Intro

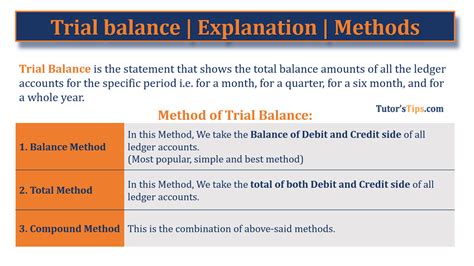

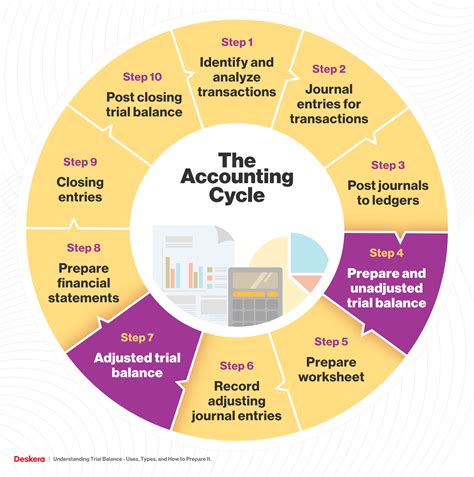

The trial balance is a crucial step in the accounting process, serving as a summary of all general ledger accounts and their respective debit or credit balances. It is an essential tool for accountants and bookkeepers to ensure that the accounting equation is balanced, which is a fundamental principle of accounting. In this article, we will delve into the trial balance format in Excel, exploring its importance, how to create one, and the benefits of using Excel for this purpose.

The trial balance is prepared at the end of an accounting period, typically monthly, quarterly, or annually, to verify that the debits equal the credits. This process involves listing all general ledger accounts and their corresponding balances, which can be a time-consuming task if done manually. However, with the advent of spreadsheet software like Excel, creating and managing a trial balance has become more efficient and less prone to errors.

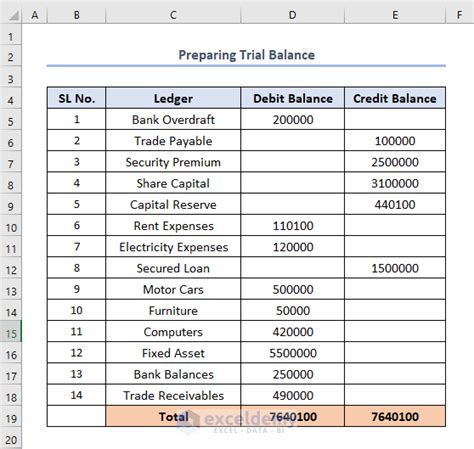

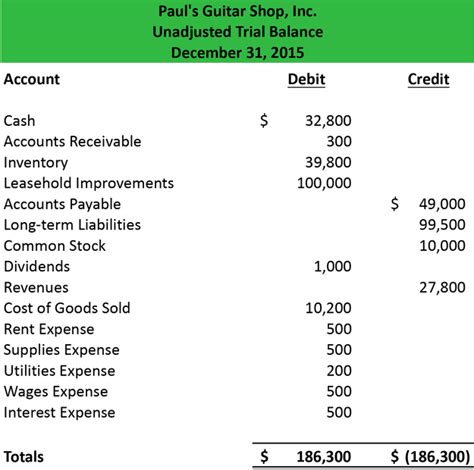

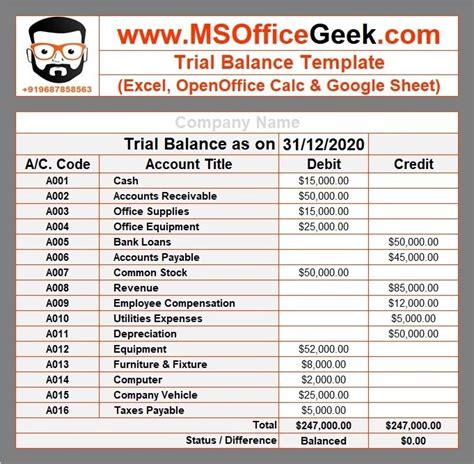

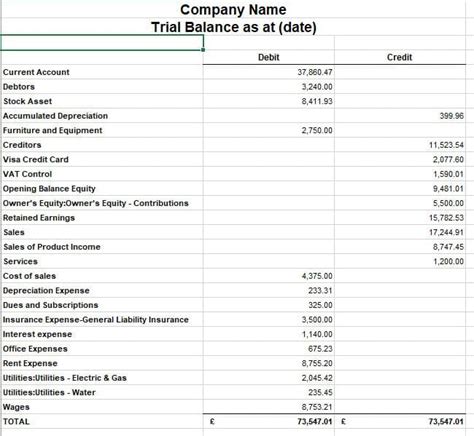

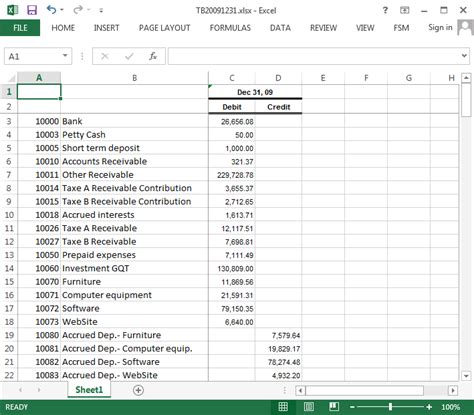

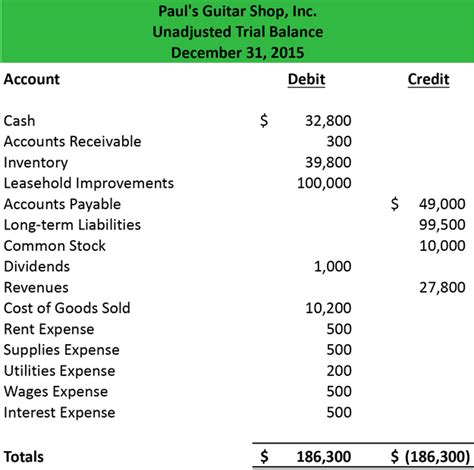

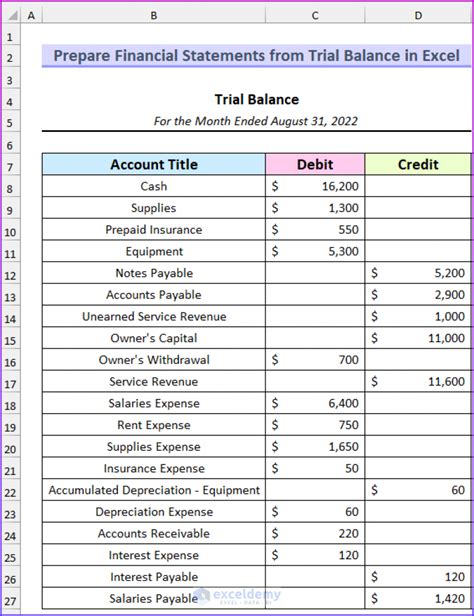

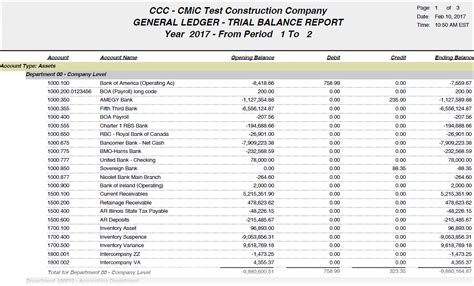

To begin with, it is essential to understand the components of a trial balance. The format typically includes the account number, account name, debit balance, and credit balance. The account number is a unique identifier assigned to each general ledger account, while the account name describes the type of account, such as cash, accounts payable, or retained earnings. The debit and credit balances represent the total value of debits and credits posted to each account during the accounting period.

Importance of Trial Balance

The trial balance plays a vital role in the accounting process, as it helps to identify errors and discrepancies in the general ledger accounts. By ensuring that the debits equal the credits, accountants can verify that the accounting equation is balanced, which is a fundamental principle of accounting. The trial balance also serves as a basis for preparing financial statements, such as the balance sheet and income statement.

Benefits of Using Excel for Trial Balance

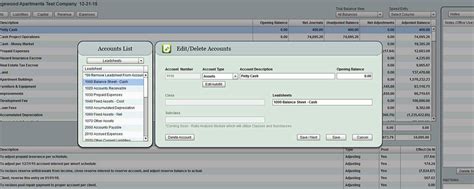

Using Excel to create and manage a trial balance offers several benefits, including increased efficiency, accuracy, and flexibility. Excel allows users to easily format and organize data, perform calculations, and create formulas to automate tasks. Additionally, Excel provides a range of tools and features, such as sorting, filtering, and pivot tables, to analyze and manipulate data.Creating a Trial Balance in Excel

To create a trial balance in Excel, follow these steps:

- Set up a new spreadsheet with the following columns: account number, account name, debit balance, and credit balance.

- Enter the account numbers and names in the respective columns.

- Enter the debit and credit balances for each account.

- Use formulas to calculate the total debits and credits.

- Verify that the debits equal the credits.

Tips for Managing a Trial Balance in Excel

To get the most out of using Excel for trial balance, consider the following tips:- Use a consistent formatting and organization throughout the spreadsheet.

- Use formulas and functions to automate calculations and reduce errors.

- Use conditional formatting to highlight errors or discrepancies.

- Use pivot tables to analyze and summarize data.

Common Errors in Trial Balance

When preparing a trial balance, it is essential to be aware of common errors that can occur. These include:

- Incorrect account numbers or names

- Incorrect debit or credit balances

- Missing or duplicate accounts

- Mathematical errors

To avoid these errors, it is crucial to carefully review and verify the trial balance, using tools and features in Excel to identify and correct discrepancies.

Best Practices for Trial Balance

To ensure the accuracy and reliability of the trial balance, follow these best practices:- Regularly review and update the general ledger accounts.

- Use a consistent accounting method and policies.

- Verify the trial balance regularly.

- Use Excel formulas and functions to automate calculations.

Trial Balance Format Examples

Here are some examples of trial balance formats:

- Simple trial balance format: includes account number, account name, debit balance, and credit balance.

- Detailed trial balance format: includes additional columns for account type, account category, and notes.

- Consolidated trial balance format: includes multiple companies or entities.

Trial Balance Templates

Using a trial balance template can save time and effort when creating a trial balance. Excel provides a range of templates and tools to help users create and manage a trial balance. These templates can be customized to meet specific needs and requirements.Conclusion and Next Steps

In conclusion, the trial balance is a critical component of the accounting process, and using Excel to create and manage it can increase efficiency, accuracy, and flexibility. By following the steps and tips outlined in this article, users can create a trial balance in Excel that meets their specific needs and requirements. For further learning and exploration, consider the following next steps:

- Explore Excel formulas and functions to automate calculations and reduce errors.

- Learn about pivot tables and conditional formatting to analyze and summarize data.

- Review and update the general ledger accounts regularly to ensure accuracy and reliability.

Trial Balance Image Gallery

What is a trial balance?

+A trial balance is a summary of all general ledger accounts and their respective debit or credit balances.

Why is a trial balance important?

+A trial balance is important because it helps to identify errors and discrepancies in the general ledger accounts and ensures that the debits equal the credits.

How do I create a trial balance in Excel?

+To create a trial balance in Excel, set up a new spreadsheet with the account number, account name, debit balance, and credit balance columns, and enter the data accordingly.

We hope this article has provided valuable insights into the trial balance format in Excel. If you have any further questions or would like to share your experiences with creating and managing a trial balance, please comment below. Additionally, feel free to share this article with others who may benefit from this information.