Intro

The world of finance and accounting has become increasingly digital, with most financial institutions providing their customers with online access to their bank statements. These statements are usually available in PDF format, which can be convenient for viewing and printing, but not ideal for analysis or manipulation. This is where a bank statement to Excel converter comes in – a tool that can save individuals and businesses a significant amount of time and effort by converting their bank statements into a format that is easily editable and analyzable.

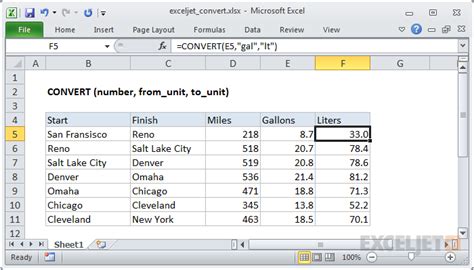

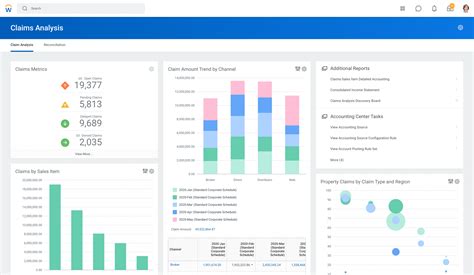

Converting bank statements to Excel can be a game-changer for individuals and businesses that need to track their finances, create budgets, or prepare tax returns. Excel is a powerful spreadsheet software that allows users to easily manipulate and analyze data, create charts and graphs, and perform complex calculations. By converting bank statements to Excel, users can take advantage of these features to gain a deeper understanding of their financial situation and make more informed decisions.

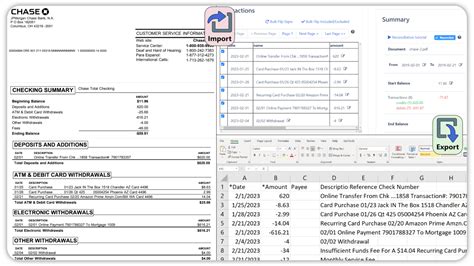

The process of converting a bank statement to Excel can be tedious and time-consuming, especially if done manually. It involves manually typing out each transaction, including the date, description, debit, and credit amounts, which can lead to errors and inaccuracies. A bank statement to Excel converter automates this process, saving users time and reducing the risk of errors. These converters use advanced algorithms to read the PDF file and extract the relevant information, which is then formatted into an Excel spreadsheet.

Benefits of Using a Bank Statement to Excel Converter

The benefits of using a bank statement to Excel converter are numerous. For one, it saves time and reduces the risk of errors. Manual data entry can be a tedious and time-consuming process, especially for large bank statements. A converter automates this process, allowing users to focus on more important tasks. Additionally, converters can handle multiple bank statements at once, making it ideal for businesses or individuals with multiple accounts.

Another benefit of using a bank statement to Excel converter is that it improves accuracy. Manual data entry is prone to errors, which can lead to inaccuracies in financial reporting and analysis. A converter uses advanced algorithms to extract data from the PDF file, reducing the risk of errors and ensuring that the data is accurate and reliable.

Key Features of a Bank Statement to Excel Converter

A good bank statement to Excel converter should have several key features. For one, it should be able to handle multiple file formats, including PDF, CSV, and Excel. It should also be able to extract data from multiple pages and handle large files. Additionally, it should have advanced error-handling capabilities, such as automatic error detection and correction.Some converters also come with additional features, such as data validation and formatting options. These features allow users to customize the output to suit their specific needs, such as formatting dates and amounts to match their existing accounting system.

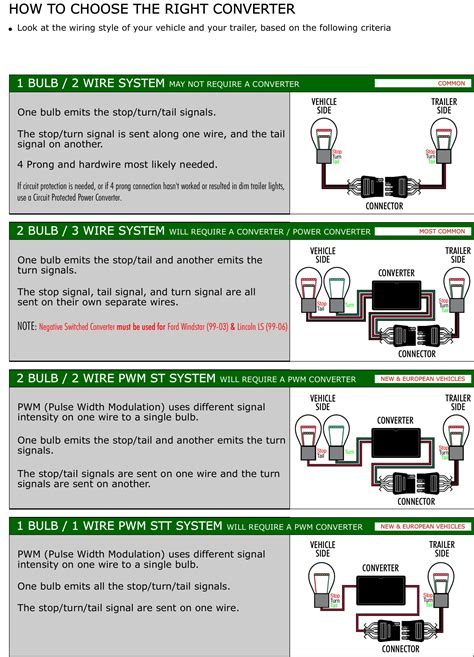

How to Choose the Right Bank Statement to Excel Converter

Choosing the right bank statement to Excel converter can be a daunting task, especially with so many options available. There are several factors to consider, such as the converter's ability to handle multiple file formats, its error-handling capabilities, and its formatting options.

One of the most important factors to consider is the converter's accuracy. A good converter should be able to extract data accurately and reliably, without introducing errors or inaccuracies. It should also be able to handle multiple pages and large files, making it ideal for businesses or individuals with multiple accounts.

Another factor to consider is the converter's ease of use. A good converter should have a user-friendly interface that is easy to navigate, even for those who are not tech-savvy. It should also come with clear instructions and support, in case users encounter any issues or have questions.

Common Uses of Bank Statement to Excel Converters

Bank statement to Excel converters have a wide range of applications, from personal finance to business accounting. Individuals can use converters to track their expenses, create budgets, and prepare tax returns. Businesses can use converters to analyze their cash flow, create financial reports, and prepare for audits.Some common uses of bank statement to Excel converters include:

- Tracking expenses and income

- Creating budgets and financial plans

- Preparing tax returns and financial reports

- Analyzing cash flow and financial performance

- Identifying trends and patterns in spending and income

Advantages of Using a Bank Statement to Excel Converter for Business

Using a bank statement to Excel converter can have several advantages for businesses. For one, it can save time and reduce the risk of errors. Manual data entry can be a tedious and time-consuming process, especially for large businesses with multiple accounts. A converter automates this process, allowing businesses to focus on more important tasks.

Another advantage of using a bank statement to Excel converter for business is that it improves accuracy. Manual data entry is prone to errors, which can lead to inaccuracies in financial reporting and analysis. A converter uses advanced algorithms to extract data from the PDF file, reducing the risk of errors and ensuring that the data is accurate and reliable.

Additionally, a bank statement to Excel converter can help businesses to analyze their cash flow and financial performance. By converting bank statements to Excel, businesses can easily create charts and graphs to visualize their financial data, identify trends and patterns, and make more informed decisions.

Best Practices for Using a Bank Statement to Excel Converter

To get the most out of a bank statement to Excel converter, there are several best practices to follow. For one, it's essential to choose a converter that is compatible with your bank's statement format. This ensures that the converter can accurately extract data from the PDF file.Another best practice is to review the output carefully to ensure that it is accurate and reliable. This involves checking for errors, such as missing or duplicate transactions, and verifying that the data is formatted correctly.

Additionally, it's essential to keep the converter up to date, as new features and updates are released regularly. This ensures that you have access to the latest features and improvements, and that the converter continues to work smoothly and efficiently.

Common Challenges and Limitations of Bank Statement to Excel Converters

While bank statement to Excel converters can be incredibly useful, there are several common challenges and limitations to be aware of. For one, some converters may struggle with complex or unusual bank statement formats. This can result in errors or inaccuracies in the output, which can be frustrating and time-consuming to correct.

Another challenge is that some converters may not be able to handle large files or multiple pages. This can be a problem for businesses or individuals with multiple accounts or large transaction volumes.

Additionally, some converters may require manual configuration or setup, which can be time-consuming and require technical expertise. This can be a barrier for those who are not tech-savvy or who do not have the time or resources to invest in learning how to use the converter.

Future Developments and Trends in Bank Statement to Excel Converters

The field of bank statement to Excel converters is constantly evolving, with new developments and trends emerging all the time. One of the most significant trends is the move towards cloud-based converters, which allow users to access their converted data from anywhere, at any time.Another trend is the increasing use of artificial intelligence and machine learning algorithms to improve the accuracy and efficiency of converters. These algorithms can learn from user feedback and adapt to new bank statement formats, making converters more reliable and effective.

Additionally, there is a growing demand for converters that can handle multiple file formats and integrate with other accounting and financial software. This allows users to seamlessly import and export data, and to use their converted data in a variety of different contexts.

Bank Statement to Excel Converter Image Gallery

What is a bank statement to Excel converter?

+A bank statement to Excel converter is a tool that converts bank statements from PDF format to Excel format, allowing users to easily edit and analyze their financial data.

How does a bank statement to Excel converter work?

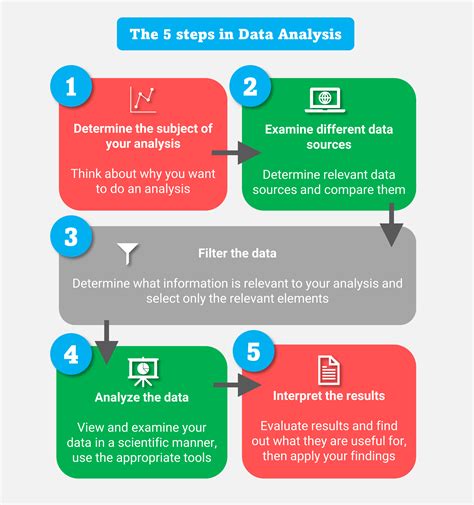

+A bank statement to Excel converter uses advanced algorithms to read the PDF file and extract the relevant information, which is then formatted into an Excel spreadsheet.

What are the benefits of using a bank statement to Excel converter?

+The benefits of using a bank statement to Excel converter include saving time, reducing the risk of errors, and improving accuracy. It also allows users to easily analyze and manipulate their financial data, creating charts and graphs to visualize their financial situation.

In conclusion, a bank statement to Excel converter is a powerful tool that can save individuals and businesses a significant amount of time and effort. By converting bank statements to Excel, users can easily edit and analyze their financial data, creating charts and graphs to visualize their financial situation. With its numerous benefits and advantages, a bank statement to Excel converter is an essential tool for anyone looking to streamline their financial management and make more informed decisions. We invite you to share your thoughts and experiences with bank statement to Excel converters in the comments below, and to explore the many resources and tools available to help you get the most out of this powerful technology.