Intro

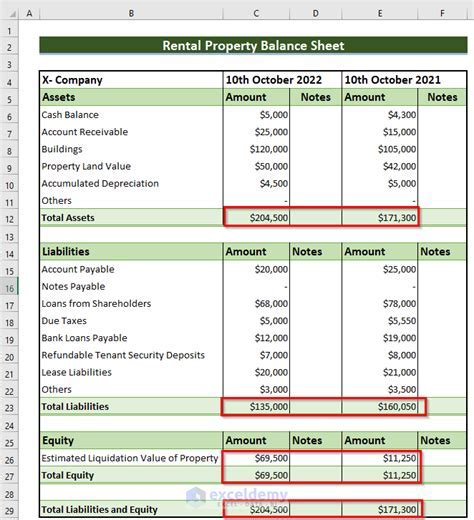

The existence of checks in Excel is a crucial aspect of financial management and data analysis. Checks are essential for verifying the accuracy of data, ensuring the integrity of financial transactions, and preventing errors. In this article, we will explore five ways Excel checks exist, providing you with a comprehensive understanding of how to utilize these checks to improve your financial management and data analysis skills.

Excel checks are vital for businesses, organizations, and individuals who rely on accurate financial data to make informed decisions. The existence of checks in Excel enables users to verify the accuracy of data, identify errors, and prevent financial losses. With the increasing complexity of financial transactions, the importance of Excel checks cannot be overstated. In this article, we will delve into the world of Excel checks, exploring their significance, benefits, and applications.

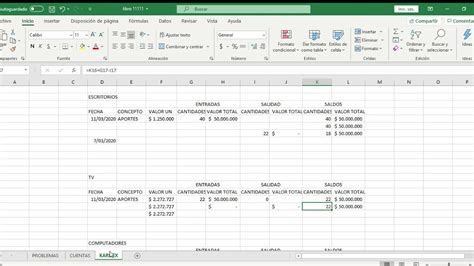

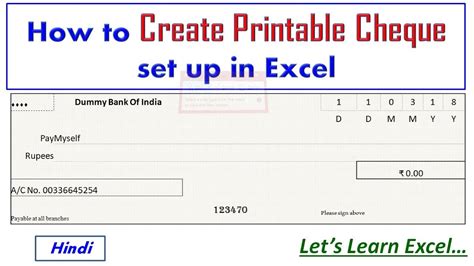

The use of Excel checks is not limited to financial management; they are also essential for data analysis, reporting, and visualization. By leveraging Excel checks, users can ensure the accuracy and integrity of their data, making it possible to create reliable reports, charts, and graphs. Moreover, Excel checks enable users to identify trends, patterns, and anomalies in their data, providing valuable insights that can inform business decisions. As we explore the five ways Excel checks exist, you will gain a deeper understanding of how to harness the power of Excel to improve your financial management and data analysis skills.

Existence of Checks in Excel

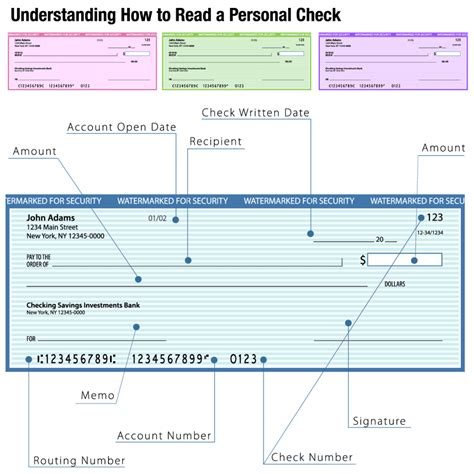

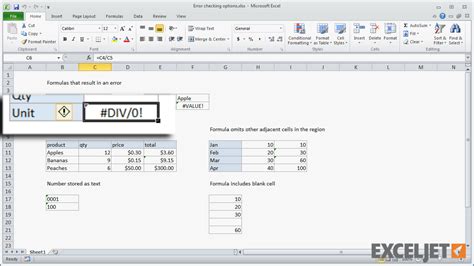

The existence of checks in Excel is a fundamental concept that underlies the functionality of the software. Excel checks are designed to verify the accuracy of data, ensuring that financial transactions, formulas, and calculations are correct. There are several types of checks in Excel, including formula checks, data validation checks, and error checks. Each type of check serves a specific purpose, enabling users to identify and correct errors, prevent financial losses, and ensure the integrity of their data.

Types of Checks in Excel

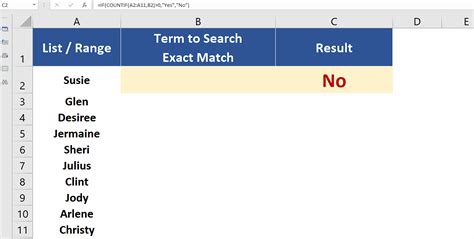

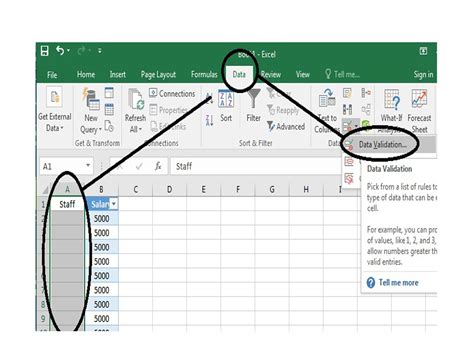

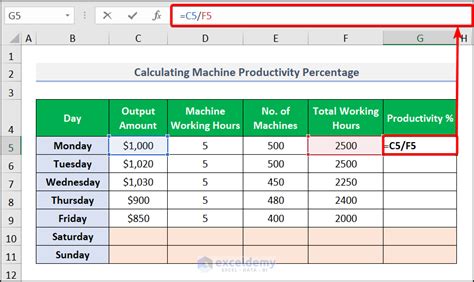

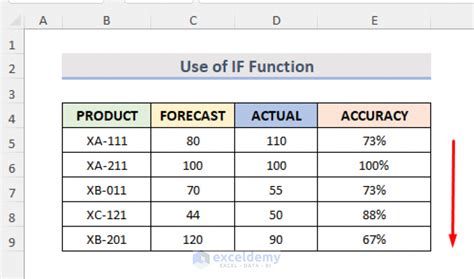

There are several types of checks in Excel, each designed to serve a specific purpose. Formula checks, for example, verify the accuracy of formulas and calculations, ensuring that financial transactions are correct. Data validation checks, on the other hand, ensure that data entered into a cell meets specific criteria, such as a date or a number. Error checks, meanwhile, identify and flag errors in formulas, calculations, and data entry. By understanding the different types of checks in Excel, users can harness their power to improve the accuracy and integrity of their data.

Benefits of Excel Checks

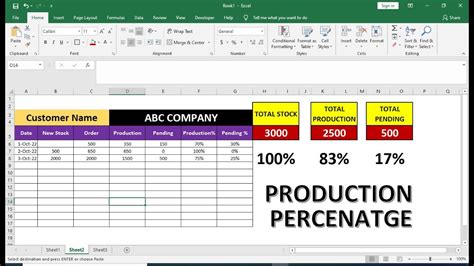

The benefits of Excel checks are numerous and significant. By leveraging Excel checks, users can ensure the accuracy and integrity of their data, prevent financial losses, and improve the efficiency of their financial management and data analysis tasks. Excel checks also enable users to identify trends, patterns, and anomalies in their data, providing valuable insights that can inform business decisions. Moreover, Excel checks can help users to reduce errors, improve productivity, and enhance the overall quality of their financial management and data analysis tasks.

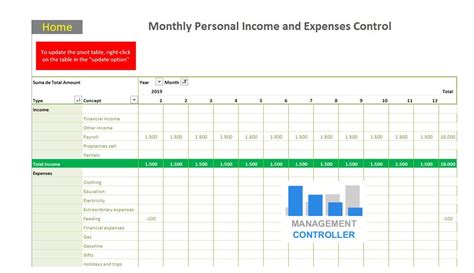

Applications of Excel Checks

The applications of Excel checks are diverse and widespread. Excel checks can be used in a variety of contexts, including financial management, data analysis, reporting, and visualization. By leveraging Excel checks, users can ensure the accuracy and integrity of their data, making it possible to create reliable reports, charts, and graphs. Excel checks can also be used to identify trends, patterns, and anomalies in data, providing valuable insights that can inform business decisions. Moreover, Excel checks can be used to improve the efficiency of financial management and data analysis tasks, reducing errors and improving productivity.

Best Practices for Using Excel Checks

To get the most out of Excel checks, users should follow best practices for using them. This includes understanding the different types of checks available in Excel, knowing how to apply them, and regularly reviewing and updating checks to ensure they remain relevant and effective. Users should also ensure that they are using the correct type of check for the task at hand, whether it is a formula check, data validation check, or error check. By following best practices for using Excel checks, users can harness their power to improve the accuracy and integrity of their data, prevent financial losses, and improve the efficiency of their financial management and data analysis tasks.

Excel Checks Image Gallery

What are Excel checks?

+Excel checks are features in Excel that verify the accuracy of data, ensuring that financial transactions, formulas, and calculations are correct.

What are the benefits of using Excel checks?

+The benefits of using Excel checks include ensuring the accuracy and integrity of data, preventing financial losses, and improving the efficiency of financial management and data analysis tasks.

How do I use Excel checks?

+To use Excel checks, you need to understand the different types of checks available in Excel, know how to apply them, and regularly review and update checks to ensure they remain relevant and effective.

What are the different types of Excel checks?

+The different types of Excel checks include formula checks, data validation checks, and error checks. Each type of check serves a specific purpose, enabling users to identify and correct errors, prevent financial losses, and ensure the integrity of their data.

Why are Excel checks important?

+Excel checks are important because they enable users to ensure the accuracy and integrity of their data, prevent financial losses, and improve the efficiency of their financial management and data analysis tasks.

In conclusion, the existence of checks in Excel is a vital aspect of financial management and data analysis. By understanding the different types of checks available in Excel, knowing how to apply them, and regularly reviewing and updating checks, users can harness their power to improve the accuracy and integrity of their data, prevent financial losses, and improve the efficiency of their financial management and data analysis tasks. We hope this article has provided you with a comprehensive understanding of the importance of Excel checks and how to use them to improve your financial management and data analysis skills. If you have any questions or comments, please do not hesitate to share them with us. We would be delighted to hear from you and provide you with further guidance and support.