Intro

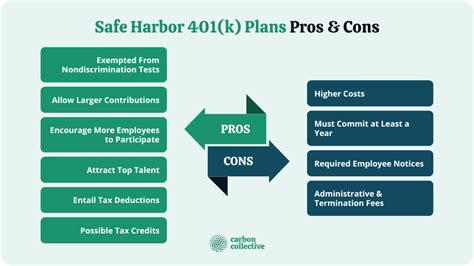

The concept of Safe Harbor match formulas has become increasingly important for employers who offer 401(k) or other retirement plans to their employees. In recent years, the Internal Revenue Service (IRS) has implemented various regulations to ensure that these plans are fair and equitable for all participants. One of the key components of these regulations is the Safe Harbor match formula, which is designed to encourage employers to make contributions to their employees' retirement accounts.

The importance of Safe Harbor match formulas cannot be overstated. By offering a Safe Harbor match, employers can avoid the complexities and costs associated with nondiscrimination testing, which is required for traditional 401(k) plans. Nondiscrimination testing is designed to ensure that highly compensated employees (HCEs) do not receive a disproportionate share of the plan's benefits. However, this testing can be time-consuming and expensive, and may require employers to make additional contributions to the plan or refund contributions to HCEs.

In addition to avoiding nondiscrimination testing, Safe Harbor match formulas can also help employers to attract and retain top talent. By offering a competitive retirement plan with a generous match, employers can differentiate themselves from their competitors and demonstrate their commitment to their employees' financial well-being. This can be particularly important in today's competitive job market, where employees are looking for more than just a salary and benefits package.

The benefits of Safe Harbor match formulas are numerous. For employers, they offer a way to simplify the administration of their retirement plan and avoid the costs associated with nondiscrimination testing. For employees, they provide a way to save for retirement and receive a generous match from their employer. By understanding how Safe Harbor match formulas work and how they can be implemented, employers can create a competitive and effective retirement plan that benefits both their business and their employees.

What is a Safe Harbor Match Formula?

A Safe Harbor match formula is a type of retirement plan contribution that is made by an employer to their employees' 401(k) or other retirement accounts. The formula is designed to ensure that the plan is fair and equitable for all participants, and that HCEs do not receive a disproportionate share of the plan's benefits. To qualify as a Safe Harbor plan, the employer must make a minimum contribution to the plan each year, which can be either a matching contribution or a non-elective contribution.

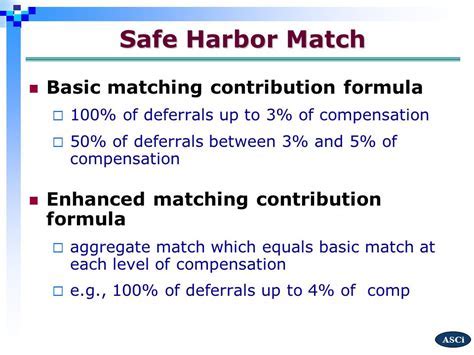

There are two types of Safe Harbor match formulas: the basic match formula and the enhanced match formula. The basic match formula requires the employer to make a 100% match on the first 3% of an employee's contributions, and a 50% match on the next 2% of contributions. The enhanced match formula requires the employer to make a 100% match on the first 4% of an employee's contributions.

How Does a Safe Harbor Match Formula Work?

A Safe Harbor match formula works by requiring the employer to make a minimum contribution to the plan each year. This contribution can be either a matching contribution or a non-elective contribution. The contribution is typically based on a percentage of the employee's compensation, and is made to the employee's retirement account.For example, let's say an employer offers a basic Safe Harbor match formula, which requires them to make a 100% match on the first 3% of an employee's contributions, and a 50% match on the next 2% of contributions. If an employee earns $50,000 per year and contributes 5% of their compensation to the plan, the employer would be required to make a contribution of $1,500 (3% of $50,000) plus $500 (50% of 2% of $50,000).

Benefits of Safe Harbor Match Formulas

The benefits of Safe Harbor match formulas are numerous. For employers, they offer a way to simplify the administration of their retirement plan and avoid the costs associated with nondiscrimination testing. By making a minimum contribution to the plan each year, employers can ensure that their plan is fair and equitable for all participants, and that HCEs do not receive a disproportionate share of the plan's benefits.

For employees, Safe Harbor match formulas provide a way to save for retirement and receive a generous match from their employer. By contributing to a 401(k) or other retirement plan, employees can reduce their taxable income and save for retirement on a tax-deferred basis. The employer match provides an additional incentive to save, and can help employees to build a larger retirement nest egg over time.

Types of Safe Harbor Match Formulas

There are two types of Safe Harbor match formulas: the basic match formula and the enhanced match formula. The basic match formula requires the employer to make a 100% match on the first 3% of an employee's contributions, and a 50% match on the next 2% of contributions. The enhanced match formula requires the employer to make a 100% match on the first 4% of an employee's contributions.The basic match formula is the most common type of Safe Harbor match formula, and is used by many employers. It is relatively simple to administer, and provides a generous match to employees who contribute to the plan. The enhanced match formula is less common, but provides an even more generous match to employees who contribute to the plan.

How to Implement a Safe Harbor Match Formula

Implementing a Safe Harbor match formula requires several steps. First, the employer must determine which type of Safe Harbor match formula to use, and must amend their plan document to reflect this choice. The employer must also notify their employees of the Safe Harbor match formula, and must provide them with information about the plan and how it works.

The employer must also make the minimum contribution to the plan each year, which can be either a matching contribution or a non-elective contribution. The contribution is typically based on a percentage of the employee's compensation, and is made to the employee's retirement account.

Best Practices for Implementing a Safe Harbor Match Formula

There are several best practices that employers can follow when implementing a Safe Harbor match formula. First, the employer should clearly communicate the terms of the plan to their employees, including the type of Safe Harbor match formula used and the minimum contribution required.The employer should also ensure that their plan is properly administered, and that all contributions are made on a timely basis. This can help to avoid any potential penalties or fines, and can ensure that the plan is fair and equitable for all participants.

Common Mistakes to Avoid When Implementing a Safe Harbor Match Formula

There are several common mistakes that employers can make when implementing a Safe Harbor match formula. One of the most common mistakes is failing to properly communicate the terms of the plan to employees. This can lead to confusion and misunderstandings, and can make it difficult for employees to understand how the plan works.

Another common mistake is failing to make the minimum contribution to the plan each year. This can result in penalties and fines, and can make it difficult for the employer to maintain a Safe Harbor plan.

How to Avoid Common Mistakes When Implementing a Safe Harbor Match Formula

To avoid common mistakes when implementing a Safe Harbor match formula, employers should clearly communicate the terms of the plan to their employees, and should ensure that their plan is properly administered. The employer should also make the minimum contribution to the plan each year, and should ensure that all contributions are made on a timely basis.The employer should also review their plan regularly to ensure that it is compliant with all applicable laws and regulations. This can help to avoid any potential penalties or fines, and can ensure that the plan is fair and equitable for all participants.

Safe Harbor Match Formulas Image Gallery

What is a Safe Harbor match formula?

+A Safe Harbor match formula is a type of retirement plan contribution that is made by an employer to their employees' 401(k) or other retirement accounts. The formula is designed to ensure that the plan is fair and equitable for all participants, and that highly compensated employees do not receive a disproportionate share of the plan's benefits.

How does a Safe Harbor match formula work?

+A Safe Harbor match formula works by requiring the employer to make a minimum contribution to the plan each year, which can be either a matching contribution or a non-elective contribution. The contribution is typically based on a percentage of the employee's compensation, and is made to the employee's retirement account.

What are the benefits of a Safe Harbor match formula?

+The benefits of a Safe Harbor match formula include simplified plan administration, avoidance of nondiscrimination testing, and increased employee participation in the plan. The formula also provides a way for employers to attract and retain top talent, and to demonstrate their commitment to their employees' financial well-being.

How do I implement a Safe Harbor match formula?

+To implement a Safe Harbor match formula, you should first determine which type of formula to use, and then amend your plan document to reflect this choice. You should also notify your employees of the Safe Harbor match formula, and provide them with information about the plan and how it works. Finally, you should make the minimum contribution to the plan each year, and ensure that all contributions are made on a timely basis.

What are some common mistakes to avoid when implementing a Safe Harbor match formula?

+Some common mistakes to avoid when implementing a Safe Harbor match formula include failing to properly communicate the terms of the plan to employees, failing to make the minimum contribution to the plan each year, and failing to ensure that all contributions are made on a timely basis. You should also review your plan regularly to ensure that it is compliant with all applicable laws and regulations.

In conclusion, Safe Harbor match formulas are an important component of 401(k) and other retirement plans. By understanding how these formulas work, and how they can be implemented, employers can create a competitive and effective retirement plan that benefits both their business and their employees. If you have any questions or comments about Safe Harbor match formulas, please feel free to share them below. Additionally, if you found this article helpful, please consider sharing it with others who may be interested in learning more about this topic.