Intro

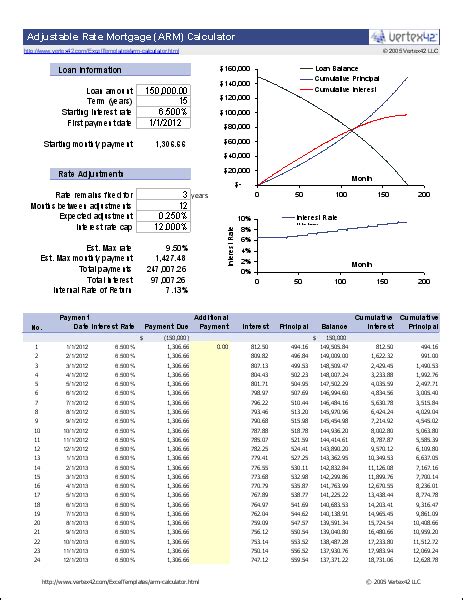

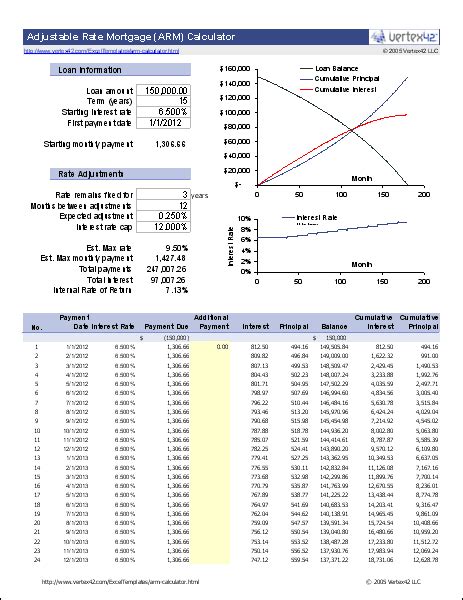

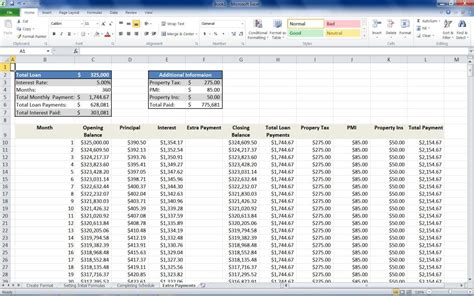

Calculate adjustable-rate mortgage payments with our Arm Mortgage Calculator Excel template, featuring amortization schedules, interest rates, and loan terms to help homeowners understand mortgage options and refinance strategies.

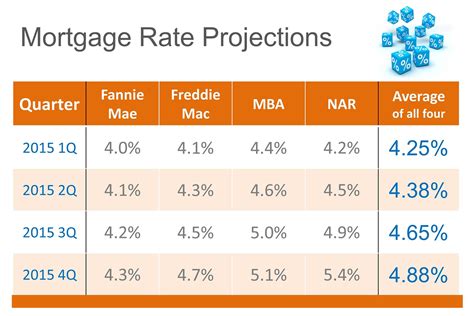

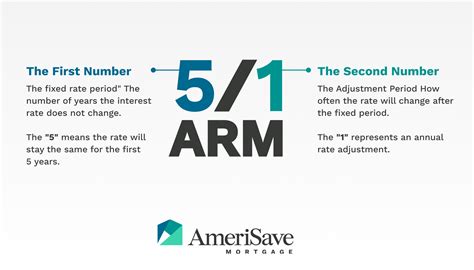

Adjustable-rate mortgages, commonly referred to as ARMs, have interest rates that can fluctuate over the life of the loan. This is in contrast to fixed-rate mortgages, where the interest rate remains constant. The potential for lower initial monthly payments is one of the main benefits of ARMs, but borrowers should also be aware of the potential risks, such as increasing monthly payments if interest rates rise. Utilizing an ARM mortgage calculator in Excel can help borrowers better understand and manage these risks.

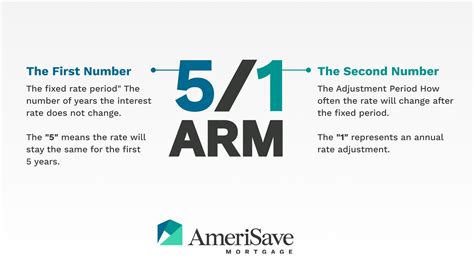

To create or use an ARM mortgage calculator in Excel, one must first understand the key components that influence the calculation. These include the initial loan amount (the principal), the initial interest rate, the adjustment period (how often the rate can change), the margin (the amount added to the index rate to determine the new interest rate), and any caps on rate adjustments (limits on how much the rate can increase or decrease at any one time or over the life of the loan).

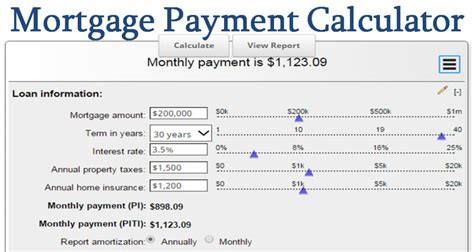

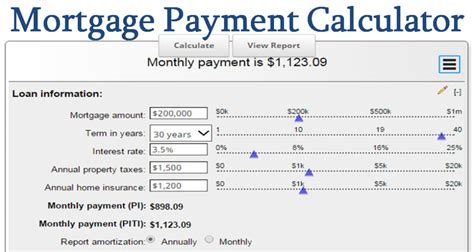

The initial steps in creating such a calculator involve setting up a table or spreadsheet that can accept these variables as inputs. The user should be able to easily modify these inputs to see how different scenarios affect their mortgage payments. The formula for calculating the monthly payment on an ARM is similar to that of a fixed-rate mortgage, using the formula for monthly payments (M) on a fixed-rate loan: M = P[r(1+r)^n]/[(1+r)^n – 1], where P is the principal loan amount, r is the monthly interest rate, and n is the number of payments. However, for an ARM, this calculation must be adjusted to account for the potential changes in the interest rate over time.

Understanding ARM Mortgage Calculators

An ARM mortgage calculator in Excel can be designed to handle these complexities. The calculator can be programmed to calculate the monthly payment based on the initial interest rate and then adjust this payment as the interest rate changes according to the specified adjustment period and caps. This allows borrowers to see not only their initial monthly payment but also how their payments might change over time, helping them to better plan their finances.

Components of an ARM Mortgage Calculator

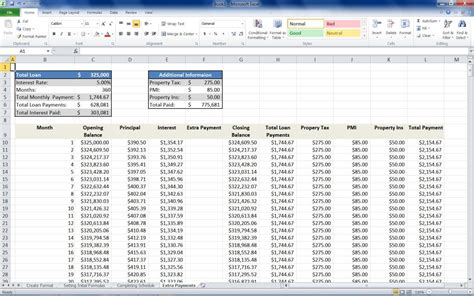

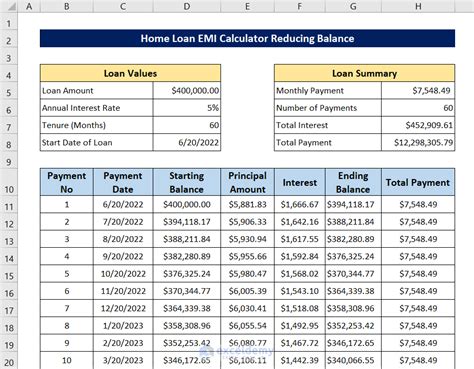

The key components of an ARM mortgage calculator include: - Initial loan amount - Initial interest rate - Adjustment period - Margin - Index rate (the base rate to which the margin is added) - Caps on rate adjustments - Loan termThese components can be input into an Excel spreadsheet, and formulas can be used to calculate the monthly payment based on the current interest rate. The spreadsheet can then be set up to simulate future adjustments in the interest rate, applying the margin to the index rate and adhering to any specified caps, to calculate future monthly payments.

Creating an ARM Mortgage Calculator in Excel

To create an ARM mortgage calculator in Excel, follow these steps:

- Set up a table with input fields for the initial loan amount, initial interest rate, adjustment period, margin, index rate, caps, and loan term.

- Use the formula for monthly payments to calculate the initial monthly payment based on the initial interest rate.

- Create a section to simulate future interest rate adjustments, applying the margin to the index rate and accounting for any caps.

- Calculate the new monthly payment after each adjustment, using the new interest rate.

- Display the results in a clear and understandable format, such as a table or chart showing how the monthly payment changes over time.

Benefits of Using an ARM Mortgage Calculator

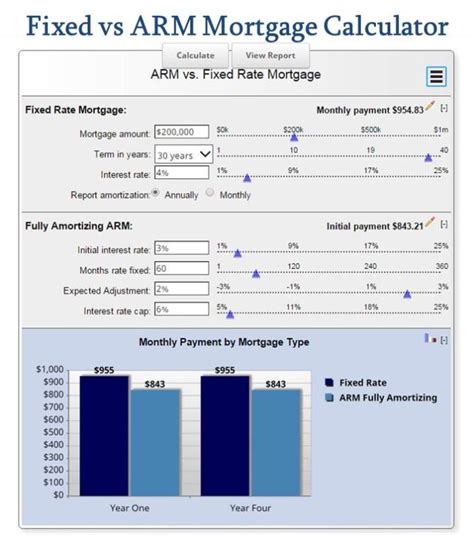

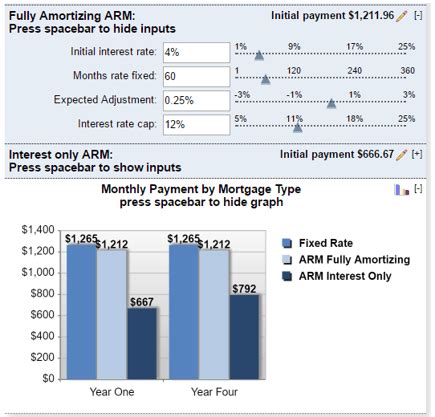

Using an ARM mortgage calculator in Excel offers several benefits to borrowers: - **Clarity on Payments**: It provides a clear picture of how monthly payments may change over the life of the loan. - **Financial Planning**: Helps borrowers plan their finances more effectively by understanding the potential risks and benefits of an ARM. - **Scenario Analysis**: Allows borrowers to test different scenarios, such as changes in interest rates or loan terms, to see how they affect monthly payments. - **Comparison Tool**: Can be used to compare ARM loans with fixed-rate loans, helping borrowers decide which type of loan best suits their needs.ARM Mortgage Calculator Example

Consider an example where a borrower is considering a 5/1 ARM with an initial interest rate of 3%, a margin of 2%, and an index rate of 1%. The loan amount is $200,000, and the loan term is 30 years. The calculator can be used to determine the initial monthly payment and how that payment may change after the first 5 years, assuming the index rate remains constant or changes.

Practical Applications

In practical terms, an ARM mortgage calculator can be a powerful tool for borrowers. For instance, it can help a borrower understand that while an ARM may offer a lower initial monthly payment compared to a fixed-rate mortgage, the potential for rate increases must be carefully considered. It can also help borrowers identify the break-even point, where the total payments over the life of the ARM equal those of a fixed-rate loan, assuming the ARM's rate increases as expected.Advanced Features of ARM Mortgage Calculators

Advanced ARM mortgage calculators may include features such as:

- The ability to input multiple rate adjustments over the life of the loan.

- Options to calculate payments based on different index rates or margins.

- A comparison feature to evaluate different loan scenarios side by side.

- Graphical representations of how payments may change over time.

These advanced features can provide borrowers with a more nuanced understanding of the potential risks and benefits associated with ARMs, enabling them to make more informed decisions about their mortgage options.

Conclusion and Next Steps

In conclusion, an ARM mortgage calculator in Excel is a valuable tool for anyone considering an adjustable-rate mortgage. By understanding how to create and use such a calculator, borrowers can better navigate the complexities of ARMs and make more informed decisions about their mortgage options. Whether you are a first-time homebuyer or an experienced borrower, taking the time to explore and understand the features and implications of an ARM can help you find the mortgage that best fits your financial situation and goals.ARM Mortgage Calculator Image Gallery

What is an ARM mortgage calculator?

+An ARM mortgage calculator is a tool used to calculate the monthly payments on an adjustable-rate mortgage, taking into account the initial interest rate, adjustment period, margin, and caps on rate adjustments.

How does an ARM mortgage calculator work?

+An ARM mortgage calculator works by using the formula for monthly payments on a loan, adjusting for the specifics of an ARM, including the potential for changing interest rates over the life of the loan.

What are the benefits of using an ARM mortgage calculator?

+The benefits include clarity on potential payments, the ability to plan finances more effectively, and the capability to compare different loan scenarios.

We invite you to share your thoughts and experiences with ARM mortgage calculators. Have you used such a tool to evaluate mortgage options? What features did you find most useful? Your insights can help others navigate the complex world of adjustable-rate mortgages. Please feel free to comment below or share this article with anyone who might benefit from understanding more about ARM mortgage calculators and their role in making informed mortgage decisions.