Intro

Understanding how to calculate and manage loan payments is crucial for both individuals and businesses. One type of loan payment plan that can be beneficial in certain situations is the interest-only amortization schedule. This type of schedule allows borrowers to pay only the interest on their loan for a specified period, which can help reduce monthly payments. However, it's essential to understand how this type of schedule works and how to manage it effectively, especially when using tools like Excel to track and plan loan payments.

The importance of managing loan payments cannot be overstated. For many people, loans are a necessary part of achieving significant financial goals, such as buying a home or starting a business. However, mismanaging loan payments can lead to financial difficulties, including accumulating debt and damaging credit scores. Therefore, having a clear understanding of loan payment structures, including interest-only amortization schedules, is vital for making informed financial decisions.

In the context of loan management, Excel is a powerful tool that can help individuals and businesses track and analyze their loan payments. Excel's capabilities extend far beyond basic calculations, allowing users to create complex models and schedules that can predict future payments and total interest paid over the life of a loan. For those dealing with interest-only loans, Excel can be particularly useful in creating an amortization schedule that outlines each payment, including the amount of interest paid and the remaining balance.

Understanding Interest-Only Amortization Schedules

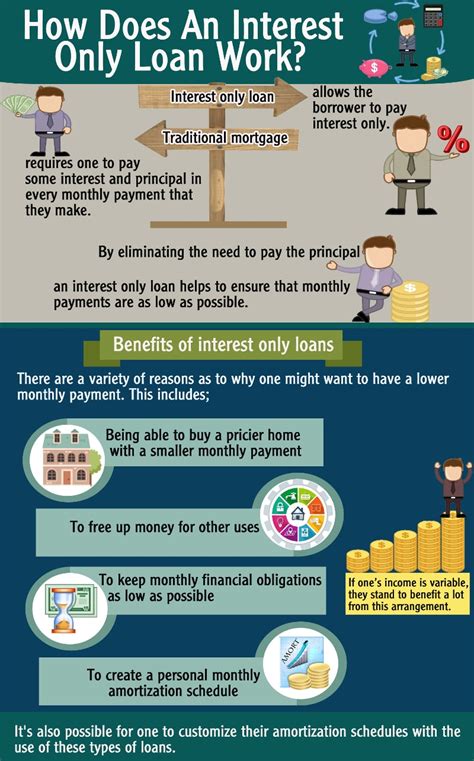

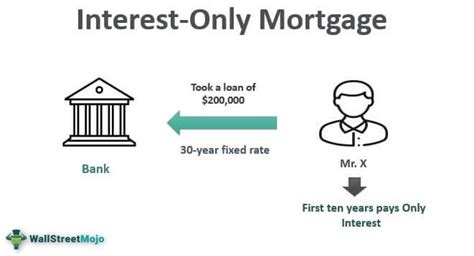

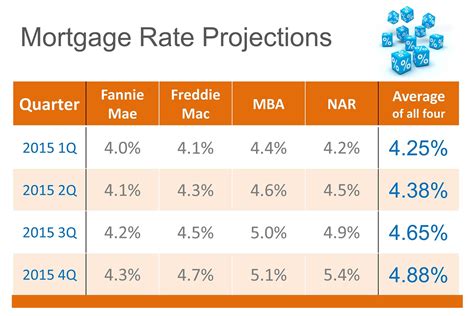

Interest-only amortization schedules are designed to allow borrowers to make payments that cover only the interest due on their loan for a specified period. This can be beneficial in the short term, as it reduces the monthly payment amount. However, it's crucial to understand that during the interest-only period, the principal amount of the loan does not decrease. After the interest-only period ends, the loan payments will increase to cover both the interest and the principal, ensuring the loan is fully repaid by the end of its term.

Benefits of Interest-Only Loans

The primary benefit of an interest-only loan is the lower monthly payment during the initial period. This can be attractive for borrowers who expect their income to increase in the future or for those who plan to sell the property before the interest-only period ends. Additionally, interest-only loans can be beneficial for investment properties, where the borrower plans to rent out the property and use the rental income to cover the loan payments.However, it's essential to consider the potential downsides of interest-only loans. Since the borrower is not paying down the principal during the interest-only period, they are not building any equity in the property. Furthermore, when the interest-only period ends, the borrower may face a significant increase in monthly payments, which can be challenging to manage.

Creating an Interest-Only Amortization Schedule in Excel

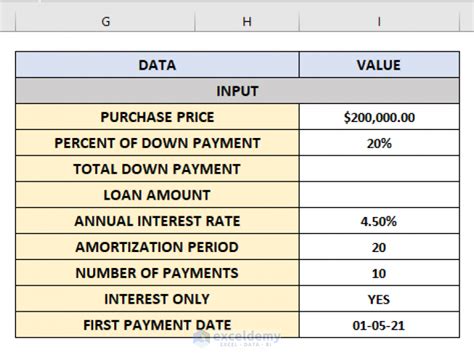

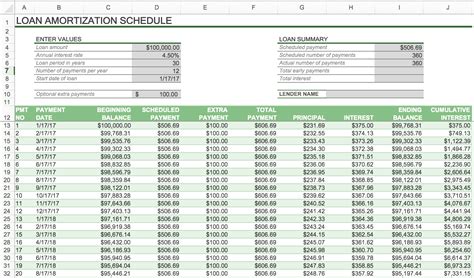

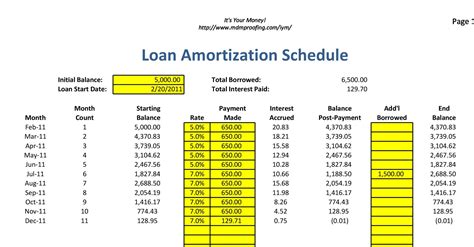

Creating an interest-only amortization schedule in Excel involves several steps. First, you need to have the loan details, including the loan amount, interest rate, loan term, and the length of the interest-only period. You can then use Excel formulas to calculate the monthly interest payment during the interest-only period and the monthly payment after this period.

- Set Up the Loan Details: Start by setting up a table with the loan details. This includes the loan amount, annual interest rate, loan term in years, and the interest-only period in years.

- Calculate the Monthly Interest Rate: The annual interest rate needs to be converted into a monthly interest rate. This is done by dividing the annual interest rate by 12.

- Calculate the Monthly Payment During the Interest-Only Period: The monthly payment during the interest-only period is simply the monthly interest rate multiplied by the loan amount.

- Calculate the Monthly Payment After the Interest-Only Period: After the interest-only period, the borrower must pay both interest and principal. The formula for the monthly payment (M) is M = P[r(1+r)^n]/[(1+r)^n – 1], where P is the principal loan amount, r is the monthly interest rate, and n is the number of payments.

Using Excel Formulas for Calculations

Excel provides a range of formulas that can be used to calculate loan payments and create amortization schedules. The PMT function, for example, can be used to calculate the monthly payment. The formula is PMT(rate, nper, pv, [fv], [type]), where rate is the monthly interest rate, nper is the total number of payments, pv is the present value (the initial amount of the loan), fv is the future value (the amount left after the loan is paid off, which is usually 0), and type is whether the payment is made at the beginning or the end of the period.Managing Interest-Only Loans Effectively

Managing an interest-only loan requires careful planning and financial discipline. Borrowers need to understand the terms of their loan, including the length of the interest-only period and how much their payments will increase after this period ends. It's also crucial to review the loan agreement to understand any prepayment penalties or other conditions that might affect the loan.

- Regularly Review Financial Situation: Borrowers should regularly review their financial situation to ensure they can afford the increased payments after the interest-only period.

- Consider Prepayments: If possible, making prepayments during the interest-only period can help reduce the principal amount, thereby reducing the monthly payments after the interest-only period ends.

- Explore Refinancing Options: If borrowers find that they cannot afford the increased payments, they may need to explore refinancing options, such as extending the loan term or switching to a different type of loan.

Common Mistakes to Avoid

One of the most common mistakes borrowers make with interest-only loans is not fully understanding the terms of the loan. This can lead to unexpected increases in monthly payments, which can be challenging to manage. Another mistake is not planning for the end of the interest-only period, which can result in financial strain.Conclusion and Future Planning

In conclusion, interest-only amortization schedules can be a useful tool for managing loan payments, especially for those who expect their financial situation to improve in the future. However, it's crucial to understand the terms of the loan and to plan carefully for the end of the interest-only period. By using tools like Excel to create and manage amortization schedules, borrowers can make informed decisions about their loan payments and ensure they are on a stable financial footing.

For future planning, borrowers should consider their long-term financial goals and how their loan payments fit into these goals. This may involve creating a comprehensive financial plan that includes strategies for managing debt, saving for the future, and building wealth.

Interest-Only Loan Image Gallery

What is an interest-only amortization schedule?

+An interest-only amortization schedule is a payment plan that allows borrowers to pay only the interest on their loan for a specified period, after which they must pay both interest and principal.

How do I create an interest-only amortization schedule in Excel?

+To create an interest-only amortization schedule in Excel, you need to set up a table with the loan details, calculate the monthly interest rate, and then use Excel formulas to calculate the monthly payments during and after the interest-only period.

What are the benefits and drawbacks of interest-only loans?

+The primary benefit of an interest-only loan is the lower monthly payment during the initial period. However, the drawbacks include not building equity during the interest-only period and facing a significant increase in monthly payments afterward.

How can I manage my interest-only loan effectively?

+To manage an interest-only loan effectively, regularly review your financial situation, consider making prepayments, and explore refinancing options if necessary. It's also crucial to understand the terms of your loan and plan for the end of the interest-only period.

What are common mistakes to avoid with interest-only loans?

+Common mistakes include not fully understanding the terms of the loan, not planning for the end of the interest-only period, and not considering the potential for increased payments.

We hope this comprehensive guide to interest-only amortization schedules has been informative and helpful. Whether you're a borrower looking to manage your loan payments more effectively or a financial advisor seeking to provide the best guidance to your clients, understanding how interest-only loans work and how to create and manage amortization schedules is crucial. If you have any further questions or would like to share your experiences with interest-only loans, please feel free to comment below. Your insights and feedback are invaluable in helping us provide the most accurate and useful information possible.