Intro

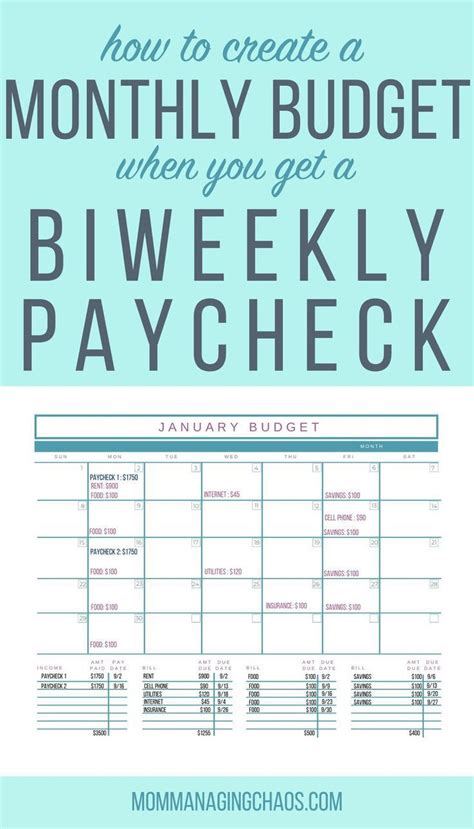

Creating and managing a budget can be a daunting task, especially for those who are new to personal finance. However, having a solid budget in place is essential for achieving financial stability and security. One effective way to manage finances is by using a bi-weekly budget. This approach involves dividing your monthly expenses into two payments, made every other week. In this article, we will explore the importance of budgeting and provide five bi-weekly budget tips to help you manage your finances effectively.

Budgeting is crucial for anyone looking to take control of their financial situation. It helps you understand where your money is going, identify areas for improvement, and make informed decisions about how to allocate your resources. By creating a budget, you can prioritize your spending, save for the future, and avoid debt. A bi-weekly budget can be particularly helpful for those who receive paychecks every other week, as it allows you to match your expenses with your income.

Effective budgeting requires discipline, patience, and a clear understanding of your financial goals. It's essential to track your income and expenses, categorize your spending, and make adjustments as needed. With a bi-weekly budget, you can break down your monthly expenses into manageable chunks, making it easier to stay on top of your finances. Whether you're looking to pay off debt, build savings, or simply improve your financial stability, a bi-weekly budget can be a valuable tool in achieving your goals.

Understanding Bi-Weekly Budgeting

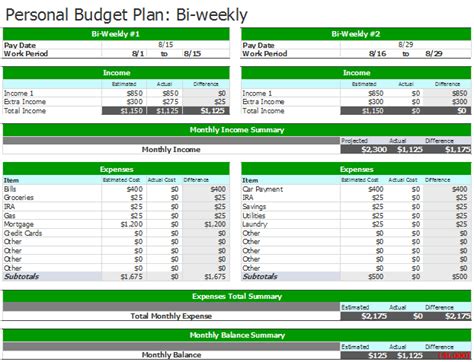

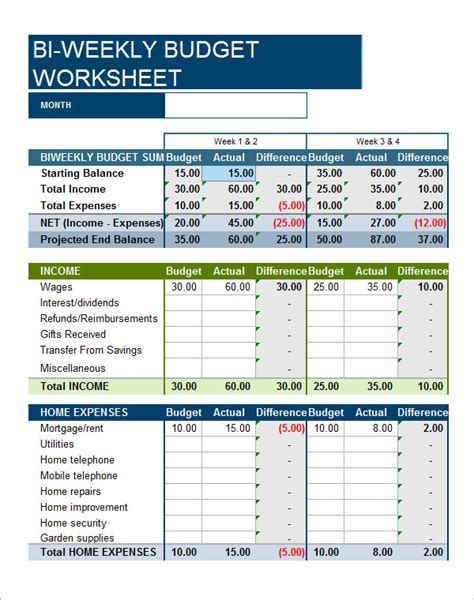

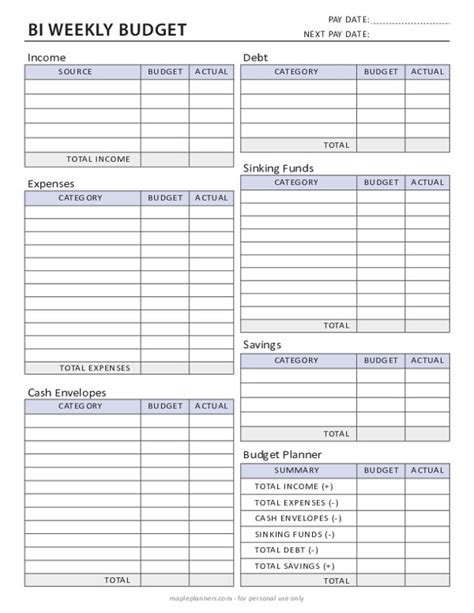

Bi-weekly budgeting involves dividing your monthly expenses into two payments, made every other week. This approach can be helpful for those who receive paychecks on a bi-weekly schedule, as it allows you to match your expenses with your income. To create a bi-weekly budget, you'll need to calculate your total monthly expenses and divide them by two. This will give you the amount you need to set aside each pay period.

Benefits of Bi-Weekly Budgeting

Some of the benefits of bi-weekly budgeting include: * Improved cash flow management * Reduced financial stress * Increased savings * Better alignment with bi-weekly pay schedules * Enhanced financial disciplineBi-Weekly Budget Tips

Here are five bi-weekly budget tips to help you manage your finances effectively:

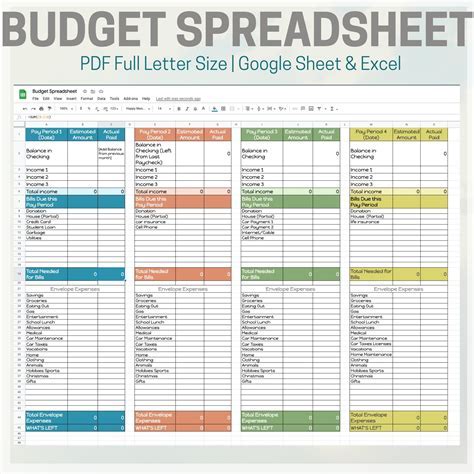

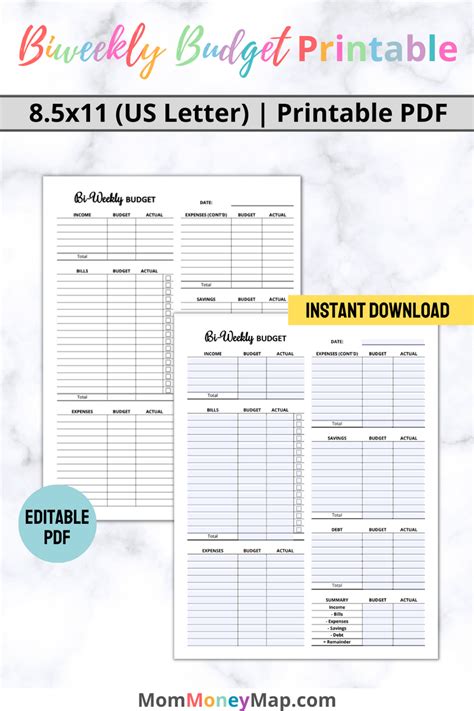

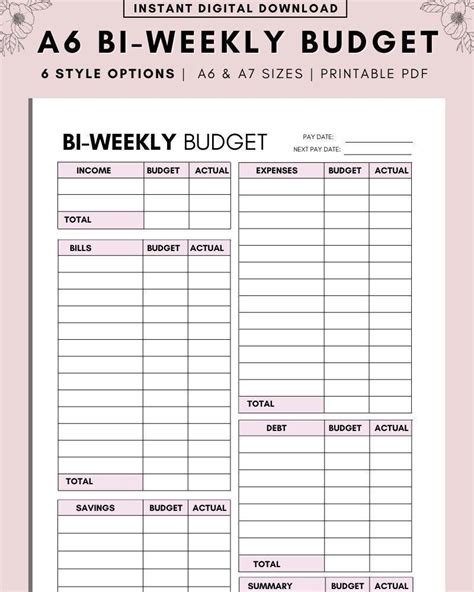

- Track your expenses: Keeping track of your income and expenses is essential for creating an effective budget. Use a budgeting app, spreadsheet, or simply a notebook to record every transaction.

- Categorize your spending: Divide your expenses into categories, such as housing, transportation, food, and entertainment. This will help you identify areas where you can cut back and make adjustments.

- Prioritize your spending: Make sure to prioritize essential expenses, such as rent/mortgage, utilities, and groceries, over discretionary spending, such as dining out or entertainment.

- Use the 50/30/20 rule: Allocate 50% of your income towards essential expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment.

- Review and adjust: Regularly review your budget to ensure you're on track to meet your financial goals. Make adjustments as needed to stay on course.

Implementing a Bi-Weekly Budget

To implement a bi-weekly budget, follow these steps: * Calculate your total monthly expenses * Divide your expenses by two to determine your bi-weekly budget * Set up automatic transfers to ensure timely payments * Review and adjust your budget regularlyCommon Bi-Weekly Budgeting Mistakes

Some common mistakes to avoid when using a bi-weekly budget include:

- Failing to account for irregular expenses

- Not prioritizing essential expenses

- Overspending on discretionary items

- Not reviewing and adjusting the budget regularly

Overcoming Bi-Weekly Budgeting Challenges

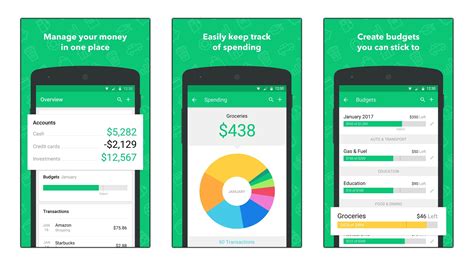

To overcome common bi-weekly budgeting challenges, consider the following strategies: * Use a budgeting app to track expenses and stay organized * Set up automatic transfers to ensure timely payments * Prioritize essential expenses and cut back on discretionary spending * Review and adjust your budget regularly to stay on courseBi-Weekly Budgeting Tools and Resources

There are many tools and resources available to help you create and manage a bi-weekly budget. Some popular options include:

- Budgeting apps, such as Mint or You Need a Budget (YNAB)

- Spreadsheets, such as Google Sheets or Microsoft Excel

- Budgeting software, such as Quicken or Personal Capital

- Online budgeting calculators and worksheets

Conclusion and Next Steps

In conclusion, a bi-weekly budget can be a valuable tool in managing your finances effectively. By following the five bi-weekly budget tips outlined in this article, you can create a budget that works for you and helps you achieve your financial goals. Remember to track your expenses, categorize your spending, prioritize essential expenses, use the 50/30/20 rule, and review and adjust your budget regularly.Bi-Weekly Budgeting Image Gallery

What is bi-weekly budgeting?

+Bi-weekly budgeting involves dividing your monthly expenses into two payments, made every other week.

How do I create a bi-weekly budget?

+To create a bi-weekly budget, calculate your total monthly expenses and divide them by two. Set up automatic transfers to ensure timely payments.

What are the benefits of bi-weekly budgeting?

+The benefits of bi-weekly budgeting include improved cash flow management, reduced financial stress, and increased savings.

How often should I review and adjust my bi-weekly budget?

+It's recommended to review and adjust your bi-weekly budget regularly, ideally every few months, to ensure you're on track to meet your financial goals.

What tools and resources are available to help with bi-weekly budgeting?

+There are many tools and resources available, including budgeting apps, spreadsheets, budgeting software, and online calculators and worksheets.

We hope this article has provided you with valuable insights and tips on how to create and manage a bi-weekly budget. By following these tips and using the right tools and resources, you can take control of your finances and achieve your financial goals. If you have any questions or comments, please don't hesitate to share them below.