Intro

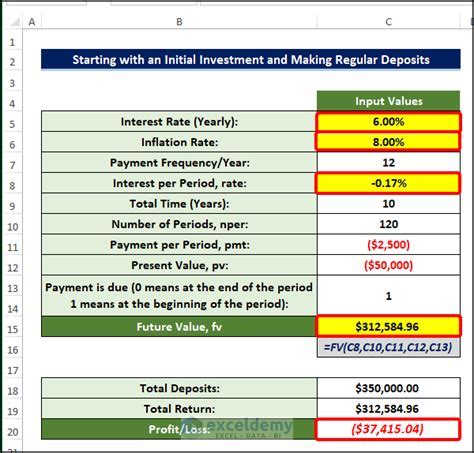

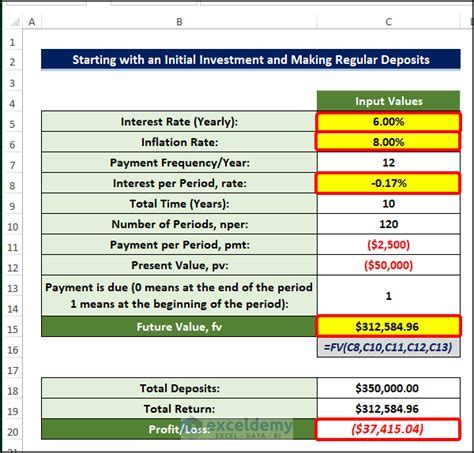

Learn to adjust for inflation in Excel using formulas and functions, accounting for CPI, deflation, and economic growth to accurately calculate values over time.

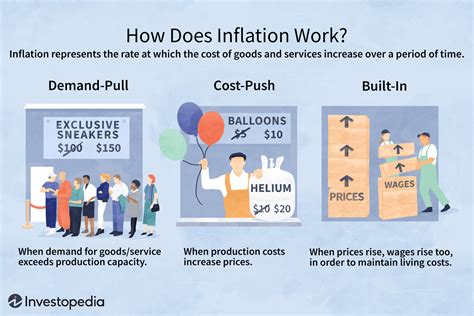

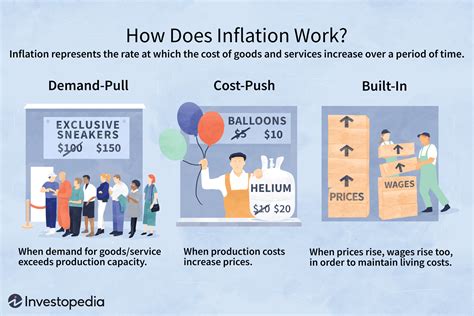

Adjusting for inflation is a crucial step in financial analysis, as it helps to accurately compare monetary values over time. Inflation can significantly impact the purchasing power of money, and failing to account for it can lead to misleading conclusions. Microsoft Excel provides several ways to adjust for inflation, and in this article, we will explore the most common methods.

The importance of adjusting for inflation cannot be overstated. Without it, financial data from different time periods may not be comparable, leading to incorrect assumptions and decisions. For instance, if a company's revenue increases by 10% over a year, it may seem like a positive trend. However, if inflation is 5% during the same period, the actual increase in purchasing power is only 5%. By adjusting for inflation, businesses and individuals can gain a more accurate understanding of their financial performance and make informed decisions.

Inflation adjustment is also essential for personal finance, as it affects the value of savings, investments, and retirement plans. For example, if someone saves $10,000 today, its purchasing power will decrease over time due to inflation. By adjusting for inflation, individuals can determine the future value of their savings and make necessary adjustments to achieve their long-term financial goals.

Understanding Inflation Adjustment Formulas

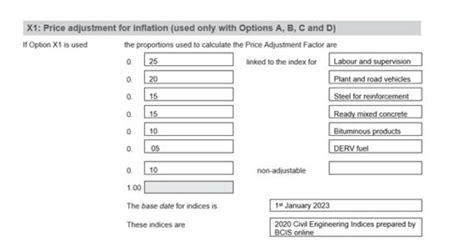

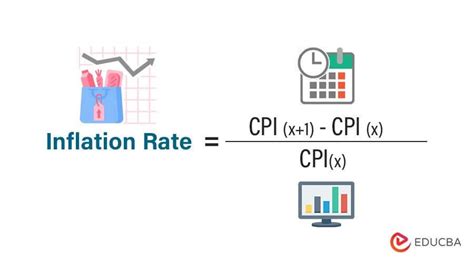

To adjust for inflation in Excel, you can use the following formulas: CPI (Consumer Price Index) adjustment, GDP (Gross Domestic Product) deflator adjustment, and the inflation rate adjustment. The CPI adjustment is the most commonly used method, as it reflects the average change in prices of a basket of goods and services consumed by households. The GDP deflator adjustment, on the other hand, measures the average change in prices of all goods and services produced within a country.

The inflation rate adjustment is a simpler method that uses the average annual inflation rate to adjust for inflation. While it is easier to calculate, it may not provide as accurate results as the CPI or GDP deflator adjustments, especially over longer periods.

Using the CPI Adjustment Formula

The CPI adjustment formula is as follows:Adjusted value = Original value x (CPI in the current year / CPI in the base year)

Where:

- Adjusted value is the value after adjusting for inflation

- Original value is the value before adjusting for inflation

- CPI in the current year is the CPI for the year in which you want to adjust the value

- CPI in the base year is the CPI for the year in which the original value was measured

For example, if you want to adjust a value of $10,000 from 2010 to 2020, and the CPI in 2010 was 100, and the CPI in 2020 was 120, the adjusted value would be:

Adjusted value = $10,000 x (120 / 100) = $12,000

Applying Inflation Adjustment in Excel

To apply inflation adjustment in Excel, you can use the following steps:

- Enter the original values in a column

- Enter the CPI values for each year in another column

- Use the CPI adjustment formula to calculate the adjusted values

- Enter the formula in a new column, and copy it down to apply it to all the original values

For example, if you have a table with the following columns:

| Year | Original Value | CPI |

|---|---|---|

| 2010 | $10,000 | 100 |

| 2011 | $10,500 | 105 |

| 2012 | $11,000 | 110 |

You can use the following formula to calculate the adjusted values:

= B2 x (C2 / C1)

Where:

- B2 is the original value for 2010

- C2 is the CPI for 2010

- C1 is the CPI for the base year (2010)

Using the GDP Deflator Adjustment Formula

The GDP deflator adjustment formula is similar to the CPI adjustment formula:Adjusted value = Original value x (GDP deflator in the current year / GDP deflator in the base year)

Where:

- Adjusted value is the value after adjusting for inflation

- Original value is the value before adjusting for inflation

- GDP deflator in the current year is the GDP deflator for the year in which you want to adjust the value

- GDP deflator in the base year is the GDP deflator for the year in which the original value was measured

For example, if you want to adjust a value of $10,000 from 2010 to 2020, and the GDP deflator in 2010 was 100, and the GDP deflator in 2020 was 120, the adjusted value would be:

Adjusted value = $10,000 x (120 / 100) = $12,000

Inflation Adjustment Using Excel Functions

Excel provides several functions that can be used to adjust for inflation, including the INDEX/MATCH function, the VLOOKUP function, and the XLOOKUP function. These functions can be used to look up the CPI or GDP deflator values for each year and apply the inflation adjustment formula.

For example, if you have a table with the following columns:

| Year | CPI |

|---|---|

| 2010 | 100 |

| 2011 | 105 |

| 2012 | 110 |

You can use the following formula to look up the CPI value for each year and apply the inflation adjustment formula:

= B2 x (INDEX(C:C, MATCH(A2, A:A, 0)) / INDEX(C:C, MATCH(A1, A:A, 0)))

Where:

- B2 is the original value for 2010

- C:C is the column containing the CPI values

- A:A is the column containing the year values

- A2 is the year for which you want to adjust the value

- A1 is the base year

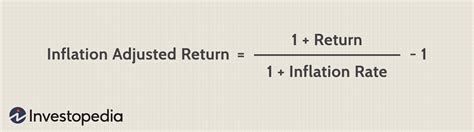

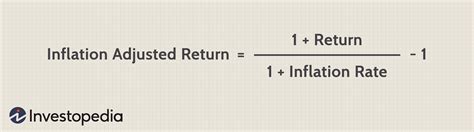

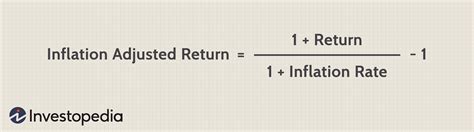

Using the Inflation Rate Adjustment Formula

The inflation rate adjustment formula is a simpler method that uses the average annual inflation rate to adjust for inflation:Adjusted value = Original value x (1 + Inflation rate)^Number of years

Where:

- Adjusted value is the value after adjusting for inflation

- Original value is the value before adjusting for inflation

- Inflation rate is the average annual inflation rate

- Number of years is the number of years between the original value and the adjusted value

For example, if you want to adjust a value of $10,000 from 2010 to 2020, and the average annual inflation rate is 2%, the adjusted value would be:

Adjusted value = $10,000 x (1 + 0.02)^10 = $12,190.48

Gallery of Inflation Adjustment Examples

Inflation Adjustment Image Gallery

Frequently Asked Questions

What is inflation adjustment?

+Inflation adjustment is the process of adjusting monetary values to account for the effects of inflation over time.

Why is inflation adjustment important?

+Inflation adjustment is important because it helps to accurately compare monetary values over time and make informed decisions.

How do I adjust for inflation in Excel?

+You can adjust for inflation in Excel using the CPI adjustment formula, the GDP deflator adjustment formula, or the inflation rate adjustment formula.

In conclusion, adjusting for inflation is a crucial step in financial analysis, and Excel provides several ways to do so. By using the CPI adjustment formula, the GDP deflator adjustment formula, or the inflation rate adjustment formula, you can accurately compare monetary values over time and make informed decisions. Whether you are a business owner, an investor, or an individual, understanding how to adjust for inflation in Excel can help you achieve your financial goals. We encourage you to try out the different methods and formulas discussed in this article and share your experiences with us. If you have any questions or need further clarification, please do not hesitate to comment below.