Hra Account Vs Hsa

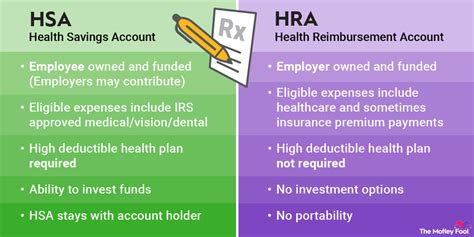

The world of health savings options can be complex, with various plans and accounts available to individuals and families. Two popular options are Health Reimbursement Arrangements (HRAs) and Health Savings Accounts (HSAs). While both are designed to help with medical expenses, they have distinct differences in terms of eligibility, contributions, and usage. In this article, we’ll delve into the details of HRAs and HSAs, exploring their characteristics, benefits, and drawbacks to help you decide which one might be the best fit for your healthcare needs.

Introduction to HRAs

A Health Reimbursement Arrangement (HRA) is an employer-funded plan that reimburses employees for medical expenses. The key aspect of an HRA is that it is entirely funded by the employer, and the contributions are not taxable to the employee. HRAs can be designed in various ways, including as a stand-alone plan or integrated with a group health plan. One of the primary reasons employers offer HRAs is to provide employees with a tax-advantaged way to pay for medical expenses not covered by their health insurance plan.

Introduction to HSAs

A Health Savings Account (HSA) is a tax-advantaged savings account available to individuals with a High Deductible Health Plan (HDHP). HSAs are funded by the account holder, which can be the individual or their employer. The contributions to an HSA are tax-deductible, and the funds grow tax-free. Moreover, if used for qualified medical expenses, the withdrawals are tax-free. HSAs are designed to encourage individuals to save for future medical expenses, providing a safety net against high healthcare costs.

Comparison of HRA and HSA

Eligibility

- HRA: Any employer can offer an HRA to its employees. There are no specific eligibility requirements regarding the type of health insurance plan the employee must have.

- HSA: To be eligible for an HSA, an individual must have a High Deductible Health Plan (HDHP) and cannot be covered by any other health plan that is not an HDHP, with certain exceptions for specific types of insurance (e.g., dental, vision, disability).

Contributions

- HRA: Contributions are made by the employer and are tax-deductible as a business expense. Employees cannot contribute to an HRA.

- HSA: Contributions can be made by the individual or their employer. The contributions are tax-deductible, reducing the individual’s taxable income.

Portability

- HRA: Generally, HRAs are not portable, meaning if you leave your job, you typically cannot take the HRA with you.

- HSA: HSAs are completely portable. You can take your HSA with you if you change jobs or retire.

Investment Options

- HRA: HRAs typically do not offer investment options. The funds are usually held in a cash account and used for reimbursement of medical expenses.

- HSA: HSAs often offer investment options, allowing account holders to invest their contributions in stocks, bonds, or mutual funds, potentially growing their savings over time.

Usage

- HRA: HRAs can only be used for eligible medical expenses as defined by the employer’s plan document. The employer decides how the funds can be used, and any unused funds typically remain with the employer.

- HSA: HSAs can be used for a wide range of qualified medical expenses, including doctor visits, hospital stays, prescriptions, and more. Unused funds roll over from year to year and can even be used for non-medical expenses in retirement, although such use may incur taxes and penalties.

Decision Framework

When deciding between an HRA and an HSA, consider the following factors:

- Employer Contributions: If your employer offers an HRA and contributes significantly to it, this might be a more immediate benefit compared to an HSA, where you or your employer can contribute, but there might be limits.

- Portability: If job security is a concern or you anticipate changing jobs, an HSA might be more appealing due to its portability.

- Investment Opportunities: If you’re looking to grow your health savings over time, an HSA with investment options could be more beneficial.

- Eligibility: Check if you’re eligible for an HSA by having an HDHP. If not, an HRA might be the better option if offered by your employer.

- Control and Flexibility: Consider whether you prefer the flexibility and control that comes with an HSA, where you manage the funds and decide how to use them, versus an HRA, where the employer has more control over the plan’s design and use.

Conclusion

Both HRAs and HSAs offer valuable benefits for managing healthcare expenses, but they serve different needs and provide different advantages. Understanding the specifics of each, including eligibility, contributions, portability, and usage, is crucial for making an informed decision. Whether you prioritize immediate reimbursement for medical expenses through an HRA or the long-term savings and investment potential of an HSA, choosing the right option can significantly impact your financial and healthcare well-being.

FAQs

Can I have both an HRA and an HSA?

+In most cases, you cannot have both an HRA and an HSA at the same time, especially if the HRA is integrated with your health plan and reimburses expenses before you meet your deductible. However, there are specific exceptions and configurations, such as a limited-purpose HRA or an HRA that only reimburses expenses after the HDHP deductible is met, that might allow for both. It's essential to review your specific plan details and consult with a benefits advisor.

How do I contribute to an HSA?

+Contributions to an HSA can be made by you or your employer. If you're making personal contributions, you can typically do so through payroll deductions, which are pre-tax, or by making a direct contribution to your HSA provider and then claiming the deduction on your tax return. The contribution limits are subject to annual change, so it's a good idea to check the current year's limits.

Can I use HSA funds for anything other than medical expenses?

+Yes, but with caution. Before age 65, using HSA funds for non-qualified medical expenses will result in having to pay income tax on the withdrawn amount plus a 20% penalty. After age 65, you can use HSA funds for non-medical expenses without the penalty, though you'll still pay income tax on those withdrawals. It's generally recommended to use HSA funds for qualified medical expenses to maximize the tax benefits.

Ultimately, the decision between an HRA and an HSA depends on your specific healthcare needs, financial situation, and employment benefits. By understanding the nuances of each option and considering your individual circumstances, you can make an informed choice that best supports your health and financial well-being.