How Does Shortterm Health Insurance Work? Affordable Options

Short-term health insurance, also known as temporary or limited-duration insurance, is designed to provide coverage for a limited period, typically ranging from several months to a few years. This type of insurance is often sought by individuals who are between jobs, waiting for other coverage to begin, or need a temporary solution due to a change in life circumstances. The primary goal of short-term health insurance is to offer a bridge of protection against unforeseen medical expenses during periods of transition.

How Short-Term Health Insurance Works

Short-term health insurance plans are structured differently from major medical plans, which are required to adhere to the Affordable Care Act (ACA) guidelines. These differences are crucial in understanding what short-term insurance covers and how it works:

Application and Approval: Applying for short-term health insurance typically involves a simplified underwriting process compared to major medical insurance. You’ll need to provide basic health information, and the insurer may ask questions about your medical history. Approval can often be granted quickly, sometimes within minutes.

Coverage Period: The coverage period for short-term plans varies but is generally limited to less than a year, although some states allow for longer durations. These plans can often be renewed, but this is not guaranteed, and the insurer may reassess your eligibility and adjust premiums upon renewal.

Benefits and Limitations: Short-term plans typically cover a range of medical services, including doctor visits, hospital stays, and sometimes prescription drugs. However, they often do not cover preventive care, maternity services, mental health care, or pre-existing conditions. The specific benefits can vary significantly between plans and insurers.

Premiums and Out-of-Pocket Costs: Premiums for short-term health insurance can be lower than those for major medical insurance because the coverage is limited and often excludes pre-existing conditions. However, out-of-pocket costs, including deductibles, copays, and coinsurance, can be higher, and there may be lifetime or annual limits on coverage.

Network Providers: Some short-term insurance plans may have a network of preferred providers from which to choose, but this network might be smaller than those of major medical plans. Seeing providers outside the network may result in higher out-of-pocket costs or even no coverage at all, depending on the plan’s terms.

Affordable Options for Short-Term Health Insurance

Given the variability in plan details, premiums, and state regulations, finding an affordable short-term health insurance option that meets your needs requires careful comparison and consideration:

Research Different Insurers: Look into various insurance companies that offer short-term plans in your state. Some may specialize in temporary insurance solutions and offer more flexible or comprehensive options.

Review Plan Details: Carefully examine the coverage, exclusions, and limitations of each plan. Consider what services are most important to you and ensure the plan provides adequate coverage for those needs.

Assess Premiums vs. Benefits: While lower premiums might be attractive, consider the overall value of the plan, including the coverage provided, deductibles, copays, and any maximum out-of-pocket expenses.

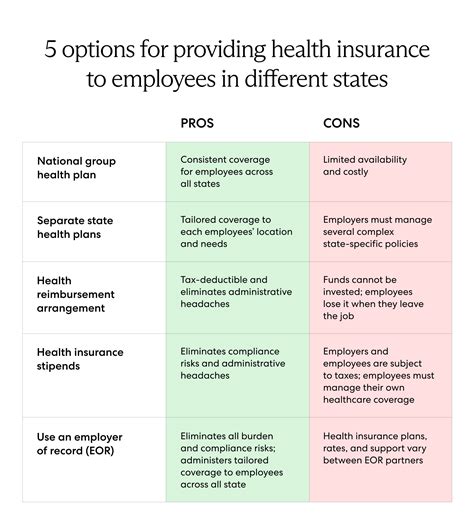

Consider Alternative Options: Depending on your situation, other health insurance options might be more suitable, such as joining a spouse’s plan, exploring Affordable Care Act (ACA) marketplace plans during open enrollment or a special enrollment period, or looking into Medicaid if you qualify.

Understand State Regulations: Some states have implemented their own rules governing short-term health insurance, which can affect the duration of coverage, renewability, and the types of services that must be covered. Familiarize yourself with these regulations to understand your options better.

Key Considerations and Future Implications

As you navigate the landscape of short-term health insurance, several factors should be at the forefront of your decision-making process:

Pre-existing Conditions: If you have a pre-existing condition, short-term health insurance might not provide the coverage you need. Major medical plans, including those through the ACA marketplace, are generally required to cover pre-existing conditions without exclusions or higher premiums based on health status.

Renewability and Cancellability: Understand the terms under which your short-term plan can be renewed or canceled. Some plans may offer guaranteed renewability, while others may reassess your health status or other factors upon renewal.

Future Health Needs: Consider your potential future health needs and whether a short-term solution will adequately address them. If you anticipate needing comprehensive, long-term coverage, exploring major medical insurance options or other alternatives might be wise.

Conclusion

Short-term health insurance can serve as a valuable interim solution for individuals facing temporary gaps in coverage. However, it’s essential to approach these plans with a clear understanding of their limitations, benefits, and how they align with your specific health care needs and financial situation. By carefully evaluating available options, considering state regulations, and weighing the pros and cons of short-term versus major medical insurance, you can make an informed decision that best protects your health and financial well-being during periods of transition.

What is the primary purpose of short-term health insurance?

+The primary purpose of short-term health insurance is to provide temporary coverage against unforeseen medical expenses during periods of transition, such as between jobs or while waiting for other coverage to begin.

Can short-term health insurance be renewed?

+Yes, short-term health insurance plans can often be renewed, but this is not always guaranteed. Upon renewal, the insurer may reassess your eligibility and adjust premiums based on your current health status or other factors.

Do short-term health insurance plans cover pre-existing conditions?

+Generally, short-term health insurance plans do not cover pre-existing conditions. These plans are designed for individuals in good health and may exclude coverage for conditions that existed before the policy’s effective date.

How do I find affordable short-term health insurance options?

+To find affordable short-term health insurance options, research different insurers, carefully review plan details, assess premiums versus benefits, and consider alternative options such as joining a spouse’s plan or exploring ACA marketplace plans.