Ppo Vs Pos

When it comes to health insurance plans, two popular options that often get compared are Preferred Provider Organization (PPO) plans and Point of Service (POS) plans. Both types of plans offer a range of benefits and drawbacks, which can make it challenging for individuals and families to decide which one is the best fit for their needs.

Understanding PPO Plans

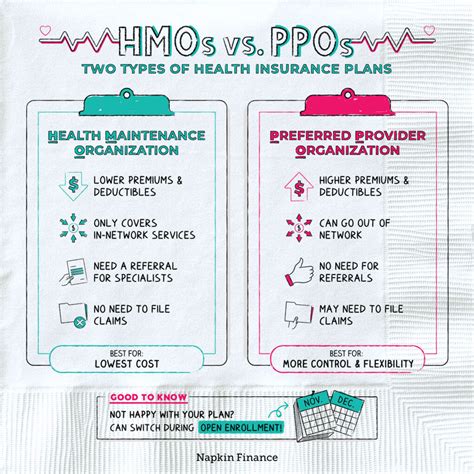

A PPO plan is a type of health insurance plan that offers a network of preferred healthcare providers. These providers have agreed to offer discounted services to plan members, which can help reduce out-of-pocket costs. With a PPO plan, you have the freedom to see any healthcare provider you choose, both in-network and out-of-network. However, seeing an out-of-network provider will typically result in higher out-of-pocket costs.

One of the primary benefits of PPO plans is the flexibility they offer. You can see any doctor or specialist you want, without needing a referral from a primary care physician. This can be particularly beneficial for individuals who have existing relationships with healthcare providers or who need to see specialists for ongoing care.

Understanding POS Plans

A POS plan, on the other hand, is a type of health insurance plan that combines elements of HMO (Health Maintenance Organization) and PPO plans. With a POS plan, you choose a primary care physician from the plan’s network, who will coordinate your care and provide referrals to specialists as needed. However, unlike an HMO plan, a POS plan also allows you to see out-of-network providers, although at a higher cost.

POS plans are often considered a more affordable option than PPO plans, as they typically have lower premiums. However, they may also have more restrictions on care, such as requiring referrals to see specialists.

Key Differences Between PPO and POS Plans

When deciding between a PPO and POS plan, there are several key differences to consider:

- Network restrictions: PPO plans offer more flexibility in terms of network restrictions, as you can see any healthcare provider you choose, both in-network and out-of-network. POS plans, on the other hand, require you to choose a primary care physician from the plan’s network and may require referrals to see specialists.

- Cost: POS plans tend to be more affordable than PPO plans, with lower premiums. However, PPO plans may offer more comprehensive coverage and lower out-of-pocket costs for in-network care.

- Referrals: POS plans typically require referrals from a primary care physician to see specialists, while PPO plans do not.

- Out-of-pocket costs: PPO plans tend to have higher out-of-pocket costs for out-of-network care, while POS plans may have higher out-of-pocket costs for care received without a referral.

Comparing PPO and POS Plans

| Plan Type | Network Restrictions | Cost | Referrals | Out-of-Pocket Costs |

|---|---|---|---|---|

| PPO | More flexible | Higher | Not required | Higher for out-of-network care |

| POS | Less flexible | Lower | Required | Higher for care without referral |

Key Takeaway

When choosing between a PPO and POS plan, consider your individual needs and preferences. If you value flexibility and are willing to pay more for comprehensive coverage, a PPO plan may be the better choice. However, if you are looking for a more affordable option with some restrictions on care, a POS plan may be the way to go.

Case Study: Choosing Between PPO and POS Plans

Meet Sarah, a 35-year-old marketing professional who is shopping for health insurance. Sarah values flexibility and wants to be able to see any healthcare provider she chooses. She is willing to pay more for comprehensive coverage and does not mind higher out-of-pocket costs for out-of-network care. Based on her needs and preferences, a PPO plan may be the better choice for Sarah.

On the other hand, meet John, a 40-year-old accountant who is looking for a more affordable health insurance option. John is willing to choose a primary care physician from the plan’s network and obtain referrals to see specialists. He is also looking to minimize his out-of-pocket costs. Based on his needs and preferences, a POS plan may be the better choice for John.

Decision Framework

When deciding between a PPO and POS plan, consider the following factors:

- Flexibility: Do you value the ability to see any healthcare provider you choose, or are you willing to choose a primary care physician from the plan’s network?

- Cost: Are you looking for a more affordable option with lower premiums, or are you willing to pay more for comprehensive coverage?

- Referrals: Are you willing to obtain referrals from a primary care physician to see specialists, or do you prefer the flexibility to see specialists without a referral?

- Out-of-pocket costs: Are you willing to pay higher out-of-pocket costs for out-of-network care, or do you want to minimize your costs?

By considering these factors and weighing the pros and cons of each plan type, you can make an informed decision that meets your individual needs and preferences.

What is the primary difference between PPO and POS plans?

+The primary difference between PPO and POS plans is the level of flexibility they offer. PPO plans allow you to see any healthcare provider you choose, both in-network and out-of-network, while POS plans require you to choose a primary care physician from the plan’s network and may require referrals to see specialists.

Which plan type is more affordable?

+POS plans tend to be more affordable than PPO plans, with lower premiums. However, PPO plans may offer more comprehensive coverage and lower out-of-pocket costs for in-network care.

Do PPO plans require referrals to see specialists?

+No, PPO plans do not require referrals to see specialists. You can see any healthcare provider you choose, both in-network and out-of-network, without needing a referral.