Intro

The payback formula is a crucial tool in finance and business, used to calculate the time it takes for an investment to generate returns equal to its initial cost. In Excel, this formula can be implemented in various ways, making it easier to analyze and decide on investments. Understanding the payback period is essential for investors, businesses, and individuals looking to assess the viability and potential of different investment opportunities.

The importance of the payback formula lies in its simplicity and the valuable insights it provides. By calculating the payback period, one can determine how long it will take for an investment to break even, which is vital for cash flow management and investment appraisal. This period is a key factor in deciding whether an investment is worthwhile, as shorter payback periods generally indicate a lower risk and a more attractive investment.

In the context of financial analysis, the payback formula is one of the primary metrics used, alongside other methods like the net present value (NPV) and internal rate of return (IRR). While NPV and IRR provide more detailed insights into an investment's profitability, the payback period offers a straightforward measure of an investment's liquidity and risk. It's particularly useful for comparing different investment projects and for making decisions in environments where cash flow is a significant concern.

Understanding the Payback Formula

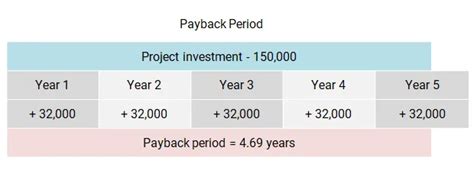

The payback formula is essentially the initial investment divided by the annual cash inflows. However, in Excel, we can use a more dynamic approach to calculate the payback period, especially when dealing with investments that have varying annual returns. The formula can be simplified as follows: Payback Period = Initial Investment / Annual Cash Inflow. For more complex scenarios, Excel's built-in functions like the XNPV (Extended Net Present Value) or creating a custom formula can be more appropriate.

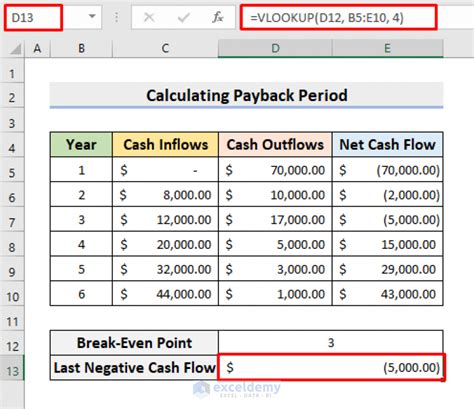

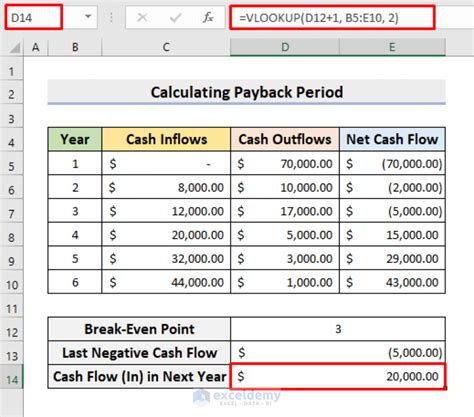

Calculating Payback Period in Excel

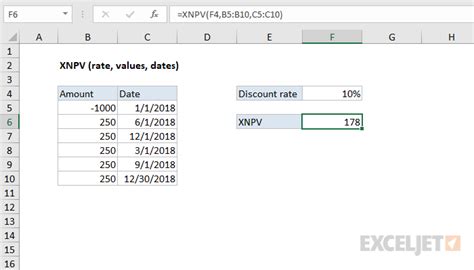

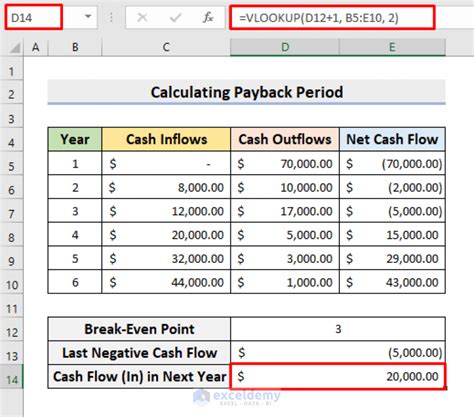

To calculate the payback period in Excel, you can follow these steps: 1. List all the initial and subsequent investments in one column. 2. List the corresponding cash inflows in another column. 3. Use the formula for the payback period, adjusting it according to your data layout. 4. For more precise calculations, especially with irregular cash flows, consider using the XNPV function.Using the XNPV Function

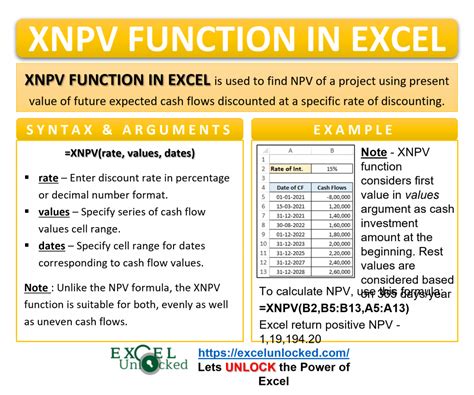

The XNPV function in Excel is highly versatile and can handle cash flows that occur at irregular intervals, making it particularly useful for calculating the payback period of investments with non-uniform returns. The syntax for the XNPV function is XNPV(rate, cash flows, dates), where:

- Rate is the discount rate.

- Cash flows are the series of cash flows.

- Dates are the dates corresponding to the cash flows.

Steps to Apply the XNPV Function

1. Prepare your data: Ensure you have the cash flows and their corresponding dates. 2. Determine the discount rate: This could be the cost of capital or an expected rate of return. 3. Apply the XNPV formula: Insert the function into a cell, inputting the discount rate, range of cash flows, and range of dates. 4. Interpret the result: The XNPV function returns the present value of the cash flows. To find the payback period, you may need to iterate or use a custom formula to find when the cumulative cash flow equals the initial investment.Implementing a Custom Payback Formula

For scenarios where the cash flows are uniform and occur at regular intervals (e.g., annually), a custom formula can be devised using basic arithmetic operations in Excel. This involves calculating the cumulative cash flows over time until the sum equals or exceeds the initial investment.

Creating a Custom Formula

1. Set up a table with years and corresponding cash inflows. 2. Calculate the cumulative cash flow for each year. 3. Use an IF function or a similar logical function to identify the year when the cumulative cash flow first exceeds the initial investment.Benefits and Limitations of the Payback Formula

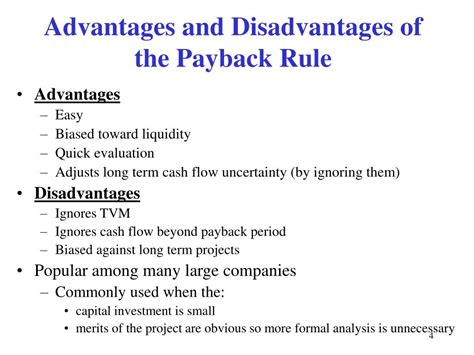

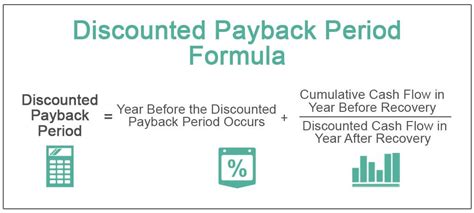

The payback formula, whether used in its basic form or through more advanced functions like XNPV in Excel, offers several benefits, including simplicity, ease of understanding, and the ability to quickly compare different investment opportunities based on their liquidity and risk. However, it also has limitations, such as not considering the time value of money (unless adjusted with a discount rate) and not accounting for cash flows beyond the payback period.

Key Considerations

- **Time Value of Money:** The basic payback formula does not account for the time value of money. Using a discounted payback period can provide a more accurate picture. - **Risk Assessment:** The payback period can serve as a rudimentary measure of risk, with shorter payback periods generally indicating lower risk. - **Comparison of Investments:** It's useful for comparing investments but may not provide a complete picture of an investment's potential.Practical Applications and Examples

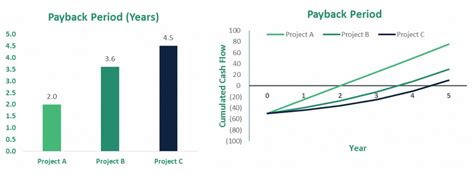

In real-world scenarios, the payback formula is applied in various contexts, from evaluating the viability of business expansion plans to assessing the potential return on investment for personal financial decisions. For instance, a company considering two different projects can use the payback period to decide which project to pursue based on which one is expected to break even sooner.

Case Study

Consider an investor who has two investment options: - Option A: An initial investment of $100,000 with expected annual returns of $20,000. - Option B: An initial investment of $50,000 with expected annual returns of $15,000. Using the payback formula, the investor can calculate the payback period for each option and decide based on the results.Gallery of Payback Period Examples

Payback Period Image Gallery

Frequently Asked Questions

What is the payback formula used for?

+The payback formula is used to calculate the time it takes for an investment to generate returns equal to its initial cost, essentially determining how long it will take for an investment to break even.

How does the XNPV function work in Excel?

+The XNPV function in Excel calculates the present value of a series of cash flows that occur at irregular intervals, using a specified discount rate. It's particularly useful for investments with non-uniform returns.

What are the limitations of the payback formula?

+The payback formula does not account for the time value of money and does not consider cash flows beyond the payback period, which can lead to an incomplete picture of an investment's potential.

How can the payback period be used for comparing investments?

+The payback period can be used to compare different investment opportunities based on their liquidity and risk, with shorter payback periods generally indicating lower risk and higher attractiveness.

Can the payback formula be applied to personal financial decisions?

+Yes, the payback formula can be applied to personal financial decisions, such as evaluating the potential return on investment for a personal project or comparing different investment options for personal finance.

In conclusion, the payback formula is a valuable tool for financial analysis, offering insights into the viability and potential of investments. By understanding how to calculate and apply the payback period, whether through basic formulas or advanced Excel functions like XNPV, individuals and businesses can make more informed decisions about their investments. As with any financial metric, it's essential to consider both the benefits and limitations of the payback formula, using it in conjunction with other analysis methods for a comprehensive view of investment potential. We invite you to share your thoughts on the payback formula and its applications in the comments below, and to explore further how this and other financial tools can aid in making smart investment choices.