Hmo Plans: Save On Healthcare Costs

The ever-evolving landscape of healthcare can be overwhelming, with costs soaring and options multiplying. Amidst this complexity, Health Maintenance Organization (HMO) plans have emerged as a beacon of hope for those seeking to tame the rising tide of medical expenses. By understanding the intricacies of HMO plans and how they operate, individuals and families can make informed decisions that save them money on healthcare costs without compromising on the quality of care.

What are HMO Plans?

At their core, HMO plans are a type of health insurance that provides coverage for a wide range of medical services in exchange for a monthly premium. The key characteristic of an HMO plan is its network of participating healthcare providers, which includes doctors, hospitals, and other medical facilities. Policyholders are generally required to receive their medical care from within this network, except in emergency situations. This structured approach allows HMOs to negotiate lower rates with healthcare providers, thereby reducing costs for the insured.

How Do HMO Plans Save on Healthcare Costs?

The cost-saving benefits of HMO plans can be attributed to several factors:

Network Negotiations: HMOs negotiate rates with healthcare providers, which are often lower than what an individual would pay out-of-pocket or through other insurance types. This negotiation power stems from the HMO’s ability to direct a large volume of patients to specific providers.

Preventive Care Focus: HMO plans typically emphasize preventive care, covering services like annual check-ups, screenings, and vaccinations without additional cost to the patient. By preventing illnesses and detecting health issues early, the need for costly treatments and hospital stays can be significantly reduced.

Primary Care Physician (PCP) Gateway: Many HMO plans require members to choose a PCP from within the network. This PCP acts as a gatekeeper, coordinating care and referrals to specialists when necessary. This approach helps in avoiding unnecessary specialist visits and tests, thereby controlling costs.

Out-of-Pocket Expenses: While HMO plans often come with lower premiums compared to other types of insurance, they may have higher out-of-pocket expenses for services received outside the network. However, for those who primarily use in-network care, the overall savings can be substantial.

Choosing the Right HMO Plan

With numerous HMO plans available, selecting the right one can be daunting. Here are some key considerations:

- Network Coverage: Ensure that your primary care physician and any specialists you see are part of the HMO’s network.

- Coverage and Benefits: Review what services are covered and to what extent. Some plans may offer additional benefits like dental, vision, or prescription drug coverage.

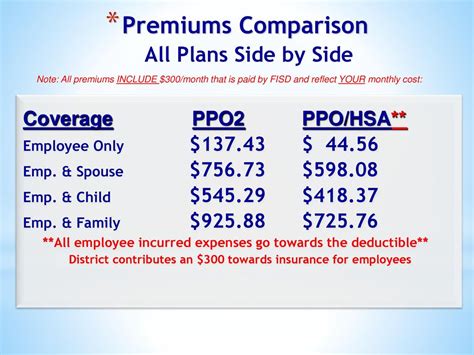

- Costs: Compare premiums, deductibles, copays, and coinsurance rates among different plans to find the best balance for your budget.

- Quality of Care: Research the HMO’s reputation, patient satisfaction ratings, and quality of care metrics to ensure you’re getting the best possible care.

Comparative Analysis: HMO vs. Other Health Insurance Plans

When deciding on a health insurance plan, it’s essential to compare the features and benefits of different types of plans. Here’s a brief overview:

- PPO (Preferred Provider Organization) Plans: Offer more flexibility than HMOs by allowing members to see any healthcare provider, both in and out of network, though out-of-network care is more expensive.

- EPO (Exclusive Provider Organization) Plans: Combine elements of HMO and PPO plans, offering a network of providers but without out-of-network benefits except in emergencies.

- POS (Point of Service) Plans: Allow members to choose between receiving care from an HMO network or seeking care outside the network, with different cost implications.

Expert Insights

Experts in the healthcare sector emphasize the importance of understanding one’s health needs and financial situation before choosing an insurance plan. “HMO plans can be incredibly cost-effective for individuals and families who are willing to work within the network. However, it’s crucial to carefully evaluate the network’s strength in your area and ensure that your healthcare needs can be adequately met,” notes Dr. Maria Rodriguez, a leading health economist.

Future Trends in HMO Plans

The healthcare landscape is constantly evolving, driven by technological advancements, policy changes, and shifting consumer needs. In the future, we can expect HMO plans to incorporate more digital health tools, expand their networks to include more specialized care, and offer more personalized health management programs. These developments are likely to enhance the cost-effectiveness and appeal of HMO plans to a broader range of consumers.

Decision Framework for Choosing an HMO Plan

- Assess Health Needs: Consider the health services you and your family require.

- Evaluate Networks: Ensure your current healthcare providers are in the network.

- Compare Costs: Calculate total costs, including premiums, deductibles, and out-of-pocket expenses.

- Review Benefits: Check what services are covered and any additional benefits.

- Research Quality and Reputation: Look into patient satisfaction and quality of care metrics.

Step-by-Step Guide to Enrolling in an HMO Plan

- Determine Eligibility: Check if you’re eligible for an HMO plan through your employer, the marketplace, or directly from an insurance company.

- Choose a Plan: Select an HMO plan that fits your needs and budget.

- Gather Required Documents: Typically, you’ll need identification, income verification, and possibly proof of prior coverage.

- Apply: Submit your application during the open enrollment period or during a special enrollment period if you qualify.

- Review and Sign: Carefully review your plan details and sign your enrollment documents.

Frequently Asked Questions

What is the main advantage of choosing an HMO plan over other types of health insurance?

+The main advantage of HMO plans is their potential to save on healthcare costs through negotiated network rates and an emphasis on preventive care, which can reduce the need for costly medical interventions.

Can I see any doctor I want with an HMO plan?

+No, with an HMO plan, you are generally required to receive medical care from healthcare providers within the HMO's network, except in emergency situations. This is a key factor in how HMOs keep costs lower for members.

How do I choose the right HMO plan for my family and me?

+Choosing the right HMO plan involves considering your health needs, the strength and convenience of the provider network, the plan's benefits and coverage, and the total costs, including premiums and out-of-pocket expenses. It's also wise to read reviews and ask about the plan's quality of care and patient satisfaction ratings.

In conclusion, HMO plans offer a viable option for individuals and families seeking comprehensive health coverage while keeping costs in check. By understanding how HMOs work, their benefits, and how to choose the right plan, consumers can navigate the complex healthcare market with confidence. As the healthcare sector continues to evolve, the appeal of HMO plans is likely to grow, making them an increasingly important part of the health insurance landscape.