Kaiser Health Plans Compared: Best Options

When it comes to selecting a health insurance plan, navigating through the numerous options can be overwhelming, especially for those considering Kaiser Health Plans. Kaiser Permanente, one of the largest nonprofit health plans in the United States, offers a wide range of health insurance options tailored to different needs and budgets. Understanding the nuances of each plan is crucial for making an informed decision that suits your health care requirements and financial situation.

Introduction to Kaiser Health Plans

Kaiser Permanente is renowned for its integrated health care model, which combines health insurance with medical care and health education. This system allows for comprehensive, coordinated care, focusing on preventive medicine and managing chronic conditions effectively. Kaiser Health Plans are available in several states, including California, Colorado, Georgia, Hawaii, Maryland, Oregon, Virginia, Washington, and the District of Columbia.

Types of Kaiser Health Plans

- Individual and Family Plans: These plans are designed for individuals and families not covered by employer-sponsored health insurance. They offer a range of deductibles, copays, and coinsurance rates to fit different budgets.

- Group Plans: For businesses and organizations, Kaiser offers group plans that can be tailored to the specific needs of the company and its employees.

- Medicare and Medicaid Plans: Kaiser Permanente also provides health plans for seniors and individuals with lower incomes, aligning with Medicare and Medicaid programs.

Key Features to Consider

- Network: Kaiser Permanente has a large network of hospitals, medical offices, and healthcare professionals. However, it’s essential to ensure your preferred healthcare providers are part of the Kaiser network, especially if you’re considering a specific type of care.

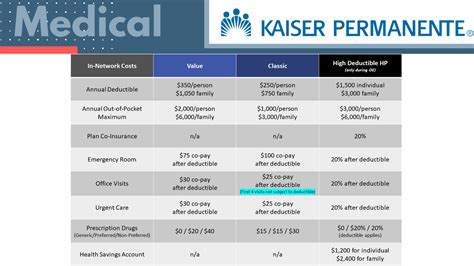

- Deductibles and Out-of-Pocket Costs: Different plans have varying deductibles, copays, and maximum out-of-pocket expenses. Understanding these costs can help you choose a plan that best aligns with your financial situation.

- Preventive Services: Many Kaiser plans cover preventive care services without additional costs, promoting early detection and treatment of health issues.

- Prescription Coverage: The coverage and cost of prescription medications can vary between plans. It’s crucial to review the formulary (list of covered drugs) if you have specific medication needs.

Comparative Analysis of Kaiser Health Plans

| Plan Type | Deductible | Copay/Coinsurance | Maximum Out-of-Pocket |

|---|---|---|---|

| Platinum | 0-1,000 | 10-30 copay | 2,000-4,000 |

| Gold | 1,000-3,000 | 20-50 copay | 4,000-6,000 |

| Silver | 2,000-5,000 | 30-70 copay | 6,000-8,000 |

| Bronze | 3,000-7,000 | 40%-60% coinsurance | 8,000-10,000 |

Expert Insights

According to health insurance experts, “The key to selecting the best Kaiser Health Plan is understanding your healthcare needs and budget. For those who frequently visit healthcare providers, a platinum plan might offer the best value despite the higher premiums. Conversely, individuals with minimal healthcare needs might find a bronze plan more economical.”

Real-World Applications

Consider the scenario of a 35-year-old individual with a moderate income and occasional healthcare visits. A silver plan might offer the right balance between premium costs and healthcare expenses. However, if this individual has a chronic condition requiring regular medical attention, a gold plan could provide more comprehensive coverage, albeit at a higher premium.

Decision Framework

- Assess Your Health Care Needs: Consider how often you visit healthcare providers and any ongoing medical conditions.

- Evaluate Your Budget: Determine how much you can afford for monthly premiums, deductibles, copays, and coinsurance.

- Compare Plan Details: Look into the specifics of each Kaiser Health Plan, including network coverage, preventive services, and prescription drug coverage.

- Consult with a Health Insurance Expert: If possible, seek advice from an expert who can help navigate the plans and choose the most suitable option.

Future Trends in Health Insurance

The health insurance landscape is continuously evolving, with a focus on patient-centered care, digital health technologies, and value-based payment models. As these trends develop, health insurance plans, including those offered by Kaiser Permanente, are likely to incorporate more personalized care options, access to virtual healthcare services, and incentives for preventive care and healthy lifestyle choices.

Conclusion

Choosing the right Kaiser Health Plan involves a thoughtful consideration of your health care needs, financial situation, and personal preferences. By understanding the types of plans available, their features, and how they align with your individual circumstances, you can make an informed decision that ensures you have comprehensive and affordable health insurance coverage.

What are the main factors to consider when choosing a Kaiser Health Plan?

+When selecting a Kaiser Health Plan, it’s essential to consider your health care needs, budget, the plan’s network, deductibles, copays, coinsurance rates, and coverage for preventive services and prescription medications.

How do I determine which Kaiser plan is best for me?

+To find the best plan, assess your health care usage, evaluate your budget for premiums and out-of-pocket expenses, and compare the specifics of each plan, including network, preventive services, and prescription coverage. Consulting with a health insurance expert can also provide personalized guidance.

Are Kaiser Health Plans available in all states?

+No, Kaiser Health Plans are not available in all states. They are currently offered in California, Colorado, Georgia, Hawaii, Maryland, Oregon, Virginia, Washington, and the District of Columbia.