Intro

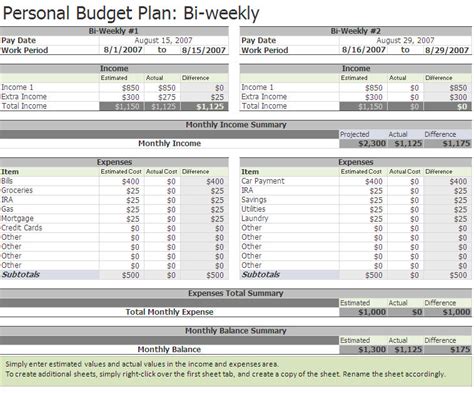

Streamline finances with a Biweekly Budget Excel Template, featuring budgeting tools, expense tracking, and financial planning to manage income and expenses efficiently.

Creating a budget is an essential step in managing personal finances effectively. It helps in tracking income and expenses, making informed financial decisions, and achieving long-term financial goals. Among the various budgeting tools available, Excel templates are highly popular due to their flexibility, ease of use, and the ability to customize according to individual needs. A biweekly budget Excel template is particularly useful for individuals who receive their income on a biweekly basis, allowing them to plan their finances more accurately.

The importance of budgeting cannot be overstated. It provides a clear picture of where money is being spent, helping identify areas where costs can be cut back. Budgeting also enables individuals to prioritize their spending, ensuring that essential expenses are covered before discretionary spending. For those who receive biweekly paychecks, a biweekly budget template can help manage the fluctuating cash flow between pay periods, reducing the risk of overspending or running out of money before the next paycheck arrives.

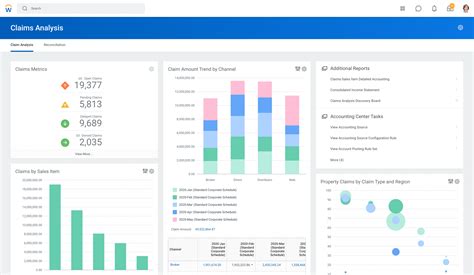

In today's digital age, utilizing a biweekly budget Excel template offers numerous benefits. It automates calculations, reducing the chance of human error and saving time. These templates can be easily customized to fit individual financial situations, including variable income, fixed expenses, savings goals, and debt repayment plans. Moreover, Excel's built-in functions and formulas enable users to forecast future financial scenarios, making it easier to plan for large purchases, emergencies, or long-term investments.

Benefits of Using a Biweekly Budget Excel Template

The benefits of using a biweekly budget Excel template are multifaceted. Firstly, it helps in organizing financial data in a structured and easily accessible manner. This organization facilitates the identification of spending patterns and areas for improvement. Secondly, by budgeting biweekly, individuals can better manage their cash flow, ensuring that bills are paid on time and savings goals are met. The template also serves as a tool for setting and achieving financial goals, whether it be paying off debt, building an emergency fund, or saving for a major purchase.

Furthermore, a biweekly budget Excel template encourages financial discipline. By regularly tracking income and expenses, individuals are more likely to stick to their financial plans, avoiding unnecessary purchases and staying focused on their financial objectives. The flexibility of Excel templates allows for adjustments as financial situations change, making them a valuable tool for long-term financial management.

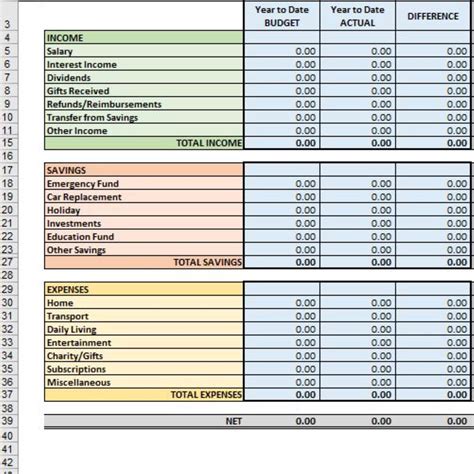

Key Components of a Biweekly Budget Excel Template

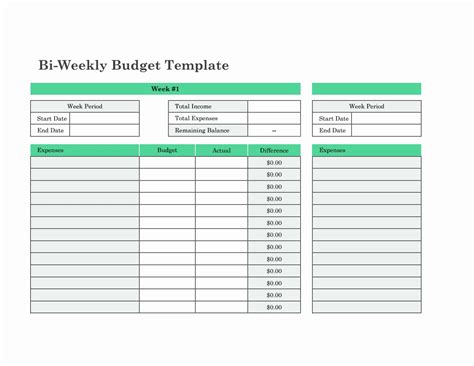

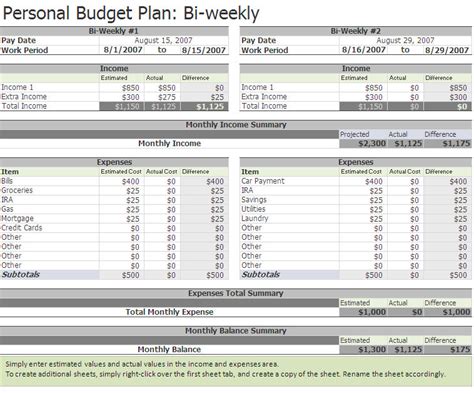

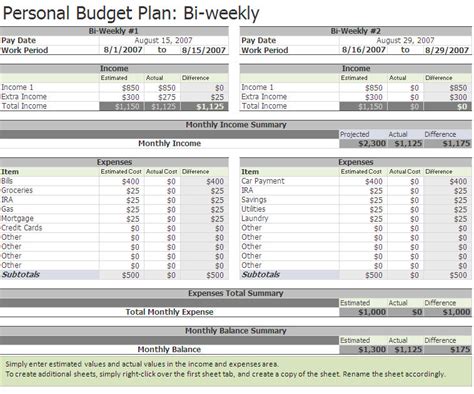

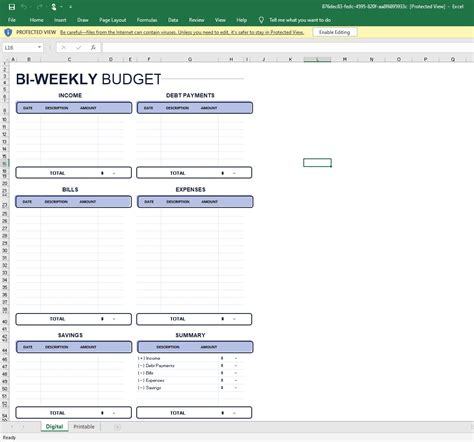

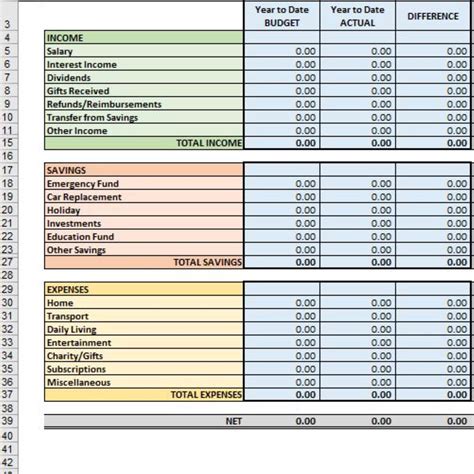

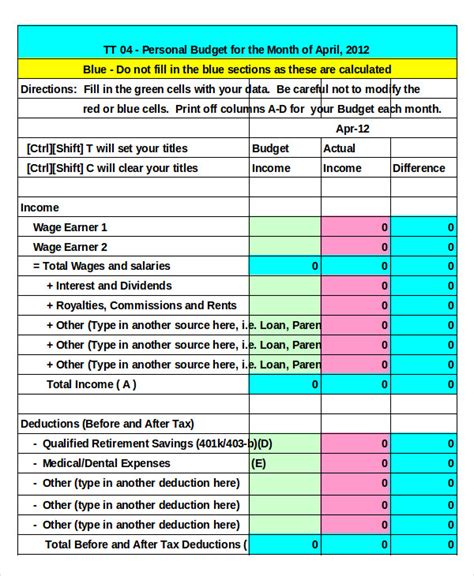

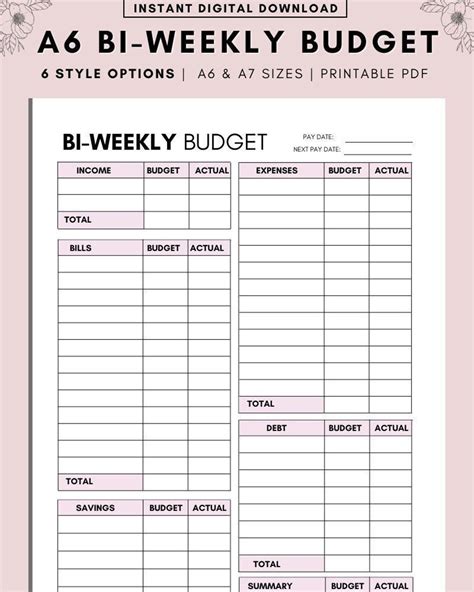

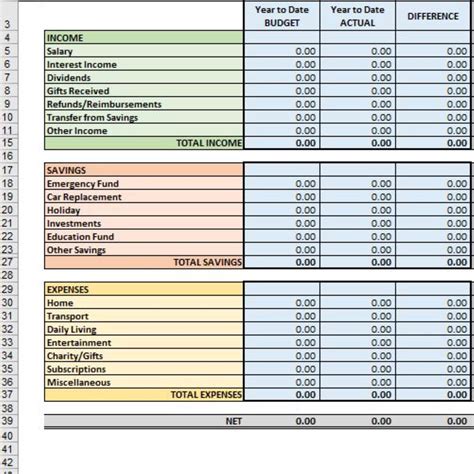

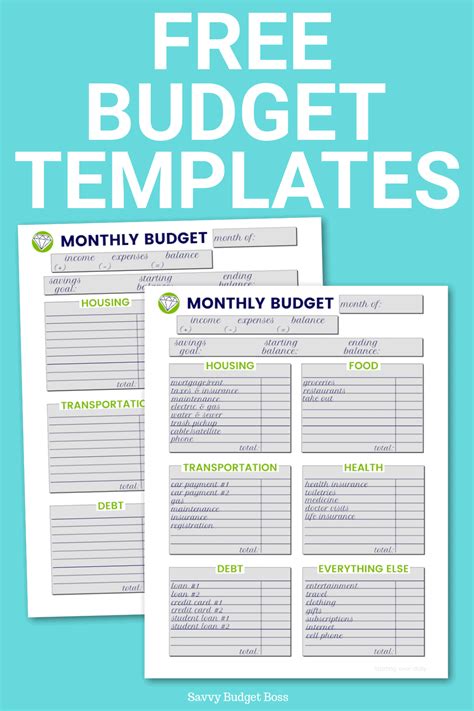

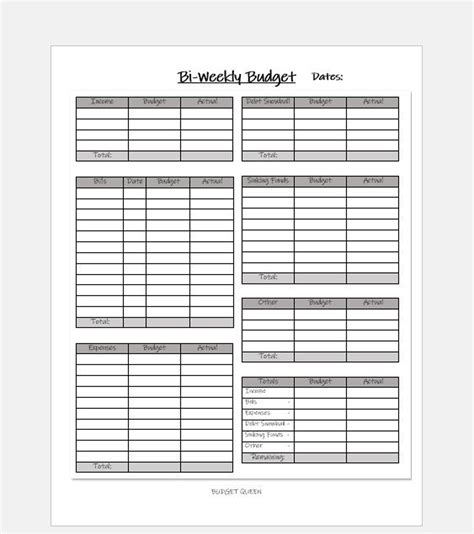

A well-structured biweekly budget Excel template should include several key components to ensure it is effective in managing finances. These components include: - Income Section: A detailed breakdown of all income sources, including the biweekly paycheck, any side hustles, or investments. - Fixed Expenses Section: A list of regular, non-discretionary expenses such as rent/mortgage, utilities, car payments, and insurance. - Variable Expenses Section: A category for expenses that can vary from one biweekly period to another, such as groceries, entertainment, and travel. - Savings and Debt Repayment Section: A part of the template dedicated to tracking savings contributions and debt repayment progress. - Budget Summary Section: A summary page that provides an overview of the budget, highlighting income, total expenses, and the balance.How to Create a Biweekly Budget Excel Template

Creating a biweekly budget Excel template from scratch can seem daunting, but it is a straightforward process. The first step is to open a new Excel workbook and set up separate sheets for income, expenses, savings, and a summary. Within these sheets, create tables with relevant headers such as date, category, and amount. Utilize Excel formulas to automate calculations, such as summing expenses or calculating the balance.

For those who are not comfortable creating a template from scratch, there are numerous free and paid biweekly budget Excel templates available online. These templates can be downloaded and customized to fit individual financial situations. When selecting a pre-made template, consider factors such as ease of use, customization options, and whether it includes all the necessary categories for tracking income and expenses.

Customizing Your Biweekly Budget Excel Template

Customization is key to making a biweekly budget Excel template effective. Start by inputting your income and fixed expenses. Then, allocate funds to variable expense categories based on historical spending patterns or desired reductions. Ensure to prioritize needs over wants and make adjustments as necessary to achieve a balanced budget.Regularly reviewing and updating the template is crucial. As income or expenses change, the budget should be adjusted accordingly. This might involve increasing savings contributions, paying off debt more aggressively, or finding ways to reduce expenses. The template should also be used to track progress towards financial goals, making adjustments to the budget as goals are achieved or priorities change.

Using Your Biweekly Budget Excel Template Effectively

To use a biweekly budget Excel template effectively, it's essential to establish a routine. Set a specific day each biweekly period to review income, track expenses, and update the template. This routine helps in staying on top of finances and making timely adjustments to the budget.

Additionally, consider implementing the 50/30/20 rule as a guideline for allocating income. Fifty percent of income should go towards necessary expenses like rent and utilities, thirty percent towards discretionary spending, and twenty percent towards saving and debt repayment. This rule provides a balanced approach to budgeting, ensuring that essential expenses are covered while also prioritizing savings and debt reduction.

Tips for Sticking to Your Biweekly Budget

Sticking to a biweekly budget requires discipline and flexibility. Here are a few tips to help: - **Automate Savings and Bill Payments**: Set up automatic transfers for savings and bill payments to ensure consistency. - **Regularly Review and Adjust**: Life is unpredictable, and financial situations can change rapidly. Regular reviews help in making necessary adjustments to the budget. - **Avoid Impulse Purchases**: Take time to think before making non-essential purchases, ensuring they align with financial goals. - **Use the Envelope System**: For variable expenses like entertainment or groceries, consider using the envelope system where cash is allocated for each category, helping to stick to budgeted amounts.Common Challenges and Solutions

Despite the benefits of using a biweekly budget Excel template, individuals may face several challenges. One common issue is overspending in certain categories, which can throw off the entire budget. To address this, identify areas of overspending and implement stricter budgeting in those categories. This might involve reducing allocations for discretionary spending or finding cheaper alternatives for necessities.

Another challenge is irregular income or unexpected expenses. For those with variable income, consider budgeting based on the lowest expected income level to ensure essential expenses are always covered. For unexpected expenses, maintain an emergency fund that can be used to cover unforeseen costs without disrupting the budget.

Overcoming Budgeting Obstacles

Overcoming budgeting obstacles requires patience, persistence, and sometimes, seeking professional advice. Financial advisors can provide personalized guidance on managing debt, investing, and creating a long-term financial plan. Additionally, online resources and budgeting communities can offer support, tips, and motivation to stay on track.For individuals struggling with debt, consider the snowball method or avalanche method for debt repayment. The snowball method involves paying off debts with the smallest balances first, providing a psychological boost as each debt is eliminated. The avalanche method, on the other hand, focuses on paying off debts with the highest interest rates first, which can save more money in interest over time.

Conclusion and Next Steps

In conclusion, a biweekly budget Excel template is a powerful tool for managing finances, especially for individuals who receive biweekly paychecks. By understanding the benefits, key components, and how to create and customize such a template, individuals can take significant steps towards achieving financial stability and security. Remember, budgeting is a process, and it may take time to find the right balance. Be patient, stay committed, and continuously look for ways to improve your financial management skills.

As you embark on your budgeting journey, consider exploring additional financial tools and resources. Learning about investing, retirement planning, and tax optimization can further enhance your financial knowledge and help in making informed decisions about your money. Whether you're looking to pay off debt, build wealth, or simply manage your day-to-day finances more effectively, a biweekly budget Excel template can be your first step towards a more secure financial future.

Final Thoughts on Biweekly Budgeting

Final thoughts on biweekly budgeting emphasize the importance of flexibility and continuous learning. Financial situations are constantly evolving, and what works today may not work tomorrow. Stay open to new budgeting strategies, tools, and techniques. Engage with financial communities, read personal finance blogs, and consider consulting with a financial advisor to ensure you're always moving towards your financial goals.Biweekly Budget Excel Template Image Gallery

What is a biweekly budget Excel template?

+A biweekly budget Excel template is a tool used for managing finances on a biweekly basis, helping individuals track income and expenses, and make informed financial decisions.

How do I create a biweekly budget Excel template?

+To create a biweekly budget Excel template, start by setting up separate sheets for income, expenses, and savings. Use tables and formulas to automate calculations and make the template user-friendly.

What are the benefits of using a biweekly budget Excel template?

+The benefits include better management of cash flow, reduced risk of overspending, and a clearer picture of financial health. It also helps in achieving financial goals such as saving, debt repayment, and investing.

We hope this comprehensive guide to biweekly budget Excel templates has been informative and helpful. Whether you're a financial novice or an experienced budgeter, these templates can be a valuable tool in your financial management arsenal. Remember, the key to successful budgeting is consistency, patience, and a willingness to learn and adapt. Share your experiences with biweekly budgeting, ask questions, or provide tips in the comments below to help others on their financial journey.