Intro

Calculate outstanding invoices with the Aging Accounts Receivable Formula, streamlining accounts management and optimizing cash flow through effective receivables analysis and financial reporting.

The aging accounts receivable formula is a crucial tool for businesses to manage their outstanding invoices and improve cash flow. As a business owner, it's essential to understand the importance of monitoring and managing your accounts receivable, as it can significantly impact your company's financial health. In this article, we will delve into the world of aging accounts receivable, exploring its benefits, working mechanisms, and steps to implement it effectively.

The aging accounts receivable formula is a method used to categorize outstanding invoices based on the number of days they have been outstanding. This formula helps businesses to identify which invoices are nearing their due date, which ones are already overdue, and which ones are at risk of becoming bad debts. By using this formula, companies can prioritize their collection efforts, allocate resources more efficiently, and minimize the risk of late payments.

To understand the aging accounts receivable formula, it's essential to grasp the concept of accounts receivable. Accounts receivable refers to the amount of money that customers owe to a business for goods or services purchased on credit. When a customer purchases a product or service on credit, the business records the transaction as an account receivable, which is essentially a loan to the customer. The business then waits for the customer to pay the invoice, usually within a specified timeframe, such as 30, 60, or 90 days.

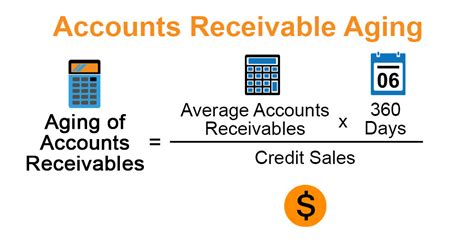

Aging Accounts Receivable Formula

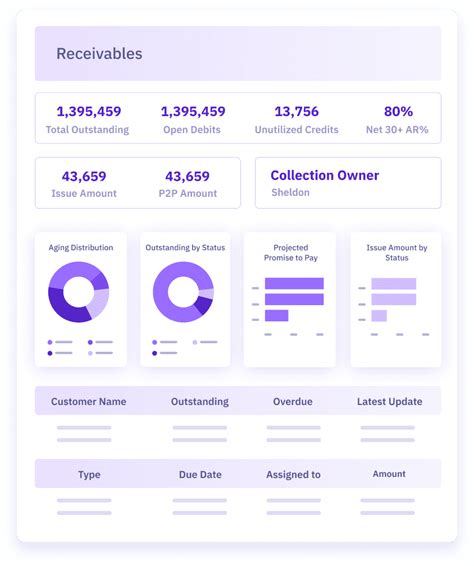

The aging accounts receivable formula is calculated by categorizing outstanding invoices into different age groups, usually 0-30 days, 31-60 days, 61-90 days, and over 90 days. The formula is as follows:

Aging Accounts Receivable = (Total Outstanding Invoices) x (Number of Days Outstanding) / (Total Number of Days)

For example, let's say a business has $10,000 in outstanding invoices, with $3,000 due within 30 days, $2,000 due within 60 days, and $5,000 due within 90 days. Using the aging accounts receivable formula, the business can calculate the average number of days its invoices have been outstanding.

Benefits of Aging Accounts Receivable

The aging accounts receivable formula offers several benefits to businesses, including:- Improved cash flow: By identifying outstanding invoices and prioritizing collection efforts, businesses can improve their cash flow and reduce the risk of late payments.

- Reduced bad debts: By monitoring outstanding invoices and taking prompt action, businesses can minimize the risk of bad debts and reduce the amount of money written off as uncollectible.

- Enhanced customer relationships: The aging accounts receivable formula helps businesses to identify customers who are having trouble paying their invoices, allowing them to offer support and assistance to prevent late payments.

Working Mechanisms of Aging Accounts Receivable

The working mechanisms of aging accounts receivable involve several steps, including:

- Identifying outstanding invoices: Businesses must identify all outstanding invoices and categorize them based on the number of days they have been outstanding.

- Prioritizing collection efforts: Based on the aging accounts receivable formula, businesses must prioritize their collection efforts, focusing on invoices that are nearing their due date or are already overdue.

- Sending reminders and notifications: Businesses must send reminders and notifications to customers who have outstanding invoices, reminding them of the payment due date and any late payment fees.

- Offering support and assistance: Businesses must offer support and assistance to customers who are having trouble paying their invoices, such as payment plans or temporary credit limits.

Steps to Implement Aging Accounts Receivable

To implement the aging accounts receivable formula, businesses must follow these steps:- Set up an accounts receivable system: Businesses must set up an accounts receivable system to track and manage outstanding invoices.

- Categorize outstanding invoices: Businesses must categorize outstanding invoices based on the number of days they have been outstanding.

- Prioritize collection efforts: Based on the aging accounts receivable formula, businesses must prioritize their collection efforts, focusing on invoices that are nearing their due date or are already overdue.

- Send reminders and notifications: Businesses must send reminders and notifications to customers who have outstanding invoices, reminding them of the payment due date and any late payment fees.

Best Practices for Aging Accounts Receivable

To get the most out of the aging accounts receivable formula, businesses must follow best practices, including:

- Regularly reviewing and updating the accounts receivable system

- Sending reminders and notifications to customers with outstanding invoices

- Offering support and assistance to customers who are having trouble paying their invoices

- Prioritizing collection efforts based on the aging accounts receivable formula

Common Mistakes to Avoid

When implementing the aging accounts receivable formula, businesses must avoid common mistakes, including:- Failing to regularly review and update the accounts receivable system

- Not sending reminders and notifications to customers with outstanding invoices

- Not offering support and assistance to customers who are having trouble paying their invoices

- Not prioritizing collection efforts based on the aging accounts receivable formula

Gallery of Aging Accounts Receivable

Aging Accounts Receivable Image Gallery

Frequently Asked Questions

What is the aging accounts receivable formula?

+The aging accounts receivable formula is a method used to categorize outstanding invoices based on the number of days they have been outstanding.

How does the aging accounts receivable formula work?

+The aging accounts receivable formula works by categorizing outstanding invoices into different age groups, usually 0-30 days, 31-60 days, 61-90 days, and over 90 days.

What are the benefits of using the aging accounts receivable formula?

+The benefits of using the aging accounts receivable formula include improved cash flow, reduced bad debts, and enhanced customer relationships.

In conclusion, the aging accounts receivable formula is a powerful tool for businesses to manage their outstanding invoices and improve cash flow. By understanding the importance of monitoring and managing accounts receivable, businesses can minimize the risk of late payments and reduce the amount of money written off as uncollectible. We encourage you to share your thoughts and experiences with the aging accounts receivable formula in the comments below. If you found this article helpful, please share it with your colleagues and friends.