Intro

Calculate fiscal years easily with Excels fiscal year formula, using date functions, financial modeling, and accounting techniques to simplify budgeting and forecasting.

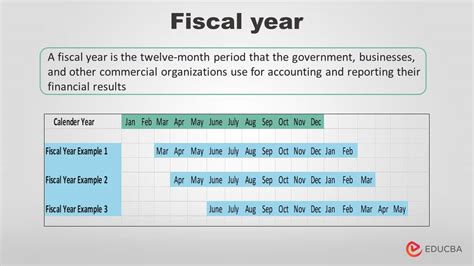

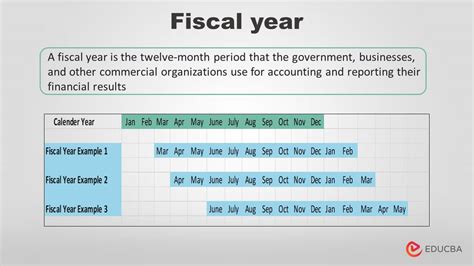

The fiscal year formula in Excel is a crucial tool for businesses and organizations that operate on a fiscal calendar different from the standard calendar year. Understanding and implementing this formula can help in financial planning, budgeting, and reporting. The fiscal year, often abbreviated as FY, is a period used for accounting and financial purposes that may not align with the traditional January to December calendar year. For instance, a company's fiscal year might run from April 1 to March 31 of the following year.

To calculate the fiscal year in Excel, you can use various formulas, depending on the specific start date of your fiscal year. One common approach is to use the YEAR and MONTH functions in combination with an IF statement. This method allows you to determine the fiscal year based on the month of a given date. For example, if your fiscal year starts in April, any date from April to December would belong to the current fiscal year, while dates from January to March would belong to the next fiscal year.

The importance of accurately calculating the fiscal year cannot be overstated. It affects financial statements, tax filings, and strategic planning. Misaligned fiscal years can lead to confusion and errors in financial analysis and forecasting. Therefore, having a reliable and efficient way to determine the fiscal year for any given date is essential for financial professionals and business managers.

In the following sections, we will delve into the specifics of creating and using fiscal year formulas in Excel, including examples and explanations to help you understand and apply these concepts effectively.

Understanding Fiscal Year Calculations

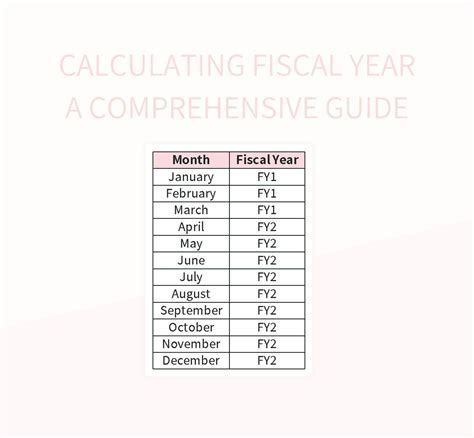

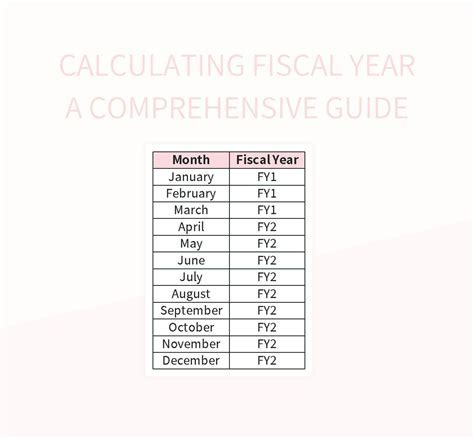

Calculating the fiscal year involves determining whether a given date falls within the current fiscal year or the next one, based on the fiscal year start month. For a fiscal year starting in April, dates from April 1 to December 31 are considered part of the current fiscal year, while dates from January 1 to March 31 belong to the next fiscal year.

To perform this calculation in Excel, you can use a formula that checks the month of the date and adjusts the year accordingly. For instance, if the date's month is 1, 2, or 3, you would add 1 to the year to get the fiscal year; otherwise, the fiscal year remains the same as the calendar year.

Basic Fiscal Year Formula

The basic formula to calculate the fiscal year, assuming the fiscal year starts in April, can be written as follows:

=IF(MONTH(A1)<4,YEAR(A1)+1,YEAR(A1))

In this formula, A1 is the cell containing the date for which you want to calculate the fiscal year. The MONTH function extracts the month from the date, and the IF statement checks if the month is less than 4 (January to March). If true, it adds 1 to the year (obtained using the YEAR function); otherwise, it returns the year as is.

Applying the Formula for Different Fiscal Year Start Dates

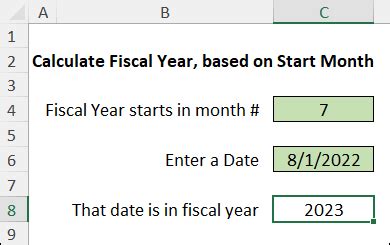

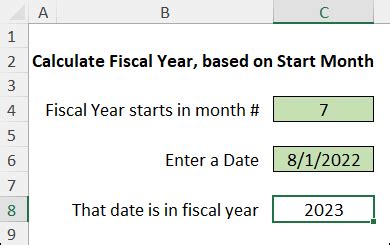

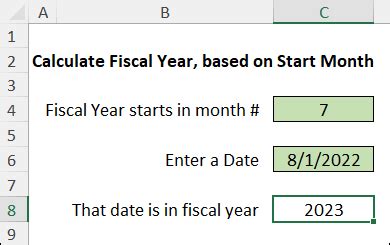

If your fiscal year starts on a month other than April, you'll need to adjust the formula accordingly. For example, if your fiscal year starts in July, you would consider dates from July to December as part of the current fiscal year, and dates from January to June as part of the next fiscal year. The formula would then be:

=IF(MONTH(A1)<7,YEAR(A1)+1,YEAR(A1))

This flexibility in the formula allows it to be adapted to various fiscal year start dates, making it a versatile tool for financial calculations.

Using the Fiscal Year Formula in Financial Planning

The fiscal year formula is not only useful for determining the fiscal year of a given date but also plays a crucial role in financial planning and budgeting. By accurately identifying the fiscal year, businesses can align their financial activities, such as budget allocations, expense tracking, and revenue projections, with their fiscal calendar.

This alignment is essential for creating realistic financial forecasts and for making informed decisions about investments, hiring, and resource allocation. Moreover, the formula can be integrated into larger financial models and spreadsheets, automating the process of fiscal year determination and reducing the risk of manual errors.

Benefits of Automated Fiscal Year Calculations

Automating the calculation of the fiscal year offers several benefits, including:

- Accuracy: Reduces the chance of human error in determining the fiscal year.

- Efficiency: Saves time by automatically calculating the fiscal year for any given date.

- Consistency: Ensures that all financial records and reports are aligned with the correct fiscal year.

- Flexibility: Can be easily adapted to different fiscal year start dates.

By incorporating the fiscal year formula into their financial management systems, organizations can streamline their financial operations, improve the accuracy of their financial analysis, and make more effective strategic decisions.

Advanced Fiscal Year Calculations and Applications

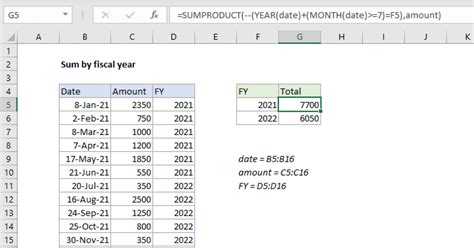

Beyond the basic application of determining the fiscal year for a given date, the fiscal year formula can be used in more advanced financial calculations and applications. For instance, it can be integrated into formulas for calculating fiscal year-to-date (FYTD) totals, which are essential for tracking financial performance over the fiscal year.

Additionally, the formula can be combined with other Excel functions, such as SUMIFS and AVERAGEIFS, to analyze financial data based on the fiscal year. This allows for detailed financial analysis and reporting that is aligned with the organization's fiscal calendar.

Examples of Advanced Fiscal Year Calculations

- Fiscal Year-to-Date (FYTD) Sales: Calculate the total sales from the start of the fiscal year to the current date.

- Fiscal Year Budget Variance: Compare actual expenses to budgeted amounts for the fiscal year to identify variances.

- Fiscal Year Average Revenue: Calculate the average revenue per month for the fiscal year to date.

These advanced calculations enable organizations to have a deeper understanding of their financial performance and make data-driven decisions to drive growth and profitability.

Gallery of Fiscal Year Calculations and Applications

Fiscal Year Image Gallery

Frequently Asked Questions About Fiscal Year Calculations

What is the fiscal year, and why is it important?

+The fiscal year is a period used for accounting and financial purposes that may not align with the traditional calendar year. It's crucial for financial planning, budgeting, and reporting, as it affects how businesses and organizations manage their finances and make strategic decisions.

How do I calculate the fiscal year in Excel?

+You can calculate the fiscal year in Excel using the formula =IF(MONTH(A1)<4,YEAR(A1)+1,YEAR(A1)), where A1 is the cell containing the date. This formula assumes the fiscal year starts in April; you can adjust it based on your fiscal year start date.

Can I use the fiscal year formula for advanced financial calculations?

+Yes, the fiscal year formula can be used in advanced financial calculations, such as calculating fiscal year-to-date totals, budget variances, and average revenues. It can be combined with other Excel functions to analyze financial data based on the fiscal year.

In conclusion, mastering the fiscal year formula in Excel is a valuable skill for anyone involved in financial management and planning. By understanding how to calculate the fiscal year and apply it in various financial contexts, professionals can enhance their financial analysis, budgeting, and strategic decision-making capabilities. Whether you're working with basic fiscal year calculations or advanced financial models, the ability to accurately determine the fiscal year is fundamental to effective financial management. We invite you to share your experiences and tips on using the fiscal year formula in Excel, and to explore how this tool can contribute to your financial planning and analysis efforts.