Intro

Master Excel fiscal year formulas to streamline financial analysis, including date functions, year-end calculations, and period reporting with 5 essential formulas.

The use of fiscal year formulas in Excel is a common practice among accountants and financial analysts. Fiscal years are periods of 12 months that do not necessarily start on January 1, which can make date-related calculations more complex. Understanding how to create and apply fiscal year formulas in Excel can greatly simplify financial reporting and analysis. In this article, we will delve into the importance of fiscal year calculations, explain how to create fiscal year formulas, and provide examples of their application.

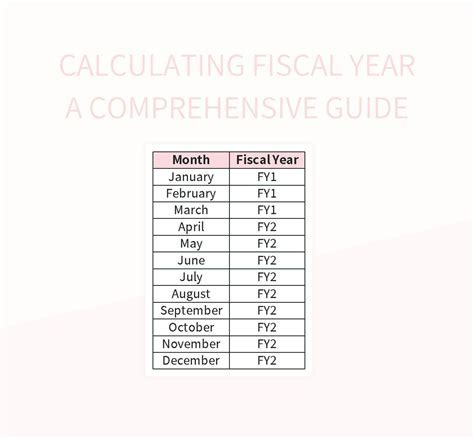

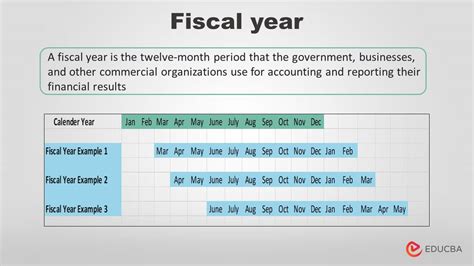

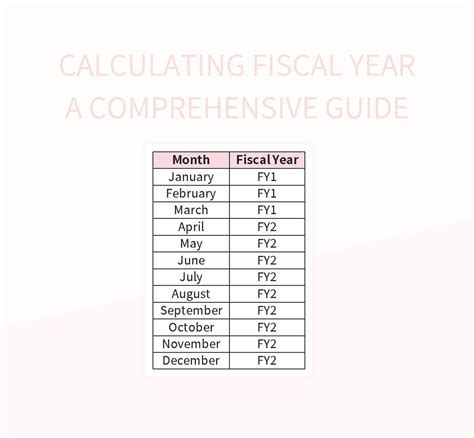

Fiscal years are crucial for businesses because they provide a standardized period for financial reporting and taxation. Unlike the calendar year, which starts on January 1 and ends on December 31, fiscal years can begin on any date, depending on the company's or organization's specific needs. For instance, a fiscal year might start on April 1 and end on March 31 of the following year. This flexibility allows companies to align their financial cycles with their operational cycles, which can vary significantly across different industries.

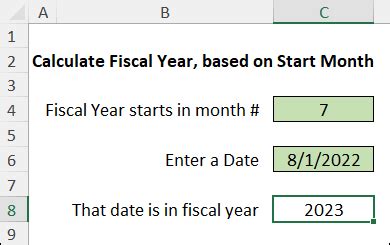

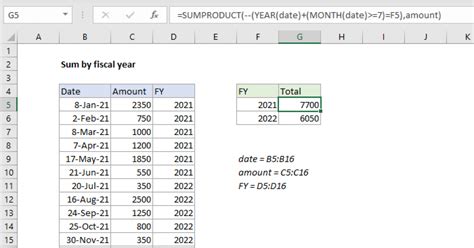

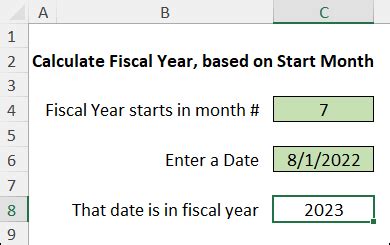

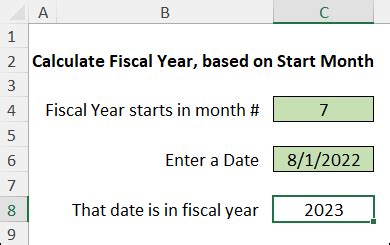

Calculating the fiscal year in Excel involves determining the year based on a given date, considering the start of the fiscal year. This can be achieved using various formulas, including the use of the YEAR, MONTH, and IF functions. For example, if a company's fiscal year starts on July 1, you would need a formula that checks if the month of the given date is July or later. If it is, the fiscal year would be the same as the calendar year; otherwise, it would be the previous calendar year.

Understanding Fiscal Year Calculations

To understand fiscal year calculations, it's essential to grasp how dates are represented in Excel. Dates in Excel are serial numbers that start from January 1, 1900, which is considered day 1. This system allows for easy date arithmetic. When calculating fiscal years, you need to consider the month and sometimes the day of the given date to determine the correct fiscal year.

Basic Fiscal Year Formula

A basic fiscal year formula can be constructed using the `IF` and `MONTH` functions. For a fiscal year starting on July 1, the formula would look something like this: `=IF(MONTH(A1)>=7,YEAR(A1),YEAR(A1)-1)`, where `A1` is the cell containing the date. This formula checks if the month of the date in `A1` is July (7) or later. If true, it returns the year of the date; otherwise, it returns the year minus one.Advanced Fiscal Year Formulas

Advanced fiscal year formulas may involve more complex logic, such as considering the day of the month for dates early in the fiscal year. For example, if the fiscal year starts on July 1 but you want to include dates from June 15 onwards as part of the new fiscal year, you would need a formula that checks both the month and the day.

Formula Considering Day and Month

The formula `=IF(OR(MONTH(A1)>6,AND(MONTH(A1)=6,DAY(A1)>=15)),YEAR(A1),YEAR(A1)-1)` checks if the month is greater than 6 (July onwards) or if the month is 6 (June) and the day is 15 or greater. If either condition is true, it returns the current year; otherwise, it returns the previous year.Practical Applications of Fiscal Year Formulas

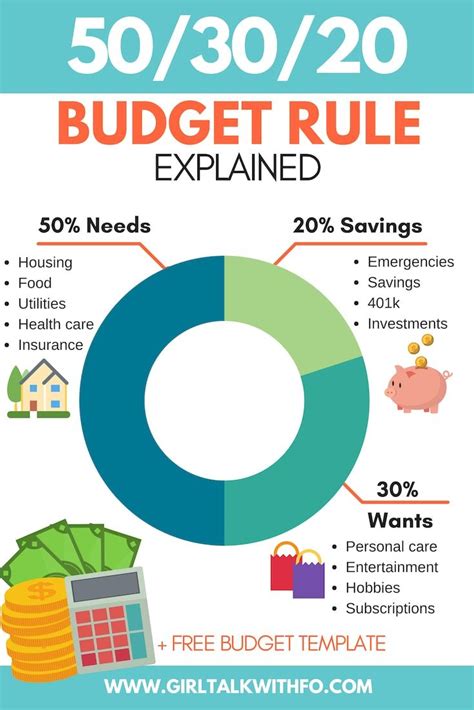

Fiscal year formulas have numerous practical applications in financial analysis and reporting. They can be used to categorize income and expenses, to analyze sales trends over fiscal years, and to prepare financial statements that align with a company's fiscal cycle.

Examples of Fiscal Year Formulas in Use

- **Budgeting:** Fiscal year formulas can help in creating dynamic budget templates that automatically adjust based on the fiscal year of the input dates. - **Financial Reporting:** They are essential for generating reports that compare financial performance across different fiscal years, helping in the identification of trends and areas for improvement. - **Tax Planning:** Understanding the fiscal year is crucial for tax planning, as tax years may not align with calendar years. Fiscal year formulas can assist in organizing financial data for tax purposes.Common Challenges and Solutions

One common challenge when working with fiscal year formulas is ensuring they correctly handle dates around the start of the fiscal year. Another challenge is adapting formulas for different fiscal year start dates. Solutions involve carefully crafting the logic of the formula to account for these scenarios and possibly using auxiliary columns to break down the calculation into more manageable steps.

Tips for Working with Fiscal Year Formulas

- **Test Thoroughly:** Always test your fiscal year formulas with a range of dates to ensure they work as expected. - **Keep it Simple:** While advanced logic can be powerful, simplicity can make formulas easier to understand and maintain. - **Use Auxiliary Columns:** Breaking down complex calculations into simpler steps using auxiliary columns can improve readability and reduce errors.Gallery of Fiscal Year Formulas

Fiscal Year Formulas Image Gallery

Frequently Asked Questions

What is a fiscal year, and why is it important?

+A fiscal year is a 12-month period used for financial reporting and taxation, which may not coincide with the calendar year. It's important because it allows companies to align their financial cycles with their operational cycles, facilitating more accurate financial analysis and planning.

How do I calculate the fiscal year in Excel?

+You can calculate the fiscal year in Excel using formulas that consider the month and sometimes the day of a given date. For example, if the fiscal year starts on July 1, you can use the formula `=IF(MONTH(A1)>=7,YEAR(A1),YEAR(A1)-1)` to determine the fiscal year.

What are some common challenges when working with fiscal year formulas?

+Common challenges include ensuring the formula correctly handles dates around the start of the fiscal year and adapting formulas for different fiscal year start dates. Solutions involve careful formula construction, thorough testing, and sometimes using auxiliary columns to simplify calculations.

In conclusion, mastering fiscal year formulas in Excel is a valuable skill for anyone involved in financial analysis, reporting, or planning. By understanding how to construct and apply these formulas effectively, professionals can streamline their work, improve accuracy, and make more informed decisions. Whether you're working with simple or complex fiscal year scenarios, Excel provides the tools and flexibility to handle your needs. We invite you to share your experiences with fiscal year formulas, ask questions, or explore more topics related to Excel and financial analysis. Your engagement is invaluable in creating a community that learns and grows together.