Intro

Unlock tax savings with the 5 Ways Excel Tax Calculator, featuring income tax calculations, deductions, and credits, making tax planning and filing easier with automated spreadsheet tools and formulas.

The world of taxation can be complex and overwhelming, especially when it comes to calculating taxes owed or refunds due. This is where Excel tax calculators come into play, offering a straightforward and efficient way to manage tax calculations. Excel, being a powerful spreadsheet program, allows users to create customized tax calculators that can simplify the tax preparation process. In this article, we will delve into the importance of tax calculators, their benefits, and provide a comprehensive guide on how to create and utilize an Excel tax calculator.

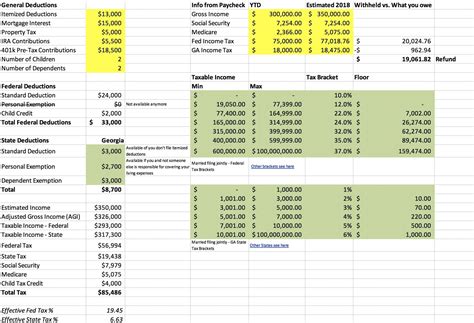

Tax season can be a stressful time for many individuals and businesses. The process of gathering all necessary documents, understanding the latest tax laws, and ensuring accuracy in tax returns can be daunting. However, with the right tools, such as an Excel tax calculator, this process can become significantly less intimidating. An Excel tax calculator is essentially a spreadsheet designed to calculate taxes based on income, deductions, and other relevant factors. It can help in estimating tax liability, planning tax payments, and even in identifying potential savings through various tax deductions and credits.

The importance of accurate tax calculation cannot be overstated. Incorrect tax calculations can lead to overpayment or underpayment of taxes, both of which have their own set of consequences. Overpaying taxes means giving the government more money than necessary, which could have been used for other financial goals or emergencies. On the other hand, underpaying taxes can result in penalties and interest on the amount owed, adding to the overall tax burden. An Excel tax calculator helps mitigate these risks by providing a precise and personalized tax calculation based on the user's financial situation.

Understanding Excel Tax Calculators

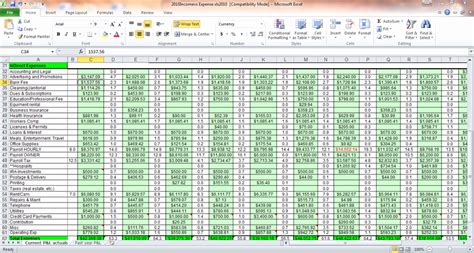

Excel tax calculators are not just limited to individuals; they can also be highly beneficial for businesses. Companies often have complex tax scenarios due to various income streams, deductions, and credits applicable to their specific industry or operations. An Excel tax calculator can be tailored to accommodate these complexities, helping businesses in tax planning and ensuring compliance with tax laws.

Benefits of Using Excel Tax Calculators

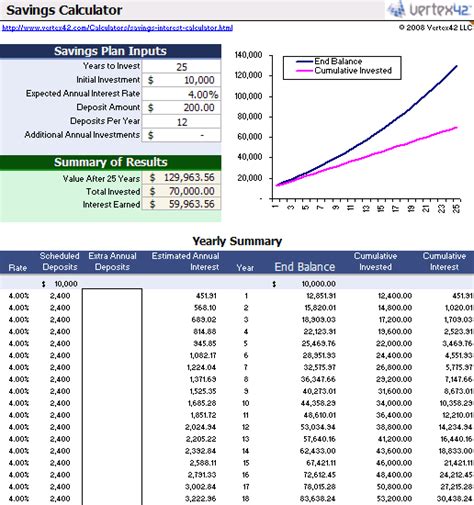

The benefits of using Excel tax calculators are multifaceted. Firstly, they offer a high degree of customization, allowing users to input their specific financial data and calculate taxes based on their unique situation. This customization also extends to the ability to update the calculator with the latest tax rates and laws, ensuring that tax calculations are always current and accurate.Secondly, Excel tax calculators can significantly reduce the time spent on tax preparation. By automating the calculation process, users can quickly estimate their tax liability or potential refund, enabling them to make informed financial decisions well in advance of the tax filing deadline.

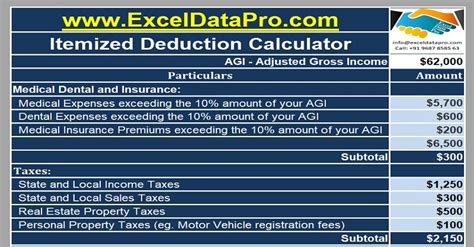

Lastly, using an Excel tax calculator can help in identifying tax-saving opportunities. By inputting different scenarios into the calculator, users can see how various deductions or credits might impact their tax bill, allowing them to optimize their tax strategy.

Creating an Excel Tax Calculator

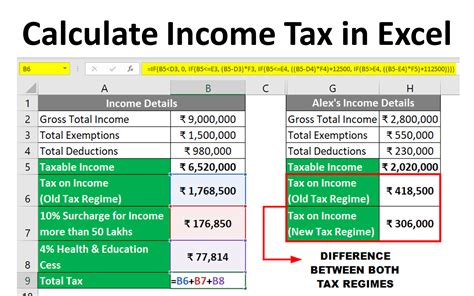

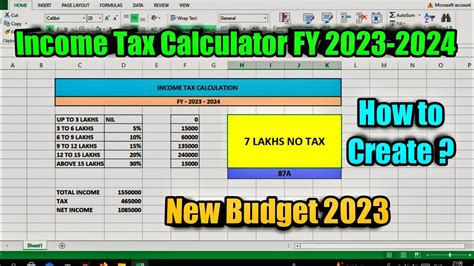

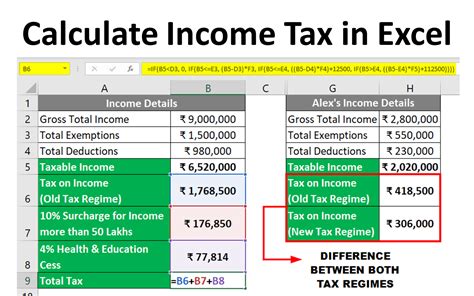

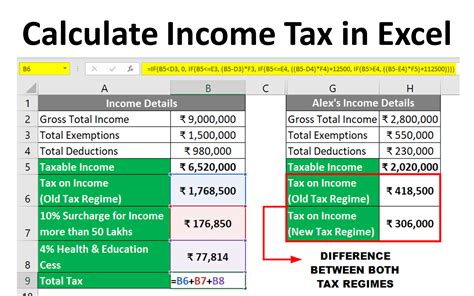

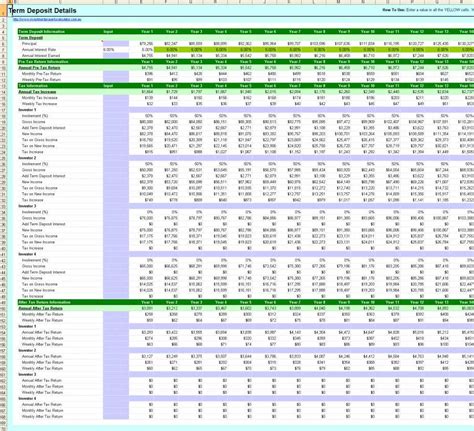

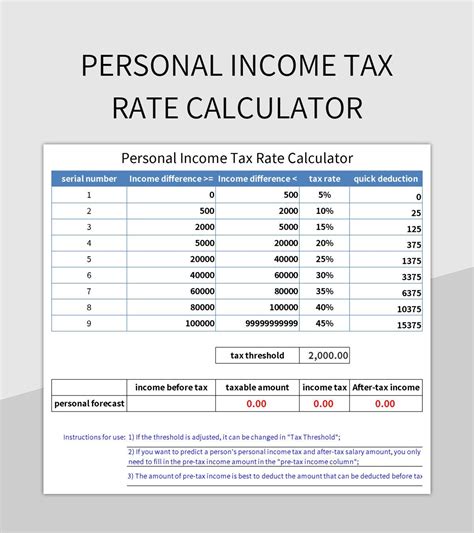

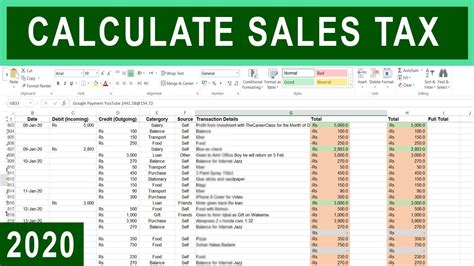

Creating an Excel tax calculator involves several steps, starting with setting up a basic spreadsheet structure. This includes columns for income, deductions, and credits, as well as rows for different tax scenarios or family members, if applicable. The next step is to research and input the current tax rates and brackets, which can usually be found on the official website of the tax authority.

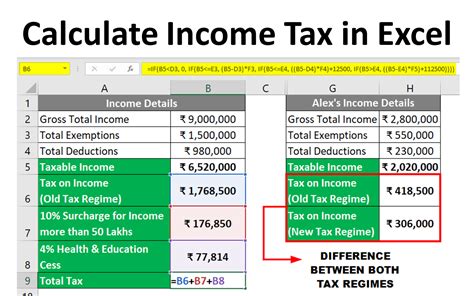

Once the basic structure is in place, formulas can be added to calculate taxable income and tax liability. This might involve using functions like IF statements to apply different tax rates based on income levels or SUM functions to add up total deductions.

Steps to Build an Excel Tax Calculator

Here are the detailed steps to build a basic Excel tax calculator: 1. **Open Excel and Create a New Spreadsheet**: Start by opening Excel and creating a new spreadsheet. Give your spreadsheet a descriptive name, such as "Tax Calculator." 2. **Set Up the Spreadsheet Structure**: Create columns for gross income, deductions, credits, and tax liability. You may also want to include columns for state or local taxes if applicable. 3. **Input Tax Rates and Brackets**: Research the current federal and state tax rates and brackets. You can find this information on the IRS website or your state's tax authority website. 4. **Create Formulas for Tax Calculations**: Use Excel formulas to calculate taxable income and tax liability. For example, you might use the formula `=A1-B1` to calculate taxable income, where A1 is gross income and B1 is total deductions. 5. **Add Conditional Formatting**: Use conditional formatting to highlight cells that exceed certain tax brackets or to indicate potential tax savings from deductions or credits.Using Your Excel Tax Calculator

Using your Excel tax calculator is straightforward. Simply input your financial data into the designated cells, and the calculator will automatically compute your tax liability or potential refund. You can experiment with different scenarios by changing income levels, deductions, or credits to see how these factors impact your tax situation.

Practical Examples

For example, let's say you want to calculate the tax impact of a potential salary increase. You could input the higher salary into the income column and see how it affects your tax liability. Similarly, if you're considering purchasing a home and want to know how the mortgage interest deduction might reduce your taxes, you could input the estimated interest payments into the deductions column.Advanced Features of Excel Tax Calculators

While a basic Excel tax calculator can be very useful, there are ways to make it even more powerful. One advanced feature is the use of macros, which are small programs that can automate repetitive tasks within Excel. For instance, a macro could be used to update tax rates automatically when the spreadsheet is opened, ensuring that calculations are always based on the most current tax laws.

Another advanced feature is the integration of external data sources. This could involve linking your tax calculator to other financial spreadsheets, such as a budget or investment tracker, to create a comprehensive financial management system.

SEO Optimization for Tax Calculators

When creating content related to Excel tax calculators, SEO optimization is crucial for visibility. This involves using relevant keywords, such as "Excel tax calculator," "tax calculation spreadsheet," and "personalized tax planning," throughout the content. It's also important to use long-tail keywords that are more specific and less competitive, such as "Excel tax calculator for small businesses" or "personal tax calculator spreadsheet."Excel Tax Calculator Image Gallery

Frequently Asked Questions

What is an Excel Tax Calculator?

+An Excel tax calculator is a spreadsheet designed to calculate taxes based on income, deductions, and other relevant factors.

How Do I Create an Excel Tax Calculator?

+To create an Excel tax calculator, start by setting up a basic spreadsheet structure, inputting current tax rates and brackets, and then creating formulas to calculate taxable income and tax liability.

What Are the Benefits of Using an Excel Tax Calculator?

+The benefits include customization, time savings, and the ability to identify tax-saving opportunities. It also helps in accurate tax calculation, reducing the risk of overpayment or underpayment of taxes.

In conclusion, Excel tax calculators are invaluable tools for anyone looking to simplify their tax preparation process. By understanding how to create and use these calculators, individuals and businesses can better manage their tax obligations, identify potential savings, and make informed financial decisions. Whether you're dealing with personal taxes or complex business tax scenarios, an Excel tax calculator can provide the clarity and precision needed to navigate the often-complex world of taxation. We invite you to share your experiences with Excel tax calculators, ask questions, or provide tips on how to maximize their benefits in the comments below.