Intro

Discover 5 ways to calculate Weighted Moving Average in Excel, using formulas and charts, for data analysis and forecasting, with tips on exponential smoothing and trend analysis.

The importance of analyzing data in Excel cannot be overstated, especially when it comes to understanding trends and making informed decisions. One powerful tool in Excel for data analysis is the weighted moving average, which allows users to assign different weights to different data points, providing a more nuanced view of trends over time. This is particularly useful in financial analysis, forecasting, and quality control, where the impact of recent data points may be more significant than older ones.

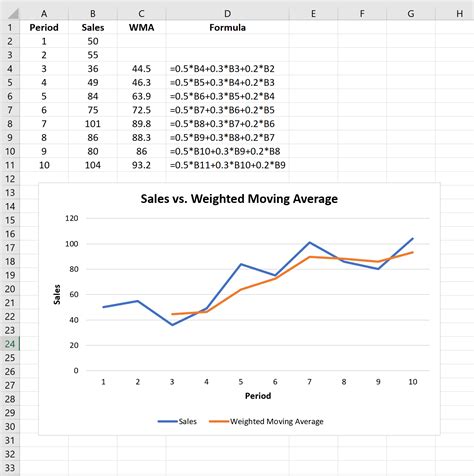

Understanding and applying weighted moving averages can significantly enhance data analysis capabilities. It helps in smoothing out fluctuations in data, highlighting patterns that might be obscured by random variations, and providing a clearer picture of the direction in which data is moving. This can be crucial for businesses and individuals looking to make data-driven decisions, as it helps in predicting future outcomes based on past trends.

The application of weighted moving averages extends across various fields, including finance, where it's used to analyze stock prices or returns on investment, and in operations management, where it can help in managing inventory levels or optimizing production schedules. Given its versatility and utility, learning how to calculate and apply weighted moving averages in Excel is a valuable skill for anyone involved in data analysis.

Introduction to Weighted Moving Average

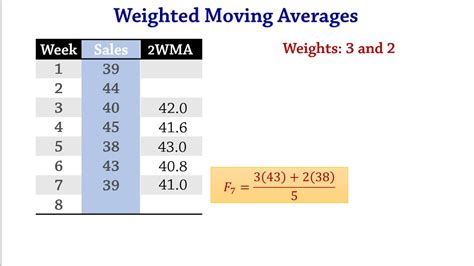

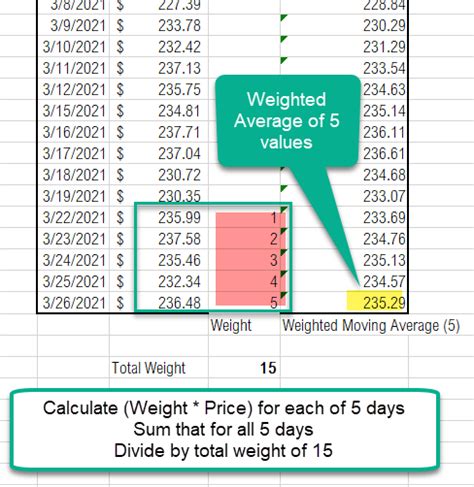

A weighted moving average is a calculation that takes into account the weighted average of a set of numbers over a certain period, with more recent data points given greater weight. This contrasts with a simple moving average, where all data points are given equal weight. The formula for a weighted moving average involves multiplying each data point by its weight, summing these products, and then dividing by the sum of the weights.

Benefits of Using Weighted Moving Average

The primary benefit of using a weighted moving average is its ability to reflect the greater importance of more recent data points. This can be particularly useful in environments where recent trends are more indicative of future performance than historical ones. Additionally, weighted moving averages can help reduce the impact of outliers or one-time events, providing a smoother and more reliable trend line.Calculating Weighted Moving Average in Excel

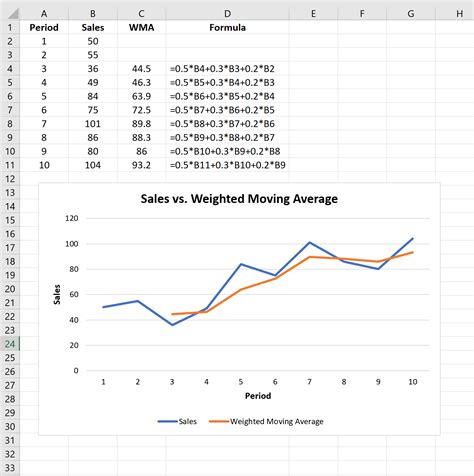

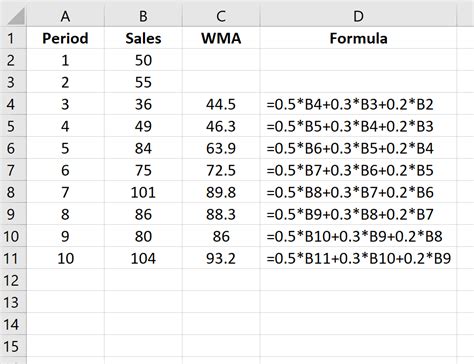

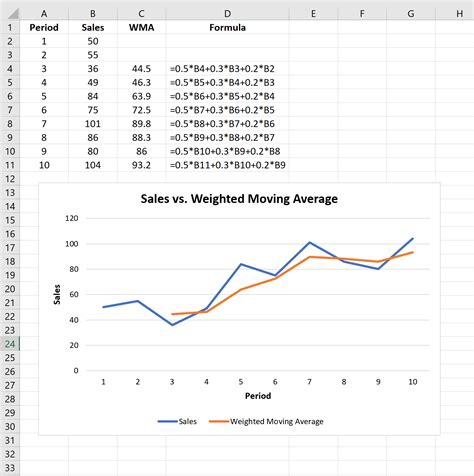

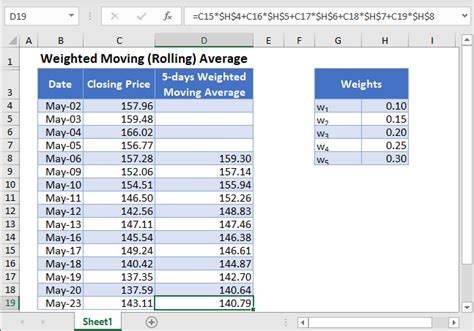

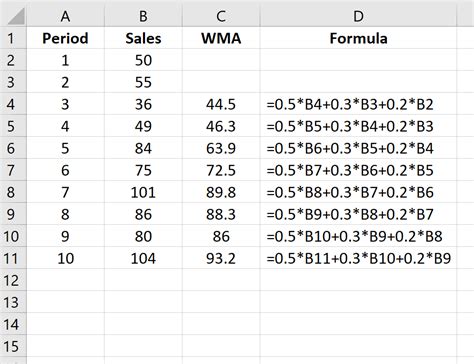

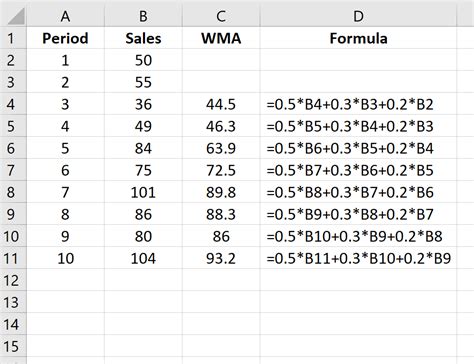

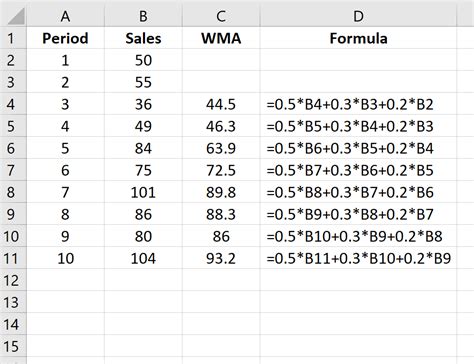

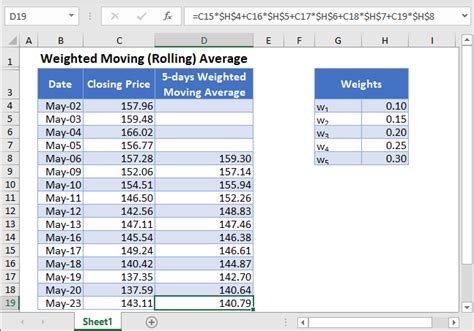

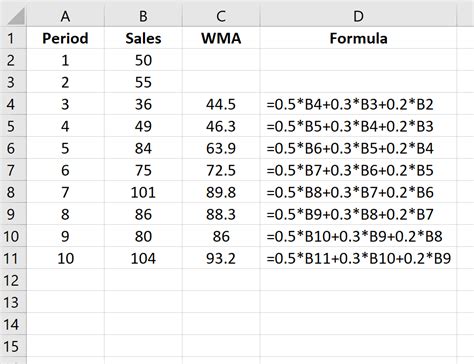

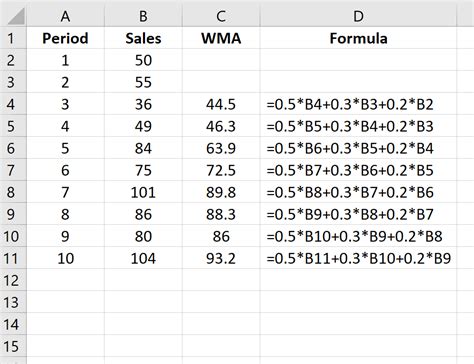

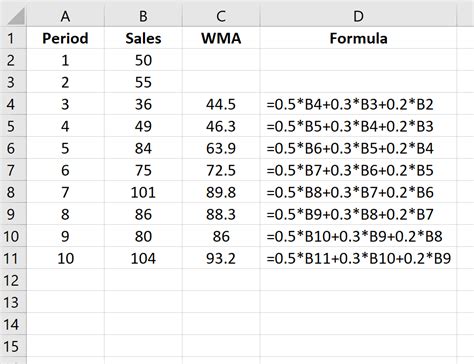

Calculating a weighted moving average in Excel involves several steps, including preparing your data, assigning weights to each data point, and then using formulas to calculate the weighted average over a specified period. Excel's built-in functions, such as SUMPRODUCT and SUM, can be particularly useful in these calculations.

Step-by-Step Guide to Calculating Weighted Moving Average

1. **Prepare Your Data**: Ensure your data is organized in a column, with each row representing a different time period. 2. **Assign Weights**: Decide on the weights for each data point. More recent data points should have higher weights. 3. **Use Formulas**: Utilize Excel formulas to calculate the weighted moving average. The SUMPRODUCT function can be used to multiply each data point by its weight and sum these products, while the SUM function can be used to sum the weights.Using Weighted Moving Average for Forecasting

Weighted moving averages are valuable tools for forecasting, as they can help predict future trends based on past data. By giving more weight to recent data points, these averages can provide a more accurate picture of where trends are headed. This is especially useful in environments where recent performance is a strong indicator of future results.

Practical Applications of Weighted Moving Average in Forecasting

- **Financial Analysis**: Weighted moving averages can be used to analyze stock prices or predict future earnings. - **Operational Planning**: They can help in managing inventory levels or optimizing production schedules based on forecasted demand.Common Challenges and Solutions

One common challenge in using weighted moving averages is determining the appropriate weights for each data point. This requires a deep understanding of the data and the context in which it is being analyzed. Another challenge is selecting the right period for the moving average, as this can significantly affect the results.

Best Practices for Overcoming Challenges

- **Understand Your Data**: Take the time to understand the nature of your data and the trends it represents. - **Experiment with Different Weights and Periods**: Find the combination that best reflects the reality of your data and the goals of your analysis.Advanced Techniques for Weighted Moving Average

For more advanced users, there are several techniques that can enhance the utility of weighted moving averages. These include using different weighting methods, such as exponential smoothing, and combining weighted moving averages with other analytical tools to provide a more comprehensive view of trends and patterns.

Exponential Smoothing as an Alternative

Exponential smoothing is a method that can be used as an alternative to weighted moving averages. It involves giving more weight to recent data points in a way that is similar to weighted moving averages but uses a formula that automatically adjusts the weights based on the data.Weighted Moving Average Excel Image Gallery

What is a weighted moving average in Excel?

+A weighted moving average in Excel is a calculation that takes into account the weighted average of a set of numbers over a certain period, with more recent data points given greater weight.

How do I calculate a weighted moving average in Excel?

+To calculate a weighted moving average in Excel, prepare your data, assign weights to each data point, and then use formulas such as SUMPRODUCT and SUM to calculate the weighted average over a specified period.

What are the benefits of using a weighted moving average in data analysis?

+The primary benefits include the ability to reflect the greater importance of more recent data points and to reduce the impact of outliers or one-time events, providing a smoother and more reliable trend line.

In conclusion, weighted moving averages are powerful tools for data analysis in Excel, offering a nuanced view of trends by assigning greater weight to more recent data points. By understanding how to calculate and apply weighted moving averages, individuals can enhance their data analysis capabilities, make more informed decisions, and predict future trends with greater accuracy. Whether you're a seasoned analyst or just starting to explore the world of data analysis, mastering the weighted moving average is a valuable skill that can open up new insights and possibilities. We invite you to share your experiences with weighted moving averages, ask questions, or explore how this technique can be applied in your specific field of interest.