Intro

Master option pricing with the Binomial Tree Model in Excel, using 5 key methods for accurate valuation, including risk-neutral probability, node calculation, and sensitivity analysis for optimal investment decisions.

The binomial tree model is a widely used financial modeling technique that helps estimate the future value of an asset or a portfolio. It is particularly useful for valuing options and other derivatives. In this article, we will explore how to implement the binomial tree model in Excel, highlighting five key ways to utilize this powerful tool.

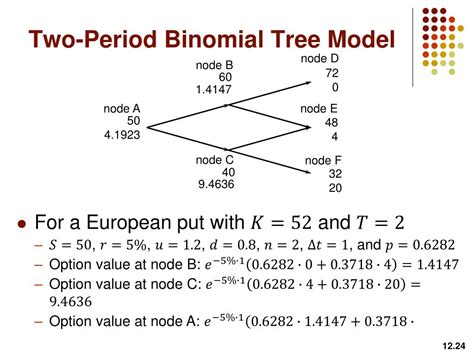

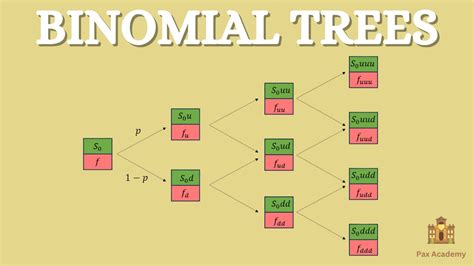

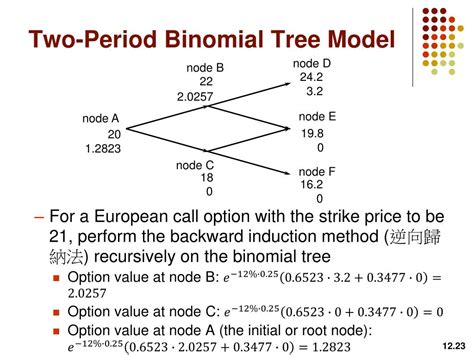

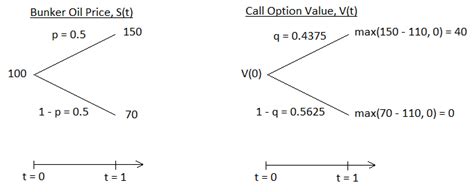

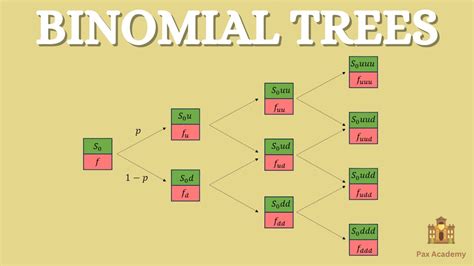

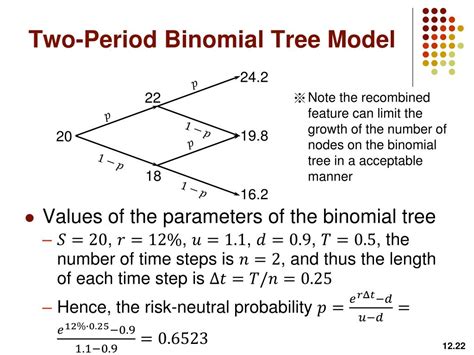

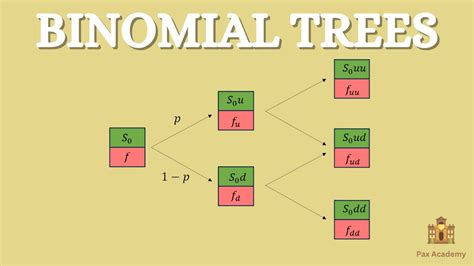

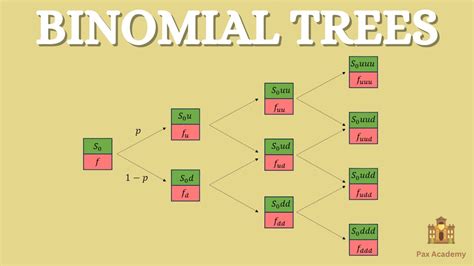

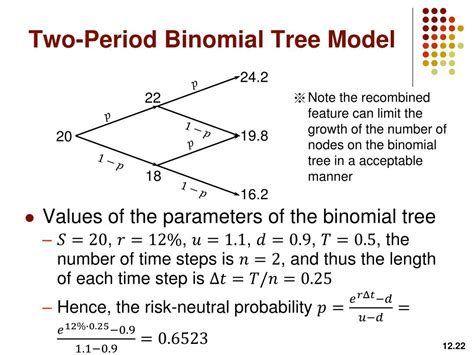

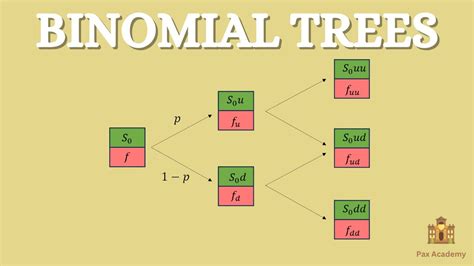

The binomial tree model is based on the idea that the price of an underlying asset can move up or down by a certain percentage at each time step, resulting in a tree-like structure of possible future prices. By calculating the probability of each possible outcome and applying the risk-neutral valuation principle, we can estimate the present value of an option or other derivative.

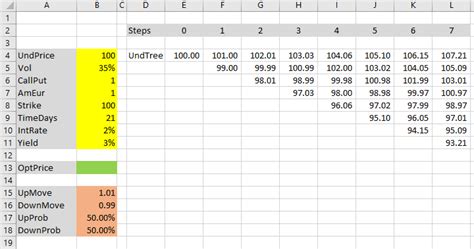

To create a binomial tree model in Excel, we need to start by setting up the basic parameters, including the current stock price, strike price, time to expiration, risk-free interest rate, and volatility. We can then use these inputs to calculate the up and down factors, which determine the size of the price movements at each time step.

Binomial Tree Model Basics

The binomial tree model is a discrete-time model, meaning that time is divided into discrete intervals, and the price movements are assumed to occur at the end of each interval. The model is typically implemented using a lattice or tree structure, with each node representing a possible future price.

To calculate the value of an option using the binomial tree model, we need to work backwards from the expiration date, calculating the option value at each node based on the probabilities of the up and down movements. The final option value is then calculated by discounting the expected payoff at expiration back to the present.

Implementing the Binomial Tree Model in Excel

To implement the binomial tree model in Excel, we can use a combination of formulas and macros. The basic steps involve:

- Setting up the input parameters, including the current stock price, strike price, time to expiration, risk-free interest rate, and volatility.

- Calculating the up and down factors using the input parameters.

- Creating a lattice or tree structure to represent the possible future prices.

- Calculating the option value at each node based on the probabilities of the up and down movements.

- Discounting the expected payoff at expiration back to the present to obtain the final option value.

Step 1: Setting Up the Input Parameters

The first step in implementing the binomial tree model in Excel is to set up the input parameters. This involves creating a table or range with the following inputs:- Current stock price

- Strike price

- Time to expiration

- Risk-free interest rate

- Volatility

We can then use these inputs to calculate the up and down factors, which determine the size of the price movements at each time step.

Step 2: Calculating the Up and Down Factors

The up and down factors are calculated using the following formulas:Up factor = exp(volatility * sqrt(time step)) Down factor = 1 / up factor

Where volatility is the annualized volatility, and time step is the length of each time interval.

Using the Binomial Tree Model to Value Options

The binomial tree model can be used to value a wide range of options, including calls, puts, and exotic options. To value an option using the binomial tree model, we need to calculate the option value at each node based on the probabilities of the up and down movements.

The basic steps involve:

- Calculating the option payoff at expiration for each possible future price.

- Discounting the expected payoff at expiration back to the present using the risk-neutral valuation principle.

- Calculating the option value at each node based on the probabilities of the up and down movements.

Calculating the Option Payoff at Expiration

The option payoff at expiration is calculated based on the difference between the underlying asset price and the strike price. For a call option, the payoff is max(0, underlying asset price - strike price), while for a put option, the payoff is max(0, strike price - underlying asset price).Advantages and Limitations of the Binomial Tree Model

The binomial tree model has several advantages, including:

- Flexibility: The binomial tree model can be used to value a wide range of options, including calls, puts, and exotic options.

- Accuracy: The binomial tree model can provide accurate estimates of option values, particularly for short-dated options.

- Ease of implementation: The binomial tree model can be easily implemented in Excel using a combination of formulas and macros.

However, the binomial tree model also has several limitations, including:

- Computational intensity: The binomial tree model can be computationally intensive, particularly for long-dated options or options with complex payoff structures.

- Assumption of constant volatility: The binomial tree model assumes that volatility is constant over the life of the option, which may not be realistic.

- Assumption of risk-neutral valuation: The binomial tree model assumes that the risk-neutral valuation principle holds, which may not be realistic in all markets.

Conclusion and Future Directions

In conclusion, the binomial tree model is a powerful tool for valuing options and other derivatives. By implementing the binomial tree model in Excel, we can easily estimate the value of a wide range of options, including calls, puts, and exotic options.However, the binomial tree model also has several limitations, including computational intensity, assumption of constant volatility, and assumption of risk-neutral valuation. Future research should focus on addressing these limitations and developing more advanced models that can capture the complexities of real-world markets.

Binomial Tree Model Image Gallery

What is the binomial tree model?

+The binomial tree model is a financial modeling technique used to estimate the future value of an asset or a portfolio.

How does the binomial tree model work?

+The binomial tree model works by dividing time into discrete intervals and assuming that the price of the underlying asset can move up or down by a certain percentage at each time step.

What are the advantages of the binomial tree model?

+The binomial tree model has several advantages, including flexibility, accuracy, and ease of implementation.

What are the limitations of the binomial tree model?

+The binomial tree model has several limitations, including computational intensity, assumption of constant volatility, and assumption of risk-neutral valuation.

How can I implement the binomial tree model in Excel?

+To implement the binomial tree model in Excel, you can use a combination of formulas and macros to calculate the option value at each node based on the probabilities of the up and down movements.

We hope this article has provided you with a comprehensive understanding of the binomial tree model and its applications in finance. Whether you are a student, a professional, or simply an individual interested in learning more about financial modeling, we encourage you to share this article with others and to continue exploring the many resources available on this topic. By working together, we can build a community of knowledgeable and informed individuals who can make informed decisions about their financial futures.