Intro

Discover 5 ways to payoff loans quickly, including debt consolidation, snowball method, and refinancing, to achieve financial freedom and reduce loan stress with effective payoff strategies.

Dealing with loan payments can be a significant source of stress for many individuals. The pressure to meet monthly deadlines, manage interest rates, and balance other financial responsibilities can be overwhelming. However, there are strategies that can help make loan repayment more manageable and efficient. In this article, we will explore five ways to payoff loans, focusing on practical advice and proven methods to help you achieve financial stability.

The importance of managing loan payments effectively cannot be overstated. By doing so, individuals can avoid late fees, reduce debt, and improve their credit scores. Moreover, paying off loans in a timely manner can free up more money in your budget for other essential expenses, savings, and investments. Whether you are dealing with student loans, personal loans, or mortgage payments, understanding the best strategies for loan repayment is crucial for achieving long-term financial health.

For many, the task of paying off loans seems daunting, especially when faced with high interest rates or large principal amounts. However, by adopting the right approach and maintaining discipline, it is possible to payoff loans efficiently. This involves not only making regular payments but also considering ways to reduce the principal amount, lower interest rates, and potentially consolidate debts. By exploring these strategies, individuals can take the first steps towards financial freedom and peace of mind.

Understanding Loan Repayment

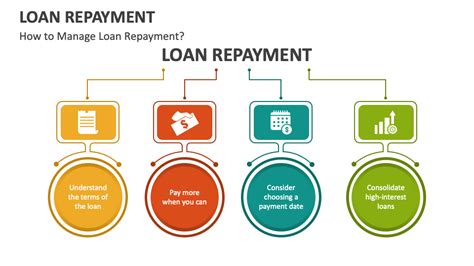

Before diving into the specifics of loan repayment strategies, it's essential to understand the basics of how loans work. Loans are typically characterized by their principal amount, interest rate, and repayment term. The principal is the initial amount borrowed, the interest rate determines the cost of borrowing, and the repayment term sets out how long you have to pay back the loan. Understanding these elements is crucial for developing an effective repayment plan.

Key Factors in Loan Repayment

When considering how to payoff loans, several key factors come into play. These include the type of loan, the interest rate, the repayment term, and your overall financial situation. For instance, loans with high interest rates may require a more aggressive repayment strategy to minimize the total cost of the loan. Similarly, loans with longer repayment terms may offer more flexibility but could also result in paying more in interest over time.Strategy 1: Snowball Method

The snowball method is a popular strategy for paying off loans, particularly when dealing with multiple debts. This approach involves paying off loans with the smallest balances first, while making minimum payments on other debts. The idea behind this method is to achieve quick wins by eliminating smaller debts, which can provide motivation and a sense of accomplishment as you progress.

To implement the snowball method, start by listing all your loans, from the smallest balance to the largest. Then, focus on paying as much as possible towards the smallest loan while making the minimum payments on the rest. Once the smallest loan is paid off, use the money you were paying on it to attack the next smallest loan, and so on. This strategy can be very effective for building momentum and staying motivated throughout the repayment process.

Benefits of the Snowball Method

The snowball method offers several benefits, including psychological advantages. The quick elimination of smaller debts provides a sense of progress and can help keep you motivated. Additionally, this approach can be less overwhelming than dealing with larger debts first, making it more manageable for those who are new to loan repayment strategies.Strategy 2: Avalanche Method

In contrast to the snowball method, the avalanche method involves paying off loans with the highest interest rates first. This approach can save you the most money in interest over time, as you're tackling the costliest debts first. By focusing on high-interest loans, you can reduce the total amount you pay over the life of the loan, making this strategy a cost-effective option.

To use the avalanche method, list your loans by their interest rates, from highest to lowest. Then, allocate as much money as possible towards the loan with the highest interest rate, while making minimum payments on the other loans. Once the loan with the highest interest rate is paid off, move on to the loan with the next highest interest rate, and so on. This strategy requires discipline but can lead to significant savings in interest payments.

Calculating Savings with the Avalanche Method

When considering the avalanche method, it's essential to calculate the potential savings. By paying off high-interest loans first, you can avoid paying thousands of dollars in interest over the life of the loan. For example, if you have a loan with a $10,000 principal and an interest rate of 20%, paying this loan off aggressively could save you a substantial amount in interest compared to paying off a loan with a lower interest rate first.Strategy 3: Debt Consolidation

Debt consolidation involves combining multiple loans into one loan with a single interest rate and repayment term. This strategy can simplify your finances by reducing the number of payments you need to make each month. Additionally, if you can secure a lower interest rate through consolidation, it can also save you money on interest over time.

To consolidate debt, you can use a personal loan, balance transfer credit card, or a debt consolidation program. The key is to find a consolidation option that offers a lower interest rate than your current loans and a repayment term that fits your budget. By streamlining your debts into a single loan, you can make your financial situation more manageable and potentially save money on interest.

Benefits of Debt Consolidation

Debt consolidation offers several benefits, including simplifying your finances and potentially reducing your monthly payments. By combining multiple loans into one, you can avoid the hassle of keeping track of multiple due dates and interest rates. Moreover, if you secure a lower interest rate, you can save money and pay off your debt faster.Strategy 4: Income-Driven Repayment

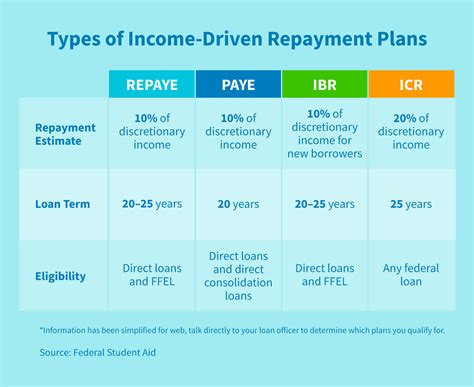

For individuals with student loans, income-driven repayment (IDR) plans can be a valuable option. IDR plans adjust your monthly payment amount based on your income and family size. The idea behind these plans is to make loan payments more affordable for borrowers who are struggling to make ends meet.

To enroll in an IDR plan, you typically need to apply through your loan servicer and provide documentation of your income. Once enrolled, your monthly payment amount will be calculated as a percentage of your discretionary income. This can significantly lower your monthly payments, making them more manageable. After a certain period, usually 20 or 25 years, any remaining balance on your loans may be forgiven, although this forgiveness may be taxable.

Eligibility for Income-Driven Repayment

Not all loans are eligible for IDR plans, so it's essential to check with your loan servicer to see if you qualify. Generally, federal student loans are eligible, but private student loans are not. Additionally, you will need to recertify your income and family size each year to continue in the program. By taking advantage of IDR plans, you can make your student loan payments more affordable and work towards loan forgiveness.Strategy 5: Bi-Weekly Payments

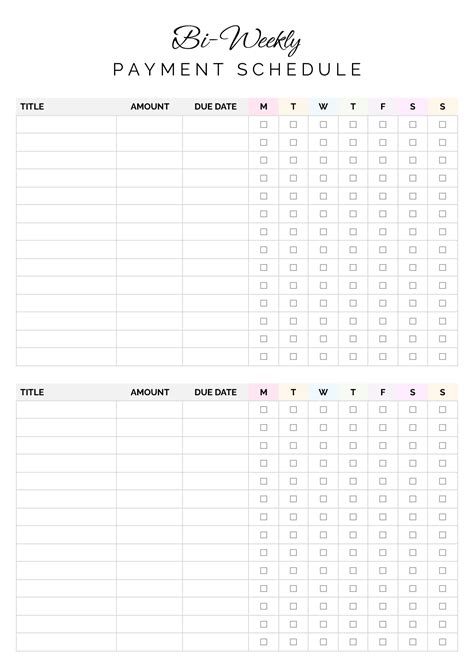

Making bi-weekly payments instead of monthly payments can be a simple yet effective strategy for paying off loans faster. By splitting your monthly payment in half and paying every two weeks, you can make 26 payments per year instead of 12. This can result in paying less interest over the life of the loan and paying off the principal balance faster.

To implement bi-weekly payments, you can either set up automatic transfers from your checking account or manually make payments every two weeks. It's crucial to confirm with your lender that they allow bi-weekly payments and to understand how these payments will be applied to your loan. By making this small adjustment to your payment schedule, you can potentially save thousands of dollars in interest and become debt-free sooner.

Calculating the Impact of Bi-Weekly Payments

The impact of bi-weekly payments can be significant, especially for large loans like mortgages. For example, on a $200,000 mortgage with a 30-year term and a 4% interest rate, making bi-weekly payments instead of monthly payments could save you over $20,000 in interest and pay off the loan about 5 years early. This strategy requires minimal effort but can have a substantial effect on your loan repayment.Loan Repayment Strategies Image Gallery

What is the best strategy for paying off loans?

+The best strategy for paying off loans depends on your individual financial situation and the terms of your loans. Consider factors like interest rates, loan balances, and your income when choosing a strategy.

How does debt consolidation work?

+Debt consolidation involves combining multiple loans into one loan with a single interest rate and repayment term. This can simplify your finances and potentially save you money on interest.

What are income-driven repayment plans?

+Income-driven repayment plans adjust your monthly loan payment based on your income and family size. These plans are designed to make loan payments more affordable for borrowers who are struggling to make ends meet.

In conclusion, paying off loans requires a well-thought-out strategy that considers your financial situation, the terms of your loans, and your long-term goals. By understanding the different repayment strategies available, such as the snowball method, avalanche method, debt consolidation, income-driven repayment, and bi-weekly payments, you can make informed decisions about how to manage your debt. Remember, the key to successful loan repayment is consistency, patience, and a willingness to adapt your strategy as your financial situation changes. By staying committed to your repayment plan and exploring ways to save money on interest, you can payoff your loans efficiently and achieve financial stability. We invite you to share your experiences with loan repayment and any strategies that have worked for you in the comments below.