Medical 1095A: File With Ease And Accuracy

The world of tax forms can be daunting, especially when it comes to the Medical 1095A form. This document is a crucial piece of paperwork for individuals and families who have received health insurance through the Health Insurance Marketplace. In this article, we will delve into the intricacies of the Medical 1095A form, exploring what it is, why it’s essential, and how to file it with ease and accuracy.

Understanding the Medical 1095A Form

The Medical 1095A form, also known as the Health Insurance Marketplace Statement, is a document provided by the Health Insurance Marketplace to individuals and families who have enrolled in a qualified health plan. This form serves as proof of health insurance coverage and is used to reconcile the premium tax credit (PTC) claimed on the tax return. The Medical 1095A form is typically sent to enrollees by the end of January each year and is available online through the Health Insurance Marketplace account.

Why is the Medical 1095A Form Important?

The Medical 1095A form is vital for several reasons:

- Premium Tax Credit Reconciliation: The form helps to reconcile the PTC claimed on the tax return, ensuring that individuals and families receive the correct amount of tax credit.

- Proof of Health Insurance Coverage: The Medical 1095A form serves as proof of health insurance coverage, which is essential for avoiding the shared responsibility payment (also known as the individual mandate penalty).

- Tax Filing: The form is required when filing taxes, as it provides necessary information for completing the tax return.

How to File the Medical 1095A Form with Ease and Accuracy

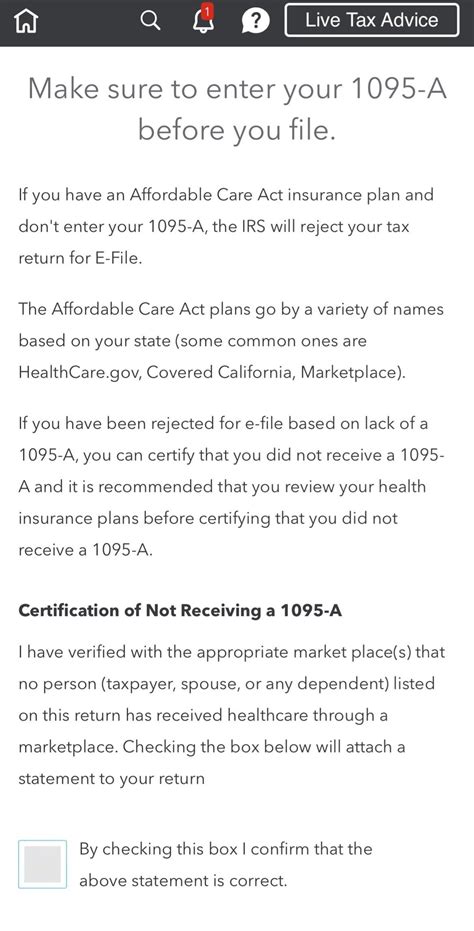

Filing the Medical 1095A form can seem like a daunting task, but with the right guidance, it can be done with ease and accuracy. Here are the steps to follow:

- Gather Required Information: Collect all necessary documents, including the Medical 1095A form, tax returns, and proof of health insurance coverage.

- Complete the Tax Return: Fill out the tax return (Form 1040) and attach the Medical 1095A form to the return.

- Reconcile the Premium Tax Credit: Use the information on the Medical 1095A form to reconcile the PTC claimed on the tax return.

- Report Changes: If there are any changes to the health insurance coverage or household income, report these changes to the Health Insurance Marketplace and the IRS.

Common Mistakes to Avoid

When filing the Medical 1095A form, there are common mistakes to avoid:

- Inaccurate Information: Ensure that all information on the form is accurate, including names, addresses, and health insurance coverage details.

- Missing Information: Make sure to include all required information, such as the policy number and coverage dates.

- Incorrect Reconciliation: Double-check the PTC reconciliation to avoid errors or discrepancies.

What is the deadline for filing the Medical 1095A form?

+The deadline for filing the Medical 1095A form is typically April 15th of each year, but it's essential to check with the IRS or a tax professional for specific deadlines and requirements.

Can I file the Medical 1095A form electronically?

+Yes, the Medical 1095A form can be filed electronically through the IRS website or tax software. However, it's crucial to ensure that all information is accurate and complete to avoid errors or delays.

Conclusion

Filing the Medical 1095A form can seem like a complex task, but by understanding the importance of the form and following the steps outlined above, individuals and families can ensure accurate and efficient filing. Remember to avoid common mistakes, and don’t hesitate to seek help from a tax professional or use tax software to guide you through the process. By taking the time to file the Medical 1095A form correctly, you can ensure that you receive the correct amount of tax credit and avoid any potential penalties or delays.