA.

What happens to my HSA if I change jobs or retire?

+Your HSA is portable, meaning you can take it with you if you change jobs or retire. You can continue to contribute to your HSA and use the funds for qualified medical expenses.

Can I use my FSA for non-medical expenses?

+No, you can only use your FSA for qualified expenses, which are defined by the IRS. Non-medical expenses are not eligible for reimbursement from an FSA.

How do I contribute to an HSA or FSA?

+You can contribute to an HSA through payroll deductions or by making direct contributions to your HSA account. For an FSA, contributions are typically made through payroll deductions.