Intro

Calculate ROI with the Excel Payback Period Formula, a crucial investment metric, using related financial keywords like return on investment, cost-benefit analysis, and break-even point to make informed decisions.

The payback period is a crucial concept in finance and accounting, used to evaluate the feasibility of investments and projects. It represents the time it takes for an investment to generate cash flows sufficient to recover its initial cost. In Excel, calculating the payback period can be straightforward using various formulas and functions. Understanding how to apply these formulas is essential for making informed decisions about investments and resource allocation.

The importance of the payback period lies in its simplicity and the insights it provides into the liquidity and risk of an investment. A shorter payback period indicates that an investment will return its initial cost more quickly, which can be beneficial for cash flow management and reducing the exposure to risks such as inflation, market fluctuations, and operational uncertainties. Conversely, a longer payback period may suggest higher risks and lower liquidity, making it less attractive to investors.

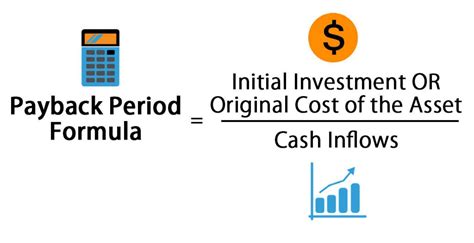

To calculate the payback period in Excel, one can use simple arithmetic if the cash flows are uniform. However, for investments with varying annual cash flows, the process involves more steps. The formula for the payback period when cash flows are even is straightforward: Payback Period = Initial Investment / Annual Cash Flow. For example, if an initial investment is $10,000 and it generates $2,000 in cash flow each year, the payback period would be $10,000 / $2,000 = 5 years.

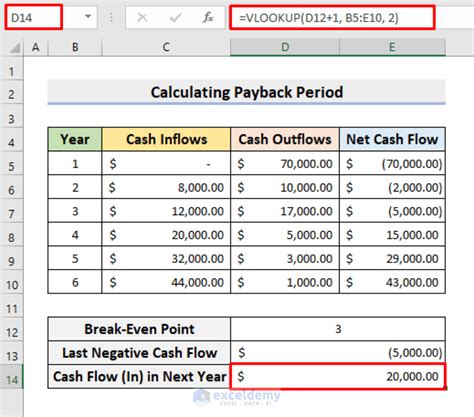

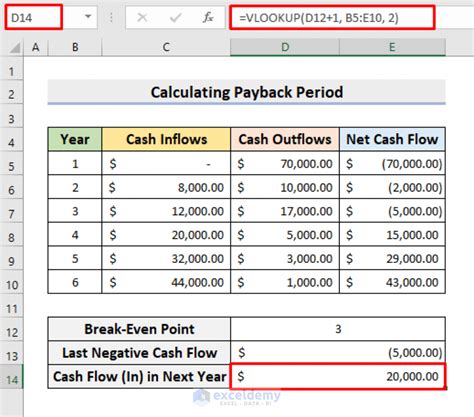

Calculating Payback Period with Uneven Cash Flows

When dealing with investments that have uneven cash flows from year to year, the calculation becomes more complex. Excel provides several functions that can be used, including the NPV (Net Present Value) function, IRR (Internal Rate of Return) function, and most directly, the XNPV and XIRR functions for non-periodic cash flows. However, for the payback period specifically, a more manual approach or the use of data tables can be effective.

To calculate the payback period with uneven cash flows manually, one can list the initial investment as a negative value, followed by the expected cash flows for each year. Then, calculate the cumulative cash flow by adding each year's cash flow to the previous year's cumulative total. The payback period is the year in which the cumulative cash flow first becomes positive.

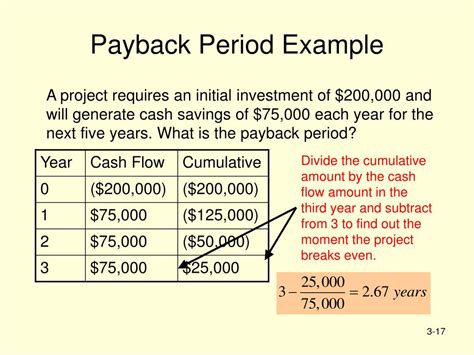

Example Calculation

For an initial investment of $100,000 with expected cash flows of $20,000 in year 1, $30,000 in year 2, and $60,000 in year 3, the calculation would be as follows: - Initial Investment: -$100,000 - Year 1: $20,000, Cumulative: -$80,000 - Year 2: $30,000, Cumulative: -$50,000 - Year 3: $60,000, Cumulative: $10,000The payback period in this scenario occurs between year 2 and year 3, as the cumulative cash flow turns positive. To find the exact payback period, one can use interpolation: Payback Period = Year 2 + (Abs(Cumulative Cash Flow at Year 2) / Cash Flow at Year 3).

Using Excel Functions for Payback Period

While there isn't a specific Excel function dedicated solely to calculating the payback period, especially for uneven cash flows, the XNPV function can be useful. The XNPV function calculates the net present value for a schedule of cash flows that is not necessarily periodic. By setting the discount rate to 0, it essentially calculates the cumulative cash flows over time, which can help in determining the payback period.

For more complex scenarios or for automating the calculation across various investments, creating a formula or using VBA (Visual Basic for Applications) can provide a customized solution. These approaches allow for dynamic calculation based on input data, making the analysis more efficient and scalable.

Steps for Calculation

1. **List Cash Flows**: Start by listing the initial investment and subsequent cash flows in separate cells. 2. **Calculate Cumulative Cash Flows**: Use the formula for cumulative sum to calculate the running total of cash flows. 3. **Determine Payback Year**: Identify the year when the cumulative cash flow turns positive. 4. **Interpolate for Exact Payback Period**: If necessary, use interpolation to find the exact time within the year when the payback occurs.Benefits and Limitations

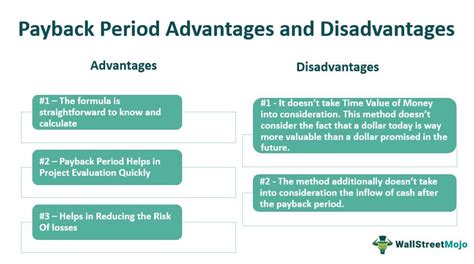

The payback period is a valuable metric for evaluating investment opportunities, offering insights into an investment's risk and liquidity. Its benefits include simplicity, ease of calculation, and the ability to compare different investments based on how quickly they can return the initial investment. However, it also has limitations, such as not considering the time value of money (unless adjusted for present value), not accounting for cash flows beyond the payback period, and potentially overlooking the overall profitability of an investment.

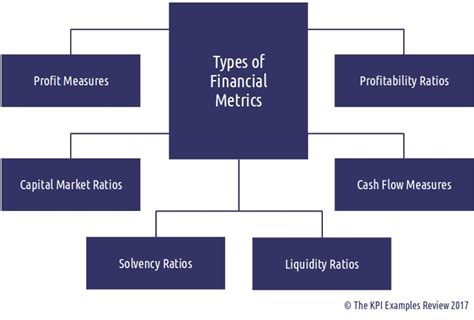

For a comprehensive analysis, the payback period should be used in conjunction with other financial metrics, such as the net present value (NPV), internal rate of return (IRR), and return on investment (ROI). Each of these metrics provides a different perspective on an investment's potential, and together they offer a more complete picture of its viability and attractiveness.

Best Practices for Investment Analysis

- **Combine Metrics**: Use the payback period alongside other financial metrics for a comprehensive view. - **Consider Risk**: Evaluate the risk associated with an investment, as higher risk investments may require shorter payback periods. - **Assess Market Conditions**: Take into account current market conditions and how they may impact investment returns.Gallery of Payback Period Examples

Payback Period Image Gallery

Frequently Asked Questions

What is the payback period, and why is it important?

+The payback period is the time it takes for an investment to generate cash flows sufficient to recover its initial cost. It's important because it helps evaluate the liquidity and risk of an investment.

How do you calculate the payback period in Excel for uneven cash flows?

+For uneven cash flows, list the initial investment and subsequent cash flows, calculate cumulative cash flows, and determine the year when the cumulative cash flow turns positive. Interpolation may be necessary for the exact payback period.

What are the limitations of using the payback period for investment analysis?

+The payback period does not consider the time value of money, does not account for cash flows beyond the payback period, and may overlook the overall profitability of an investment. It should be used in conjunction with other financial metrics.

How can the payback period be used effectively in investment decisions?

+Use the payback period to compare different investments based on their liquidity and risk. Combine it with other metrics like NPV, IRR, and ROI for a comprehensive analysis. Consider the risk and market conditions associated with each investment.

What role does Excel play in calculating and analyzing the payback period?

+Excel provides various functions and tools that can be used to calculate and analyze the payback period, including formulas for cumulative sums, the XNPV function for non-periodic cash flows, and data tables for scenario analysis.

In conclusion, understanding and calculating the payback period is a fundamental aspect of investment analysis, providing valuable insights into an investment's potential for return and risk. By leveraging Excel's capabilities and combining the payback period with other financial metrics, investors and analysts can make more informed decisions. Whether you're evaluating a business investment, a real estate venture, or any other type of investment, the payback period is a crucial metric that should not be overlooked. We invite you to share your thoughts on the importance of the payback period in investment decisions and how you use Excel in your financial analyses.