Intro

Calculate taxes easily with the Federal Income Tax Brackets Excel Formula, utilizing tax tables, deductions, and exemptions to determine taxable income and rates.

The federal income tax brackets are a critical component of the US tax system, and understanding how they work is essential for individuals and businesses to manage their tax obligations effectively. One of the most efficient ways to calculate federal income tax brackets is by using Excel formulas. In this article, we will delve into the world of federal income tax brackets, their importance, and how to use Excel formulas to calculate them accurately.

The federal income tax system in the United States is progressive, meaning that higher income earners are subject to higher tax rates. The tax brackets are adjusted annually for inflation, and there are currently seven tax brackets, ranging from 10% to 37%. Understanding these brackets and how they apply to different income levels is crucial for tax planning and financial management. By using Excel formulas, individuals and businesses can easily calculate their tax liability and make informed decisions about their financial strategies.

The importance of accurately calculating federal income tax brackets cannot be overstated. Incorrect calculations can lead to overpayment or underpayment of taxes, resulting in penalties and fines. Moreover, understanding the tax brackets can help individuals and businesses take advantage of tax deductions and credits, reducing their tax liability and increasing their cash flow. By using Excel formulas, individuals and businesses can ensure accuracy and efficiency in their tax calculations, saving time and reducing the risk of errors.

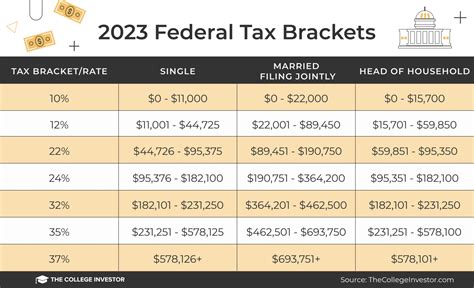

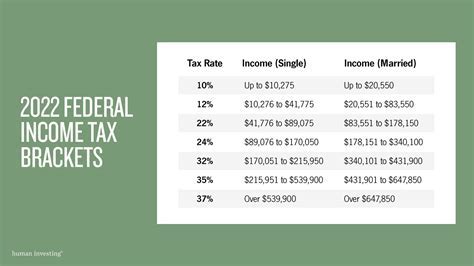

Federal Income Tax Brackets Overview

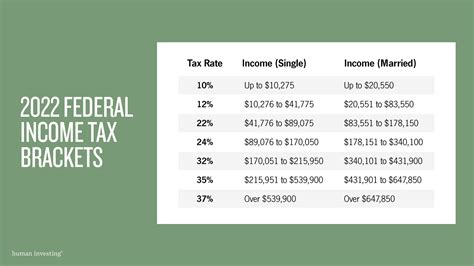

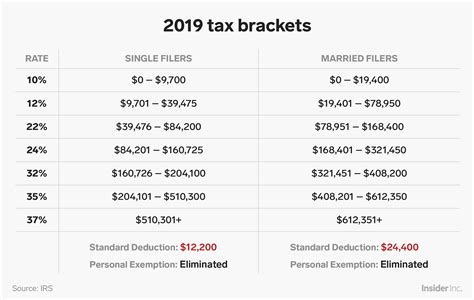

The federal income tax brackets are adjusted annually for inflation, and the tax rates range from 10% to 37%. The tax brackets are as follows:

- 10%: $0 to $9,875 (single) or $0 to $19,750 (joint)

- 12%: $9,876 to $40,125 (single) or $19,751 to $80,250 (joint)

- 22%: $40,126 to $80,250 (single) or $80,251 to $171,050 (joint)

- 24%: $80,251 to $164,700 (single) or $171,051 to $326,600 (joint)

- 32%: $164,701 to $214,700 (single) or $326,601 to $414,700 (joint)

- 35%: $214,701 to $518,400 (single) or $414,701 to $622,050 (joint)

- 37%: $518,401 or more (single) or $622,051 or more (joint)

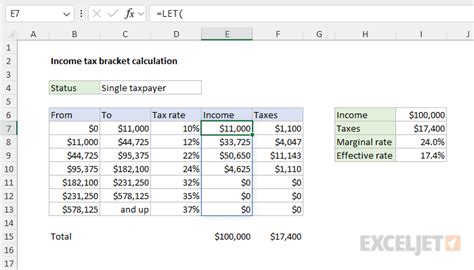

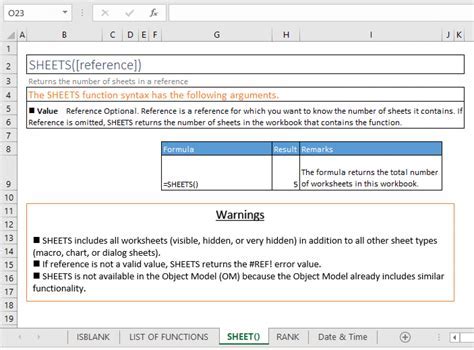

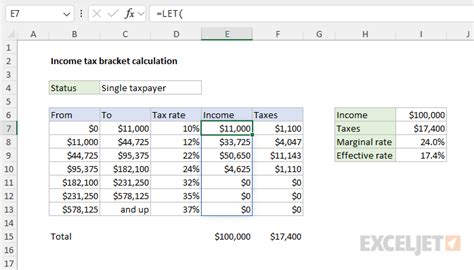

Excel Formula for Federal Income Tax Brackets

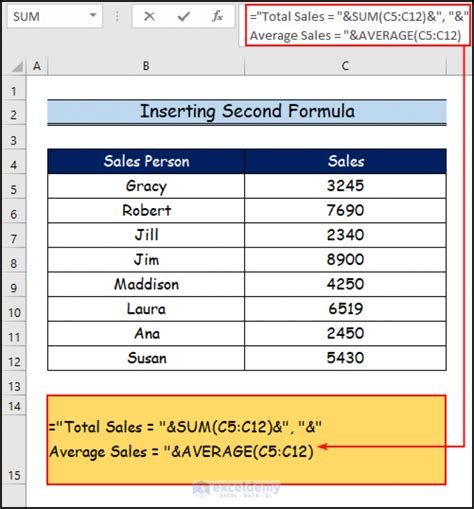

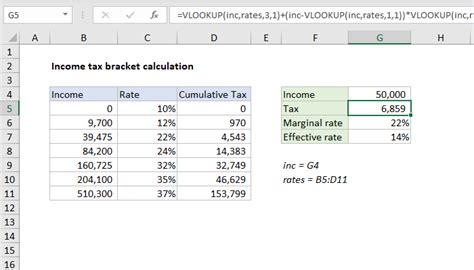

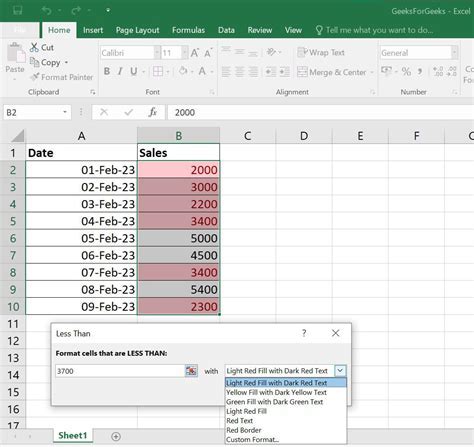

To calculate the federal income tax brackets using Excel formulas, you can use the following steps:

- Create a table with the tax brackets and corresponding tax rates.

- Use the IF function to determine which tax bracket applies to the individual's or business's income.

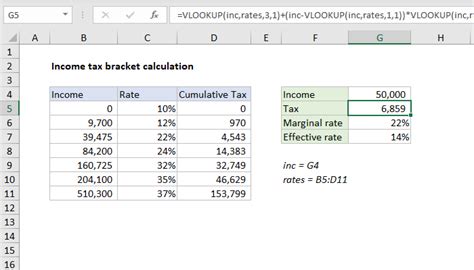

- Use the VLOOKUP function to retrieve the tax rate for the applicable tax bracket.

- Calculate the tax liability by multiplying the income by the tax rate.

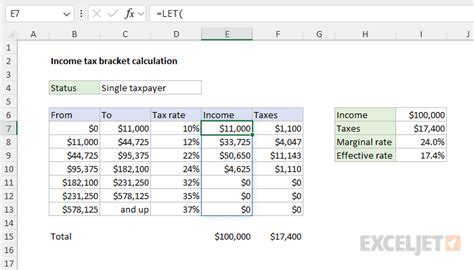

The Excel formula for calculating federal income tax brackets is as follows: =IF(A1<=9875,0.10A1,IF(A1<=40125,0.109875+0.12*(A1-9875),IF(A1<=80250,0.109875+0.12(40125-9875)+0.22*(A1-40125),IF(A1<=164700,0.109875+0.12(40125-9875)+0.22*(80250-40125)+0.24*(A1-80250),IF(A1<=214700,0.109875+0.12(40125-9875)+0.22*(80250-40125)+0.24*(164700-80250)+0.32*(A1-164700),IF(A1<=518400,0.109875+0.12(40125-9875)+0.22*(80250-40125)+0.24*(164700-80250)+0.32*(214700-164700)+0.35*(A1-214700),0.109875+0.12(40125-9875)+0.22*(80250-40125)+0.24*(164700-80250)+0.32*(214700-164700)+0.35*(518400-214700)+0.37*(A1-518400)))))))

How to Use the Excel Formula

To use the Excel formula, follow these steps:

- Enter the individual's or business's income in cell A1.

- Copy and paste the Excel formula into cell B1.

- Press Enter to calculate the tax liability.

- Adjust the income in cell A1 to see how the tax liability changes.

Benefits of Using Excel Formulas for Federal Income Tax Brackets

Using Excel formulas to calculate federal income tax brackets offers several benefits, including:

- Accuracy: Excel formulas can accurately calculate tax liability, reducing the risk of errors.

- Efficiency: Excel formulas can quickly calculate tax liability, saving time and increasing productivity.

- Flexibility: Excel formulas can be easily adjusted to accommodate changes in income or tax brackets.

- Scalability: Excel formulas can be used to calculate tax liability for multiple individuals or businesses.

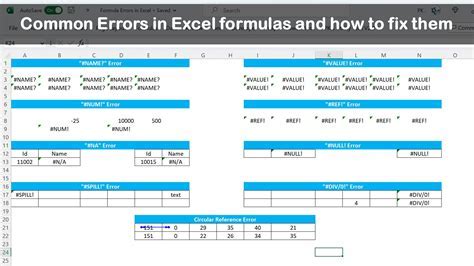

Common Mistakes to Avoid

When using Excel formulas to calculate federal income tax brackets, there are several common mistakes to avoid, including:

- Incorrectly entering income or tax brackets.

- Using outdated tax brackets or rates.

- Failing to account for tax deductions or credits.

- Not adjusting for changes in income or tax brackets.

Best Practices for Using Excel Formulas

To get the most out of Excel formulas for federal income tax brackets, follow these best practices:

- Use up-to-date tax brackets and rates.

- Double-check income and tax bracket entries.

- Use clear and concise formatting.

- Test and validate formulas to ensure accuracy.

Gallery of Federal Income Tax Brackets

Federal Income Tax Brackets Image Gallery

What are the current federal income tax brackets?

+The current federal income tax brackets are 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

How do I calculate my federal income tax liability using Excel formulas?

+To calculate your federal income tax liability using Excel formulas, use the IF function to determine which tax bracket applies to your income, and then multiply your income by the corresponding tax rate.

What are the benefits of using Excel formulas for federal income tax brackets?

+The benefits of using Excel formulas for federal income tax brackets include accuracy, efficiency, flexibility, and scalability.

In conclusion, federal income tax brackets are a critical component of the US tax system, and understanding how they work is essential for individuals and businesses to manage their tax obligations effectively. By using Excel formulas, individuals and businesses can accurately calculate their tax liability, taking into account the different tax brackets and rates. We encourage readers to share their experiences with using Excel formulas for federal income tax brackets and to ask any questions they may have in the comments section below. Additionally, we invite readers to explore our other articles on tax-related topics and to share this article with others who may benefit from this information.