Intro

Calculate profitability with a Break Even Point Analysis Excel Template, utilizing financial metrics like revenue, costs, and margins to determine feasibility and optimize business strategies.

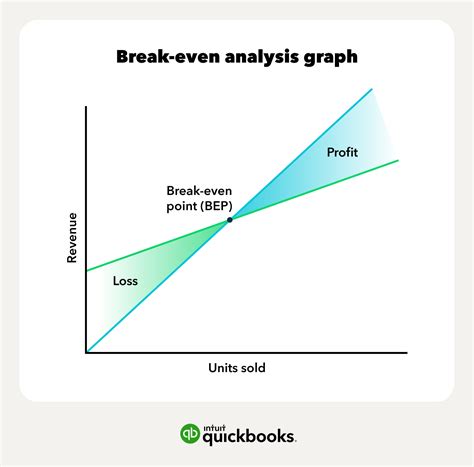

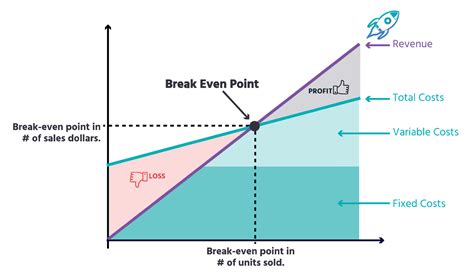

The break-even point analysis is a crucial tool for businesses to determine the point at which their total revenue equals their total fixed and variable costs. This analysis helps companies to identify the sales volume they need to achieve in order to break even, making it an essential component of business planning and decision-making. In this article, we will delve into the world of break-even point analysis, exploring its importance, how it works, and providing a comprehensive guide on how to create a break-even point analysis Excel template.

The break-even point is a critical metric that helps businesses to understand the relationship between their costs, pricing, and sales volume. By calculating the break-even point, companies can determine the minimum sales required to cover their costs, making it easier to set realistic goals and make informed decisions about pricing, production, and investments. Moreover, the break-even point analysis can help businesses to identify areas where they can reduce costs, increase efficiency, and improve profitability.

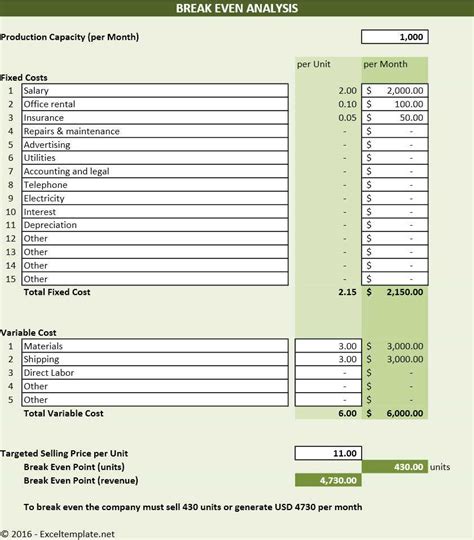

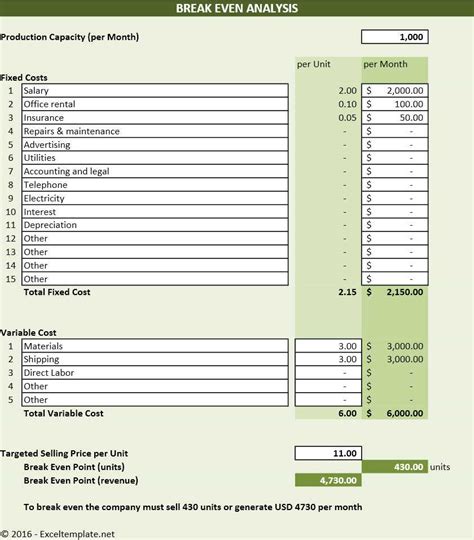

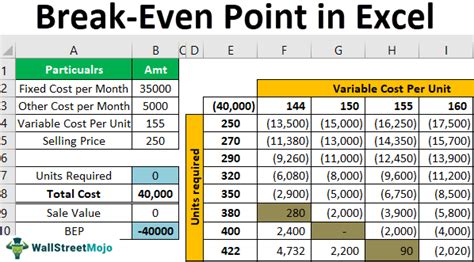

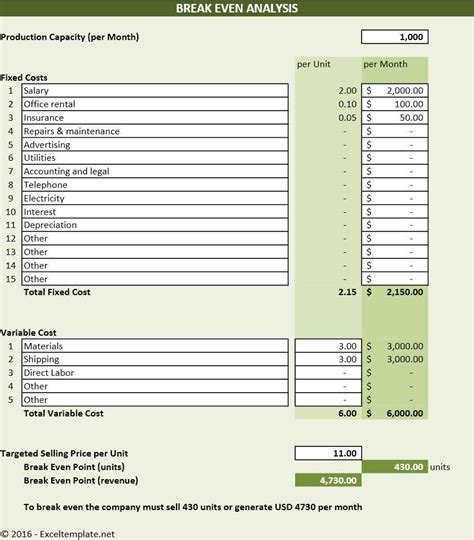

To calculate the break-even point, businesses need to consider their fixed and variable costs. Fixed costs are expenses that remain the same even if the company produces more or less, such as rent, salaries, and insurance. Variable costs, on the other hand, are expenses that vary with the production volume, such as raw materials, labor, and marketing expenses. By understanding the relationship between these costs and the sales volume, companies can make informed decisions about their pricing strategy, production levels, and investment plans.

Understanding Break-Even Point Analysis

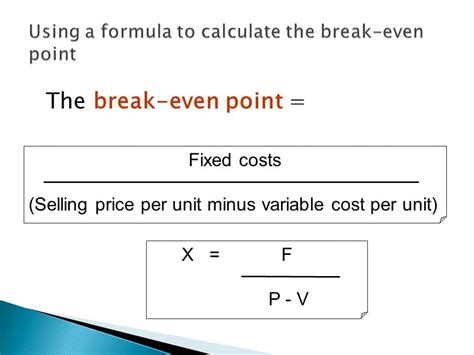

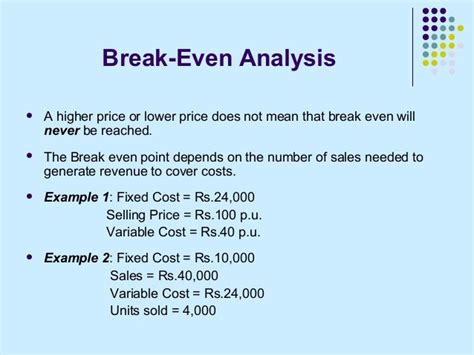

The break-even point analysis is based on the following formula: Break-Even Point (BEP) = Fixed Costs / (Selling Price - Variable Costs). This formula helps businesses to calculate the sales volume required to break even, making it easier to set realistic goals and make informed decisions about their operations. By using this formula, companies can determine the minimum sales required to cover their costs, identify areas where they can reduce costs, and improve their profitability.

Benefits of Break-Even Point Analysis

The break-even point analysis offers several benefits to businesses, including: * Helps to determine the minimum sales required to cover costs * Identifies areas where costs can be reduced * Improves profitability by optimizing pricing and production levels * Enhances decision-making by providing a clear understanding of the relationship between costs, pricing, and sales volume * Enables businesses to set realistic goals and make informed decisions about investments and expansionsCreating a Break-Even Point Analysis Excel Template

Creating a break-even point analysis Excel template is a straightforward process that requires a basic understanding of Excel formulas and functions. To create a template, follow these steps:

- Open a new Excel spreadsheet and create a table with the following columns: Sales Volume, Selling Price, Variable Costs, Fixed Costs, and Break-Even Point.

- Enter the fixed costs, variable costs, and selling price into the respective columns.

- Use the formula BEP = Fixed Costs / (Selling Price - Variable Costs) to calculate the break-even point.

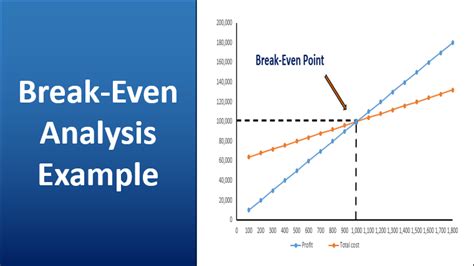

- Create a chart to visualize the break-even point and the relationship between sales volume, costs, and profitability.

Steps to Create a Break-Even Point Analysis Excel Template

Here are the steps to create a break-even point analysis Excel template: * Step 1: Enter the fixed costs, variable costs, and selling price into the respective columns. * Step 2: Use the formula BEP = Fixed Costs / (Selling Price - Variable Costs) to calculate the break-even point. * Step 3: Create a chart to visualize the break-even point and the relationship between sales volume, costs, and profitability. * Step 4: Use the template to analyze different scenarios and make informed decisions about pricing, production, and investments.Using the Break-Even Point Analysis Excel Template

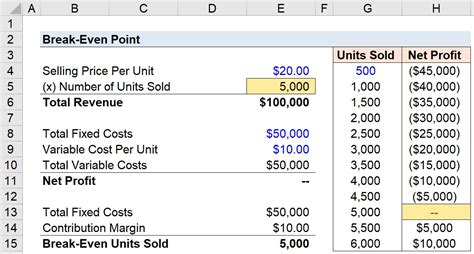

The break-even point analysis Excel template can be used to analyze different scenarios and make informed decisions about pricing, production, and investments. By using the template, businesses can:

- Determine the minimum sales required to cover costs

- Identify areas where costs can be reduced

- Improve profitability by optimizing pricing and production levels

- Enhance decision-making by providing a clear understanding of the relationship between costs, pricing, and sales volume

Practical Examples of Break-Even Point Analysis

Here are some practical examples of break-even point analysis: * A company produces widgets at a variable cost of $10 per unit and sells them at $20 per unit. The fixed costs are $100,000 per year. Using the break-even point formula, the company can calculate the break-even point and determine the minimum sales required to cover costs. * A restaurant has fixed costs of $50,000 per month and variable costs of $5 per meal. The selling price per meal is $10. Using the break-even point formula, the restaurant can calculate the break-even point and determine the minimum number of meals required to cover costs.Gallery of Break-Even Point Analysis Examples

Break-Even Point Analysis Image Gallery

What is the break-even point analysis?

+The break-even point analysis is a tool used to determine the point at which a company's total revenue equals its total fixed and variable costs.

How to calculate the break-even point?

+The break-even point can be calculated using the formula BEP = Fixed Costs / (Selling Price - Variable Costs).

What are the benefits of break-even point analysis?

+The break-even point analysis offers several benefits, including determining the minimum sales required to cover costs, identifying areas where costs can be reduced, and improving profitability.

In conclusion, the break-even point analysis is a powerful tool that can help businesses to make informed decisions about their operations, pricing, and investments. By creating a break-even point analysis Excel template, companies can easily calculate the break-even point and analyze different scenarios to optimize their profitability. Whether you are a small business owner or a financial analyst, understanding the break-even point analysis is crucial for making informed decisions and achieving success in today's competitive market. We invite you to share your thoughts and experiences with break-even point analysis, and to explore our website for more resources and templates to help you achieve your business goals.