Intro

Calculate payback period in Excel using formulas and templates, determining investment returns and break-even points with ease, and analyzing cash flows for informed decisions.

Calculating the payback period is a crucial step in evaluating the feasibility of a project or investment. The payback period is the time it takes for an investment to generate cash flows that equal its initial cost. In this article, we will delve into the world of finance and explore how to calculate the payback period using Excel.

The payback period is an essential metric in finance, as it helps investors and businesses determine the viability of a project. A shorter payback period indicates a more attractive investment, as it takes less time to recover the initial outlay. In contrast, a longer payback period may signal a riskier investment, as it may take more time to generate sufficient cash flows to cover the initial cost.

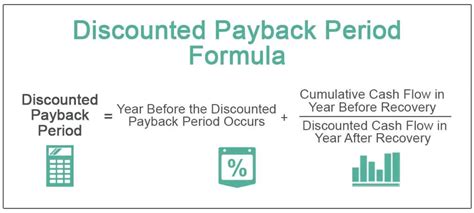

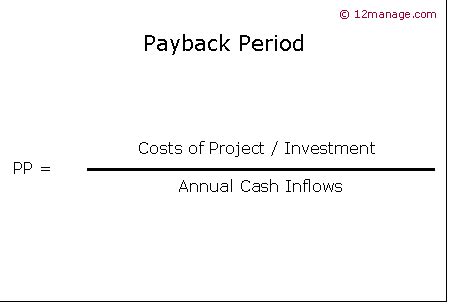

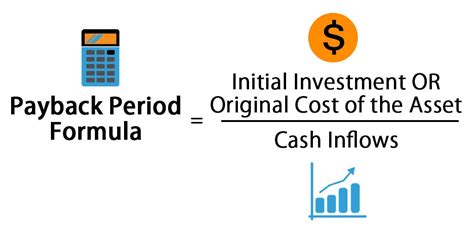

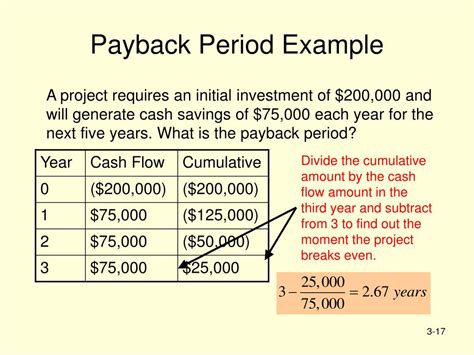

To calculate the payback period, you need to know the initial investment, the annual cash flows, and the discount rate. The discount rate is the rate at which future cash flows are discounted to their present value. The payback period can be calculated using the following formula:

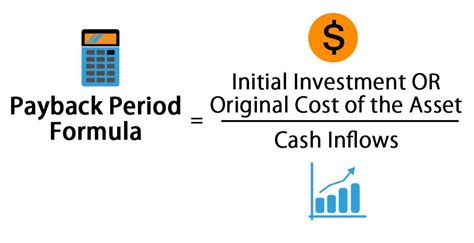

Payback Period = Initial Investment / Annual Cash Flow

However, this formula assumes that the cash flows are uniform and do not take into account the time value of money. To get a more accurate calculation, you can use the Excel formula:

=IPMT(rate, nper, pv, [fv], [type])

Where:

- rate is the discount rate

- nper is the number of periods

- pv is the present value (initial investment)

- fv is the future value (optional)

- type is the type of payment (optional)

But, to calculate the payback period, we will use a simpler approach.

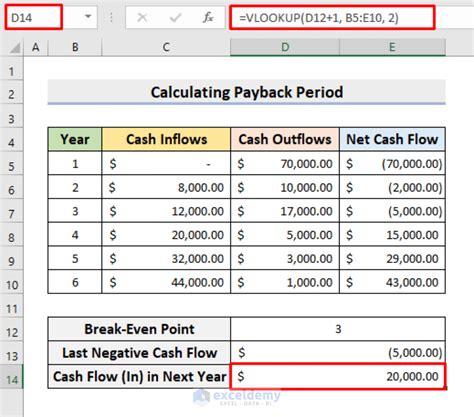

Calculating Payback Period in Excel

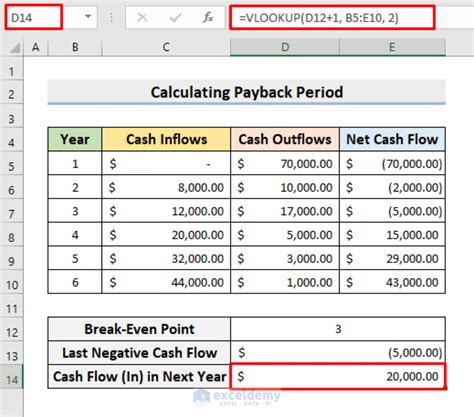

To calculate the payback period in Excel, follow these steps:

- Open a new Excel worksheet and create a table with the following columns: Year, Cash Flow, Cumulative Cash Flow, and Payback Period.

- Enter the initial investment in the first row of the Cumulative Cash Flow column.

- Enter the annual cash flows in the Cash Flow column.

- Calculate the cumulative cash flow by adding the current year's cash flow to the previous year's cumulative cash flow.

- Calculate the payback period by dividing the initial investment by the annual cash flow.

Here is an example:

| Year | Cash Flow | Cumulative Cash Flow | Payback Period |

|---|---|---|---|

| 0 | -10000 | -10000 | |

| 1 | 2000 | -8000 | |

| 2 | 3000 | -5000 | |

| 3 | 4000 | -1000 | |

| 4 | 5000 | 4000 | 2.5 |

In this example, the payback period is 2.5 years, which means that it will take approximately 2.5 years for the investment to generate cash flows that equal its initial cost.

Using Excel Formulas to Calculate Payback Period

You can also use Excel formulas to calculate the payback period. The formula is:

=YEAR(FIND(-INITIAL_INVESTMENT,CUMULATIVE_CASH_FLOW))

Where:

- INITIAL_INVESTMENT is the initial investment

- CUMULATIVE_CASH_FLOW is the range of cells containing the cumulative cash flows

For example:

=YEAR(FIND(-10000,B2:B6))

This formula will return the year in which the cumulative cash flow equals the initial investment.

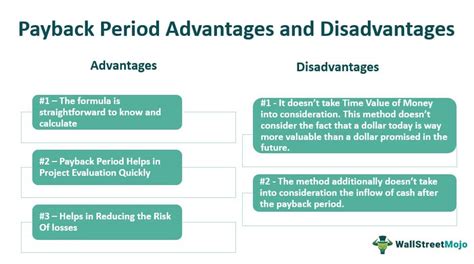

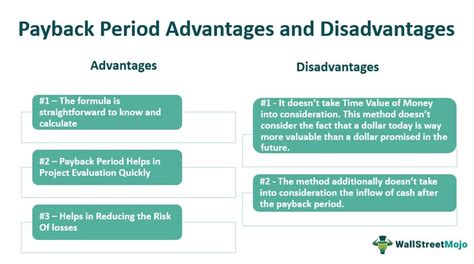

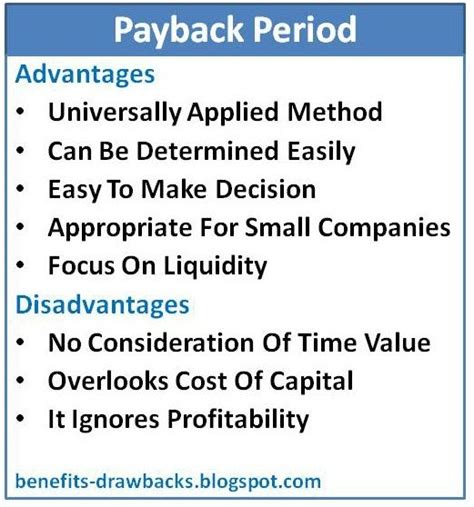

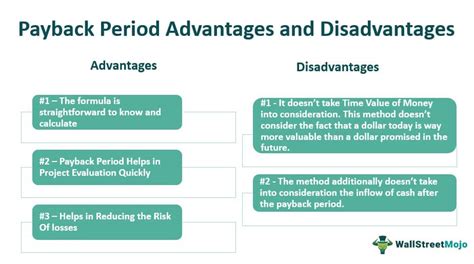

Benefits of Calculating Payback Period

Calculating the payback period has several benefits, including:

- Evaluating the feasibility of a project or investment

- Comparing different investment opportunities

- Determining the risk of an investment

- Identifying the potential return on investment

By calculating the payback period, you can make informed decisions about your investments and ensure that you are getting the best possible return on your money.

Limitations of Payback Period

While the payback period is a useful metric, it has several limitations, including:

- It does not take into account the time value of money

- It does not consider the risk of an investment

- It does not account for inflation

- It does not provide a complete picture of an investment's potential return

To get a more accurate picture of an investment's potential return, you should use other metrics, such as the internal rate of return (IRR) or the net present value (NPV).

Real-World Applications of Payback Period

The payback period has several real-world applications, including:

- Evaluating the feasibility of a new business venture

- Comparing different investment opportunities

- Determining the risk of an investment

- Identifying the potential return on investment

For example, a company may use the payback period to evaluate the feasibility of investing in a new piece of equipment. If the payback period is less than 2 years, the company may decide to invest in the equipment. However, if the payback period is more than 5 years, the company may decide not to invest.

Common Mistakes to Avoid When Calculating Payback Period

When calculating the payback period, there are several common mistakes to avoid, including:

- Not considering the time value of money

- Not accounting for inflation

- Not using the correct discount rate

- Not considering the risk of an investment

To avoid these mistakes, you should use the correct formula and consider all the relevant factors, such as the time value of money, inflation, and risk.

Best Practices for Calculating Payback Period

To get the most accurate calculation of the payback period, you should follow these best practices:

- Use the correct formula

- Consider all relevant factors, such as the time value of money, inflation, and risk

- Use the correct discount rate

- Consider multiple scenarios and sensitivity analysis

By following these best practices, you can ensure that your calculation of the payback period is accurate and reliable.

Payback Period Image Gallery

What is the payback period?

+The payback period is the time it takes for an investment to generate cash flows that equal its initial cost.

How do I calculate the payback period?

+To calculate the payback period, you can use the formula: Payback Period = Initial Investment / Annual Cash Flow.

What are the benefits of calculating the payback period?

+Calculating the payback period helps you evaluate the feasibility of a project or investment, compare different investment opportunities, and determine the risk of an investment.

What are the limitations of the payback period?

+The payback period does not take into account the time value of money, inflation, or risk. It also does not provide a complete picture of an investment's potential return.

How can I use the payback period in real-world applications?

+The payback period can be used to evaluate the feasibility of a new business venture, compare different investment opportunities, and determine the risk of an investment.

In