Intro

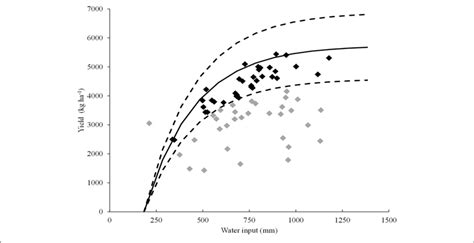

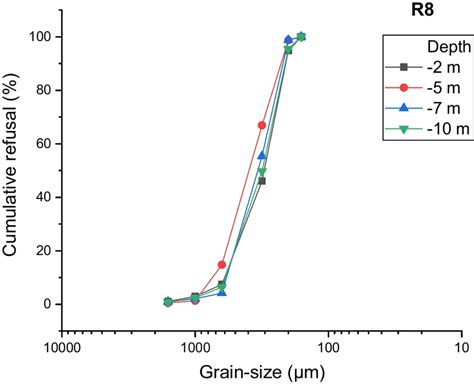

Understanding and analyzing data is crucial in various fields, including finance, science, and engineering. One of the essential tools for data analysis is Microsoft Excel, which offers a wide range of functions and features to help users interpret and visualize data. The grain curve, also known as the yield curve, is a graphical representation of the relationship between bond yields and their corresponding maturity periods. In this article, we will explore 5 ways to create and analyze a grain curve in Excel, highlighting its importance and applications.

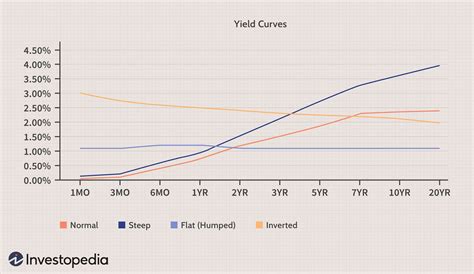

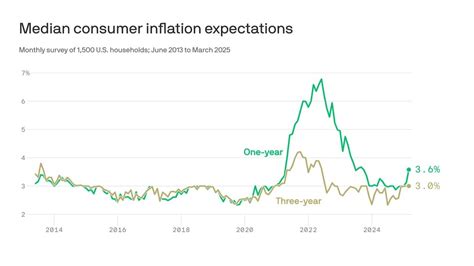

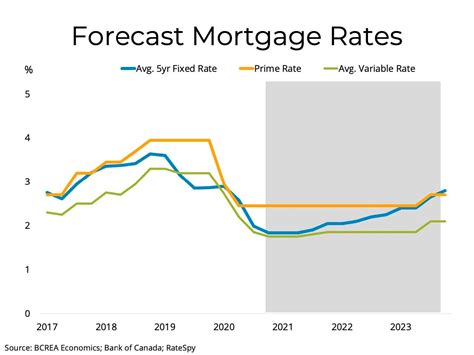

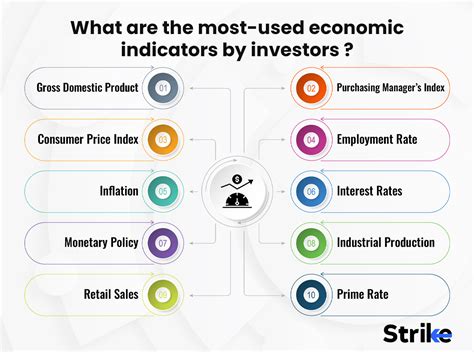

The grain curve is a vital tool for investors, economists, and financial analysts, as it helps them understand the market's expectations of future interest rates and inflation. A normal grain curve is upward-sloping, indicating that longer-term bonds have higher yields than shorter-term bonds. However, an inverted grain curve, where shorter-term bonds have higher yields than longer-term bonds, can be a sign of an impending recession. Therefore, creating and analyzing a grain curve in Excel is essential for making informed investment decisions and predicting market trends.

Introduction to Grain Curve

Creating a Grain Curve in Excel

Step-by-Step Guide to Creating a Grain Curve

To create a grain curve in Excel, follow these steps: * Open a new Excel spreadsheet and create a table with two columns: one for the maturity periods and one for the corresponding bond yields. * Enter the data into the table, making sure to format the maturity periods as dates and the bond yields as percentages. * Select the entire table and go to the "Insert" tab in the ribbon. * Click on the "Scatter" button in the "Charts" group and select the "Scatter with only markers" option. * Customize the chart as needed, adding a title, labels, and a legend.Analyzing a Grain Curve

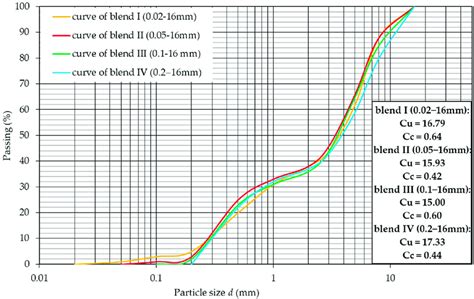

Interpreting the Grain Curve

To interpret the grain curve, look for the following features: * The slope of the curve: A steep slope indicates a strong expectation of future inflation, while a flat slope indicates a weak expectation. * The shape of the curve: A normal curve is upward-sloping, while an inverted curve is downward-sloping. * The level of the curve: A high curve indicates high interest rates, while a low curve indicates low interest rates.Applications of Grain Curve

Limitations of Grain Curve

Grain Curve Image Gallery

What is a grain curve?

+A grain curve, also known as a yield curve, is a graphical representation of the relationship between bond yields and their corresponding maturity periods.

How is a grain curve created in Excel?

+A grain curve can be created in Excel by plotting the bond yields against their corresponding maturity periods using a scatter plot.

What are the applications of a grain curve?

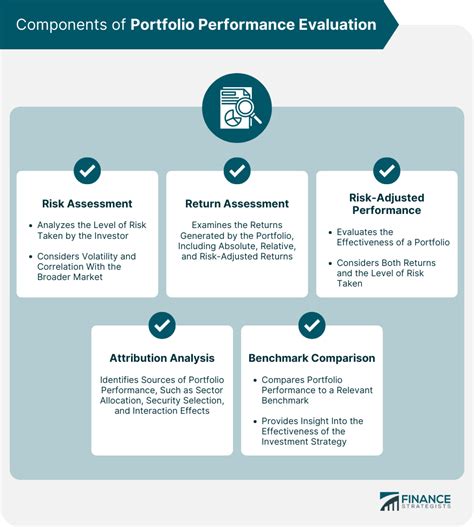

+The grain curve has several applications, including predicting future interest rates, measuring inflation expectations, and evaluating bond portfolios.

What are the limitations of a grain curve?

+The grain curve has several limitations, including being based on historical data, being subject to interpretation, and not accounting for other factors that can affect bond yields.

How can a grain curve be used in investment decisions?

+A grain curve can be used in investment decisions by analyzing the shape and slope of the curve to predict future interest rates and inflation, and adjusting the investment portfolio accordingly.

In conclusion, the grain curve is a vital tool for investors, economists, and financial analysts, as it helps them understand the market's expectations of future interest rates and inflation. By creating and analyzing a grain curve in Excel, users can gain insights into the market's expectations and make informed investment decisions. We encourage readers to share their experiences and knowledge about grain curves in the comments section below. Additionally, we invite readers to share this article with others who may benefit from learning about grain curves and their applications in finance and economics.