Intro

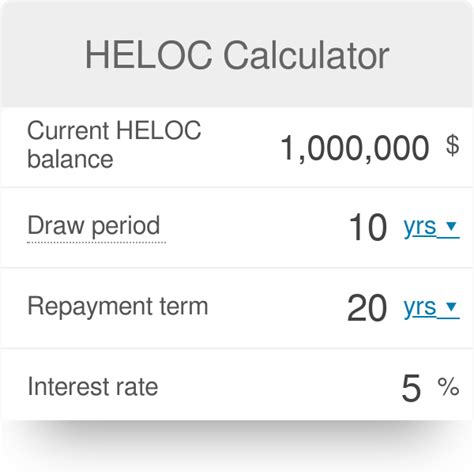

Home equity lines of credit (HELOCs) can be a great way to tap into the value of your home to finance large expenses or consolidate debt. However, managing your HELOC payments can be complex, especially if you want to make extra payments to pay off the principal balance faster. A HELOC payment calculator Excel spreadsheet can be a useful tool to help you understand your payment schedule and make informed decisions about your payments.

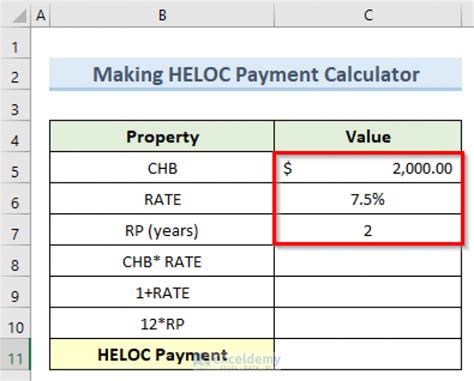

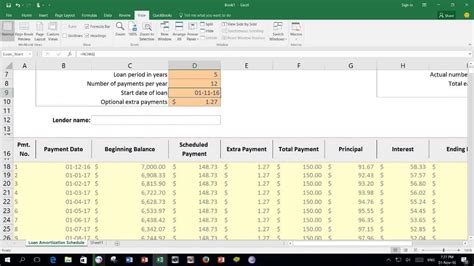

To create a HELOC payment calculator in Excel, you will need to know the following information: the initial loan amount, the interest rate, the loan term, and the minimum monthly payment. You can then use formulas to calculate the total interest paid over the life of the loan, the total amount paid, and the payoff period. With this information, you can experiment with different payment scenarios, including making extra payments, to see how they affect your loan.

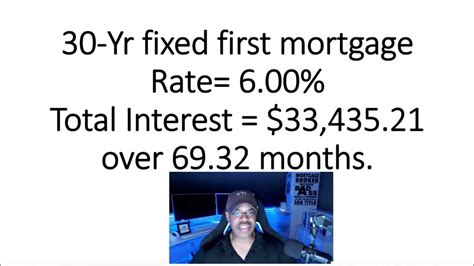

Making extra payments on your HELOC can have a significant impact on the total interest paid and the payoff period. By paying more than the minimum monthly payment, you can reduce the principal balance faster, which in turn reduces the amount of interest you owe. This can save you thousands of dollars in interest over the life of the loan and help you pay off the loan faster.

For example, let's say you have a $50,000 HELOC with an interest rate of 6% and a 10-year loan term. The minimum monthly payment is $555. If you make the minimum payment, you will pay a total of $66,551 over the life of the loan, including $16,551 in interest. However, if you make an extra payment of $200 per month, you will pay a total of $58,419, including $8,419 in interest. By making the extra payment, you will save $8,132 in interest and pay off the loan 2 years faster.

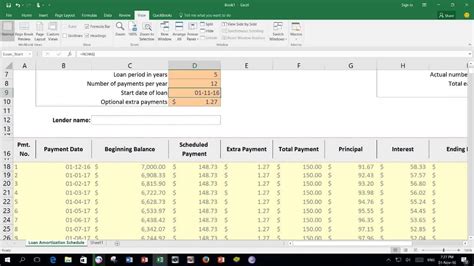

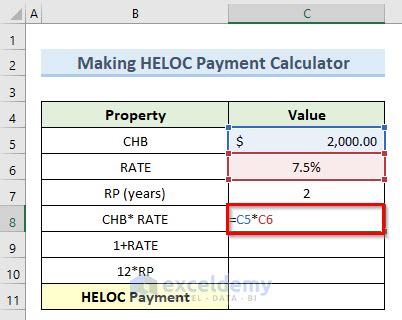

How to Create a HELOC Payment Calculator in Excel

To create a HELOC payment calculator in Excel, follow these steps:

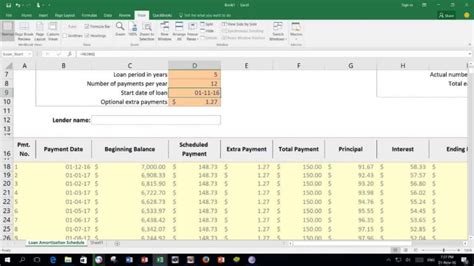

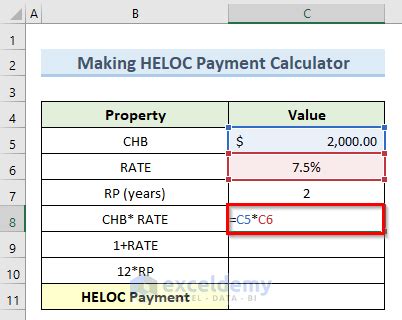

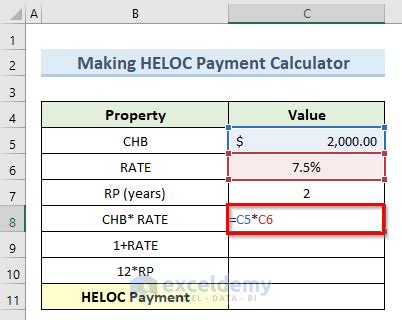

- Open a new Excel spreadsheet and create a table with the following columns: Loan Amount, Interest Rate, Loan Term, Minimum Monthly Payment, and Extra Payment.

- Enter the initial loan amount, interest rate, and loan term in the corresponding cells.

- Calculate the minimum monthly payment using the formula:

=PMT(Interest Rate, Loan Term, Loan Amount). - Calculate the total interest paid and the total amount paid using the formulas:

=IPMT(Interest Rate, Loan Term, Loan Amount)and=PMT(Interest Rate, Loan Term, Loan Amount) * Loan Term, respectively. - Create a section for extra payments, where you can enter the amount of the extra payment and the frequency of the payments (e.g., monthly, quarterly).

- Use formulas to calculate the new payoff period and the total interest paid with the extra payments.

Benefits of Using a HELOC Payment Calculator

Using a HELOC payment calculator can help you in several ways:

- It helps you understand your payment schedule and make informed decisions about your payments.

- It allows you to experiment with different payment scenarios, including making extra payments, to see how they affect your loan.

- It helps you save money on interest by identifying the most effective way to pay off your loan.

- It gives you a clear picture of the total interest paid and the payoff period, which can help you plan your finances better.

How to Make Extra Payments on Your HELOC

To make extra payments on your HELOC, follow these steps:

- Review your loan agreement to see if there are any prepayment penalties or restrictions on making extra payments.

- Determine how much you can afford to pay extra each month.

- Decide on the frequency of your extra payments (e.g., monthly, quarterly).

- Set up automatic payments to ensure that you make your extra payments on time.

- Monitor your loan balance and adjust your extra payments as needed to stay on track with your payoff plan.

Tips for Paying Off Your HELOC Faster

Here are some tips for paying off your HELOC faster:

- Make extra payments regularly to reduce the principal balance faster.

- Consider making bi-weekly payments instead of monthly payments to pay off the loan faster.

- Use any extra funds, such as tax refunds or bonuses, to make lump sum payments on your HELOC.

- Avoid using your HELOC for non-essential purchases, as this can increase your loan balance and make it harder to pay off the loan.

- Consider refinancing your HELOC to a lower interest rate or a shorter loan term to save money on interest and pay off the loan faster.

Common Mistakes to Avoid When Using a HELOC

Here are some common mistakes to avoid when using a HELOC:

- Using your HELOC for non-essential purchases, such as vacations or entertainment.

- Not making regular payments, which can lead to late fees and negative credit reporting.

- Not paying attention to the interest rate and fees associated with your HELOC, which can increase your loan balance over time.

- Not having a plan to pay off the loan, which can lead to a longer payoff period and more interest paid over time.

- Not reviewing your loan agreement carefully, which can lead to unexpected fees or penalties.

Conclusion and Next Steps

In conclusion, a HELOC payment calculator Excel spreadsheet can be a valuable tool for managing your HELOC payments and making informed decisions about your loan. By using this calculator and following the tips outlined in this article, you can pay off your HELOC faster and save money on interest. Remember to avoid common mistakes, such as using your HELOC for non-essential purchases or not making regular payments, and to review your loan agreement carefully to understand the terms and conditions of your loan.

HELOC Payment Calculator Image Gallery

What is a HELOC payment calculator?

+A HELOC payment calculator is a tool that helps you calculate your HELOC payments and understand your payment schedule.

How do I create a HELOC payment calculator in Excel?

+To create a HELOC payment calculator in Excel, you need to know the initial loan amount, interest rate, loan term, and minimum monthly payment. You can then use formulas to calculate the total interest paid and the payoff period.

What are the benefits of using a HELOC payment calculator?

+The benefits of using a HELOC payment calculator include understanding your payment schedule, making informed decisions about your payments, and saving money on interest by identifying the most effective way to pay off your loan.

We hope this article has been helpful in understanding how to create a HELOC payment calculator in Excel and how to use it to manage your HELOC payments. If you have any further questions or comments, please don't hesitate to reach out. Share this article with your friends and family who may be interested in learning more about HELOC payment calculators.