Intro

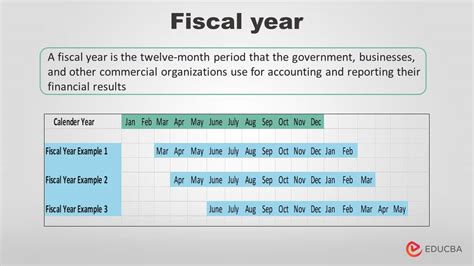

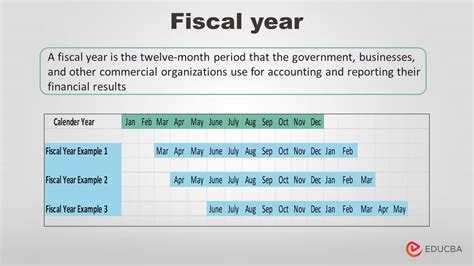

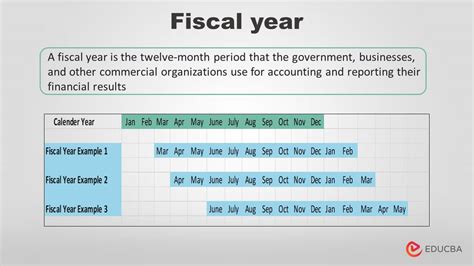

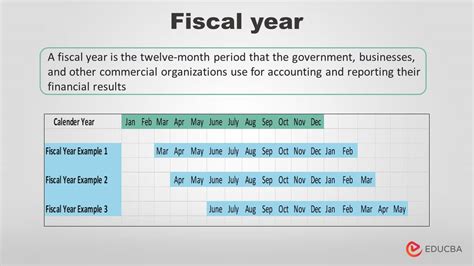

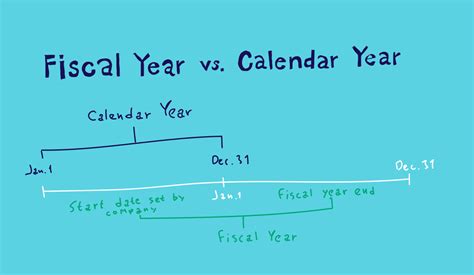

Calculating the fiscal year is a crucial aspect of financial planning and management for businesses and organizations. The fiscal year, also known as the financial year, is a period of 12 months used by companies and governments to prepare financial statements, budget, and make strategic decisions. Unlike the calendar year, which starts on January 1 and ends on December 31, the fiscal year can begin on any date and is often chosen to align with the organization's business cycle or to simplify accounting and tax purposes. In this article, we will explore five ways to calculate the fiscal year, highlighting the importance of understanding this concept for effective financial management.

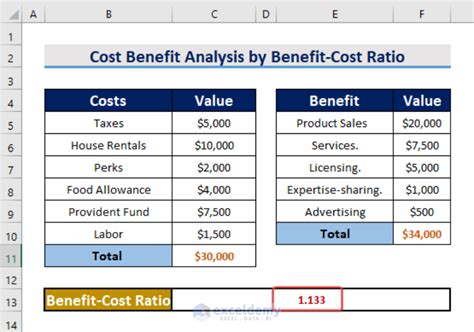

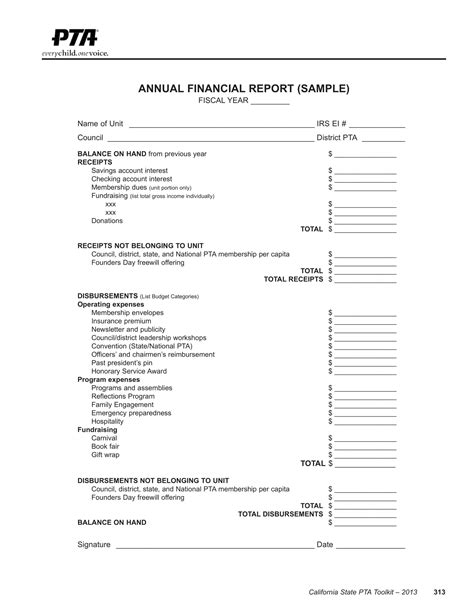

The fiscal year calculation is essential for businesses to accurately track their financial performance, make informed decisions, and comply with regulatory requirements. It serves as a framework for financial reporting, budgeting, and forecasting, enabling organizations to evaluate their progress and adjust their strategies accordingly. Moreover, the fiscal year calculation helps businesses to identify areas of improvement, optimize their operations, and allocate resources more efficiently. With a clear understanding of the fiscal year calculation, organizations can better navigate the complexities of financial management and achieve their long-term goals.

The calculation of the fiscal year can significantly impact a company's financial statements, tax obligations, and overall financial health. For instance, a company with a fiscal year ending on June 30 may have a different financial reporting cycle than a company with a fiscal year ending on December 31. This difference can affect the timing of financial statements, tax payments, and other critical financial events. Therefore, it is essential for businesses to carefully consider their fiscal year calculation and ensure that it aligns with their operational needs and regulatory requirements.

Understanding Fiscal Year Calculations

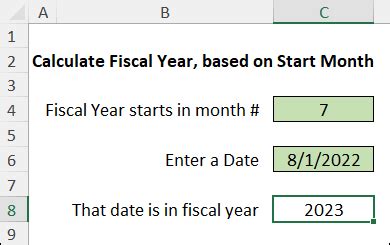

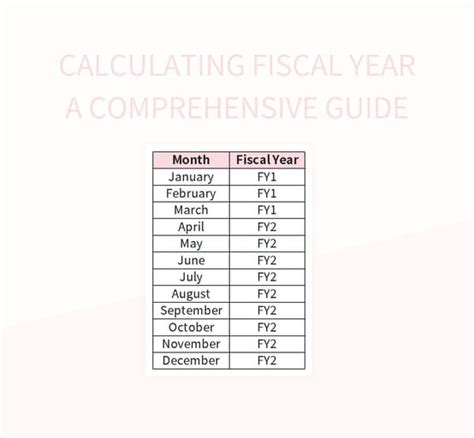

To calculate the fiscal year, organizations must first determine their fiscal year-end date, which marks the end of their 12-month financial period. The fiscal year-end date can be any date, but it is typically chosen to coincide with the end of a quarter, such as March 31, June 30, September 30, or December 31. Once the fiscal year-end date is established, the organization can calculate its fiscal year by counting back 12 months from the fiscal year-end date.

Fiscal Year Calculation Methods

There are several methods to calculate the fiscal year, including:- Calendar Year Method: This method uses the calendar year as the basis for the fiscal year, with the fiscal year starting on January 1 and ending on December 31.

- Fiscal Year-End Method: This method uses the fiscal year-end date as the basis for the fiscal year, with the fiscal year starting on the first day of the month following the fiscal year-end date and ending on the fiscal year-end date.

- 52-53 Week Method: This method uses a 52- or 53-week fiscal year, with the fiscal year starting on the first day of the week following the fiscal year-end date and ending on the last day of the week preceding the next fiscal year-end date.

- Quarterly Method: This method uses a quarterly fiscal year, with the fiscal year starting on the first day of the quarter following the fiscal year-end date and ending on the last day of the quarter preceding the next fiscal year-end date.

- Modified Fiscal Year Method: This method uses a modified fiscal year, with the fiscal year starting on a date other than January 1 and ending on a date other than December 31.

Benefits of Calculating Fiscal Year

Calculating the fiscal year offers several benefits to organizations, including:

- Improved Financial Management: Calculating the fiscal year enables organizations to better manage their finances, make informed decisions, and allocate resources more efficiently.

- Enhanced Financial Reporting: Calculating the fiscal year provides a framework for financial reporting, enabling organizations to prepare accurate and timely financial statements.

- Simplified Tax Compliance: Calculating the fiscal year helps organizations comply with tax regulations, reducing the risk of errors and penalties.

- Better Budgeting and Forecasting: Calculating the fiscal year enables organizations to prepare more accurate budgets and forecasts, making it easier to achieve their financial goals.

- Increased Transparency and Accountability: Calculating the fiscal year promotes transparency and accountability, enabling stakeholders to evaluate an organization's financial performance and make informed decisions.

Common Fiscal Year Calculation Mistakes

When calculating the fiscal year, organizations should avoid common mistakes, such as:- Inconsistent Fiscal Year-End Dates: Using inconsistent fiscal year-end dates can lead to errors in financial reporting and tax compliance.

- Incorrect Fiscal Year Calculation: Failing to calculate the fiscal year correctly can result in inaccurate financial statements and tax returns.

- Failure to Consider Accounting Rules: Ignoring accounting rules and regulations can lead to errors in financial reporting and tax compliance.

Best Practices for Calculating Fiscal Year

To ensure accurate and effective fiscal year calculations, organizations should follow best practices, such as:

- Establish a Consistent Fiscal Year-End Date: Using a consistent fiscal year-end date helps ensure accuracy and consistency in financial reporting and tax compliance.

- Use a Standardized Fiscal Year Calculation Method: Adopting a standardized fiscal year calculation method reduces the risk of errors and inconsistencies.

- Consider Accounting Rules and Regulations: Ensuring compliance with accounting rules and regulations helps prevent errors and penalties.

- Regularly Review and Update Fiscal Year Calculations: Regularly reviewing and updating fiscal year calculations helps ensure accuracy and effectiveness.

Fiscal Year Calculation Tools and Resources

To facilitate accurate and efficient fiscal year calculations, organizations can utilize various tools and resources, such as:- Financial Management Software: Financial management software, such as accounting and enterprise resource planning (ERP) systems, can automate fiscal year calculations and provide real-time financial insights.

- Spreadsheets and Templates: Spreadsheets and templates can help organizations calculate and track fiscal year data, providing a flexible and customizable solution.

- Accounting and Tax Professionals: Consulting with accounting and tax professionals can provide organizations with expert guidance and support for fiscal year calculations and compliance.

Conclusion and Next Steps

In conclusion, calculating the fiscal year is a critical aspect of financial management for businesses and organizations. By understanding the different methods and best practices for calculating the fiscal year, organizations can ensure accurate and effective financial reporting, budgeting, and forecasting. To take the next step, organizations should review their current fiscal year calculation methods and consider implementing standardized and automated solutions to improve accuracy and efficiency.

Fiscal Year Image Gallery

What is the purpose of calculating the fiscal year?

+The purpose of calculating the fiscal year is to provide a framework for financial reporting, budgeting, and forecasting, enabling organizations to evaluate their progress and make informed decisions.

How do I calculate the fiscal year?

+To calculate the fiscal year, determine the fiscal year-end date and count back 12 months. The fiscal year can start on any date, but it is typically chosen to coincide with the end of a quarter.

What are the benefits of calculating the fiscal year?

+The benefits of calculating the fiscal year include improved financial management, enhanced financial reporting, simplified tax compliance, better budgeting and forecasting, and increased transparency and accountability.

We hope this article has provided you with a comprehensive understanding of the fiscal year calculation and its importance in financial management. If you have any further questions or would like to share your experiences with calculating the fiscal year, please comment below. Additionally, feel free to share this article with others who may benefit from this information.