10+ Banner Health Billing Secrets For Reduced Costs

Navigating the complexities of medical billing can be a daunting task, especially when it comes to large healthcare systems like Banner Health. Understanding the intricacies of billing processes and identifying areas where costs can be optimized is crucial for patients, healthcare providers, and insurance companies alike. Here, we delve into over 10 secrets or strategies that can help reduce costs associated with Banner Health billing, making healthcare more affordable and accessible.

1. Understanding Your Bill

The first step in managing billing costs is understanding what you’re being charged for. Banner Health bills can be complex, including charges for doctor visits, hospital stays, procedures, medications, and more. Look for itemized bills that break down each charge. If something seems unclear or excessive, don’t hesitate to reach out to Banner Health’s billing department for clarification.

2. Negotiating with Providers

It’s not uncommon for uninsured patients or those with high deductible plans to negotiate their medical bills. Banner Health, like many healthcare providers, may offer discounts for prompt payment or for patients who are uninsured. It’s essential to inquire about any potential discounts or financial assistance programs that might be available.

3. Utilizing Financial Assistance Programs

Many hospitals, including those within the Banner Health system, offer financial assistance programs for patients who cannot afford their medical care. These programs can significantly reduce or even eliminate medical bills for eligible patients. The criteria for eligibility vary, but they often consider factors like income level, family size, and insurance status.

4. Pre-Procedure Estimates

For non-emergency procedures, it’s wise to request an estimate of costs beforehand. Banner Health can provide estimates based on the procedure, your insurance coverage, and any out-of-pocket expenses you might incur. This proactive approach can help you plan financially and avoid unexpected costs.

5. Insurance Plan Selection

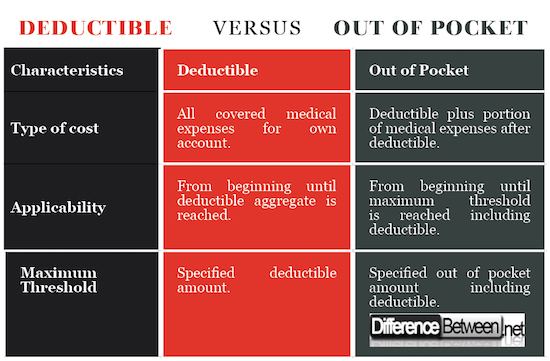

Choosing the right insurance plan can significantly impact your out-of-pocket costs when using Banner Health services. Consider plans that have Banner Health within their network, as out-of-network costs can be substantially higher. Also, look at the plan’s deductible, copays, and coinsurance rates, especially for services you anticipate needing.

6. Pre-Certification and Authorization

Some procedures and treatments require pre-certification or authorization from your insurance provider. Ensure that you or your healthcare provider completes this step, as failure to do so can result in denied claims and higher out-of-pocket costs.

7. Claims Appeal Process

If your insurance claim is denied, you have the right to appeal. Understanding the appeal process and preparing a strong case can help overturn initial denials. Banner Health may also offer assistance or guidance through this process.

8. Patient Advocacy Services

Patient advocacy services can be invaluable in navigating complex billing issues. These advocates can help negotiate bills, understand insurance coverage, and identify potential errors in billing. Some patient advocacy services are free, while others may charge a fee.

9. Medical Billing Advocates

For those dealing with extensive or complicated medical bills, hiring a medical billing advocate might be beneficial. These professionals specialize in reviewing medical bills for errors, negotiating with healthcare providers, and ensuring that clients are charged fairly.

10. Staying Organized

Keeping detailed records of your medical expenses, bills, and communications with Banner Health and your insurance provider is crucial. This can help identify discrepancies, facilitate smoother appeals, and ensure that you’re taking full advantage of any discounts or programs available to you.

11. Prompt Payment Discounts

Some healthcare providers offer discounts for patients who pay their bills promptly. Inquiring about such discounts with Banner Health’s billing department could lead to savings. Even without official discounts, paying bills on time can help avoid additional late fees.

12. Financial Counseling

Banner Health, like many healthcare systems, offers financial counseling to patients. These services can help you understand your billing options, apply for financial assistance, and develop a plan to manage your medical expenses.

Conclusion

Navigating the world of medical billing requires patience, persistence, and sometimes a bit of negotiation. By understanding your bills, exploring available discounts and financial assistance programs, and being proactive about your healthcare costs, you can reduce the financial burden associated with Banner Health billing. Remember, it’s always a good idea to seek help when needed, whether through patient advocacy services, medical billing advocates, or financial counseling provided by Banner Health.

How do I request a detailed estimate of costs for a procedure at Banner Health?

+To request a detailed estimate of costs, you can contact Banner Health's billing department directly. They can provide you with an estimate based on your insurance coverage and the specific procedure you're planning to undergo. It's also a good idea to ask about any pre-certification requirements and potential out-of-pocket expenses.

Are there any specific steps I should take to appeal a denied insurance claim related to a Banner Health visit?

+Yes, if your insurance claim is denied, you should first review the denial reason provided by your insurance company. Then, gather any necessary documentation to support your appeal, such as medical records and a detailed explanation of your situation. Submit your appeal according to the instructions provided by your insurance company, and consider seeking assistance from Banner Health's patient advocacy services or a medical billing advocate if needed.

What kind of financial assistance programs does Banner Health offer to patients who cannot afford their medical bills?

+Banner Health offers various financial assistance programs, including charity care and sliding scale discounts, to help patients who cannot afford to pay their medical bills. Eligibility for these programs is typically based on income level, family size, and insurance status. You can inquire about these programs by contacting Banner Health's financial counseling department, who can guide you through the application process and help determine if you qualify for assistance.

In conclusion, managing and reducing costs associated with Banner Health billing requires a proactive and informed approach. By utilizing the strategies outlined here and staying engaged with your healthcare providers and insurance company, you can navigate the complex world of medical billing with greater ease and potentially lower costs.