Intro

Calculating daily compound interest is a crucial task for individuals and businesses to understand the growth of their investments or debts over time. Excel, being a powerful spreadsheet software, provides an efficient way to perform these calculations. In this article, we will delve into the world of compound interest, its importance, and how to calculate it on a daily basis using Excel.

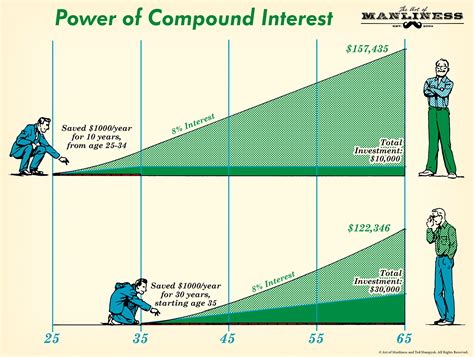

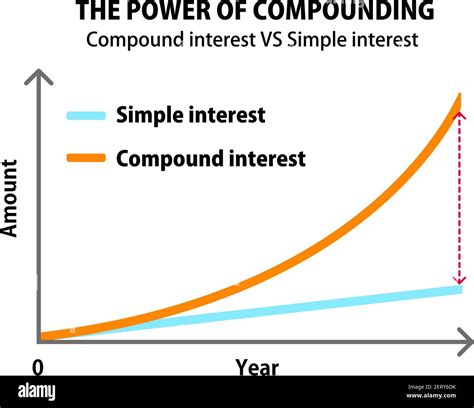

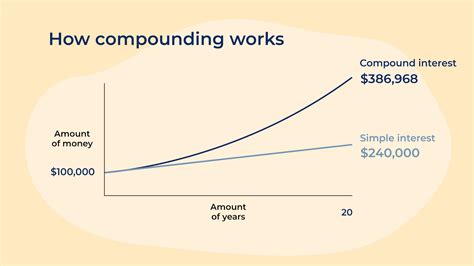

The concept of compound interest is not new, but its application and implications are vast and complex. Compound interest is the interest calculated on the initial principal, which also includes all the accumulated interest from previous periods. This results in a snowball effect, where the interest earned in one period becomes the base for the interest calculated in the subsequent period. Understanding how to calculate compound interest is essential for making informed decisions about investments, loans, and savings.

Compound interest can significantly impact both personal finance and business operations. For investors, it can mean the difference between a modest return and a substantial profit. For borrowers, it can result in paying back much more than the initial loan amount. Therefore, calculating daily compound interest is vital for planning and managing financial resources effectively. With Excel, this task becomes straightforward, allowing users to input various scenarios and see the outcomes instantly.

Understanding Compound Interest Formula

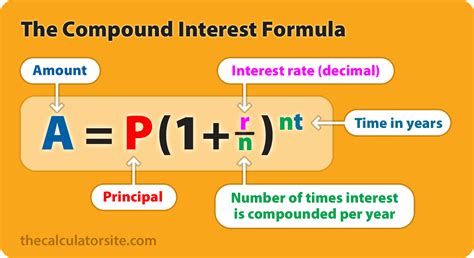

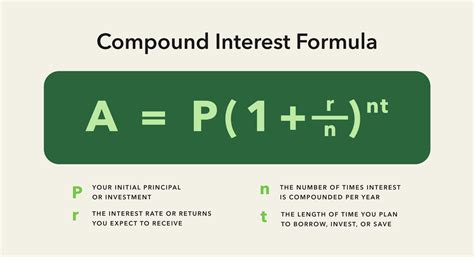

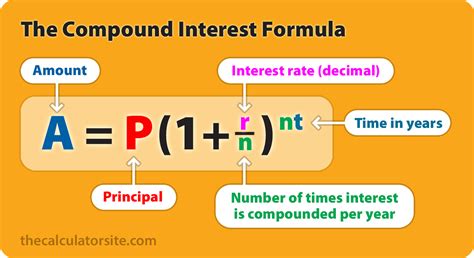

Before diving into the Excel calculations, it's essential to understand the compound interest formula. The formula for compound interest is A = P(1 + r/n)^(nt), where:

- A is the amount of money accumulated after n years, including interest.

- P is the principal amount (the initial amount of money).

- r is the annual interest rate (decimal).

- n is the number of times that interest is compounded per year.

- t is the time the money is invested for in years.

Calculating Daily Compound Interest in Excel

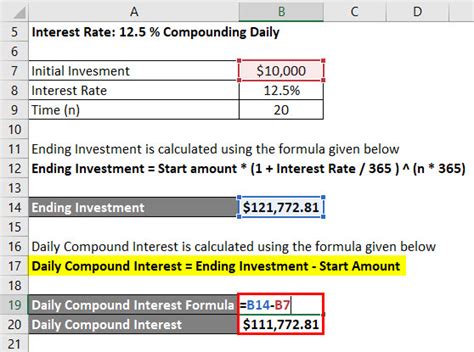

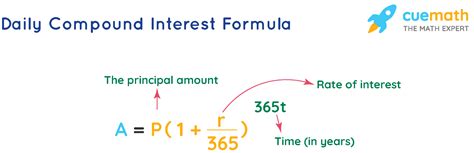

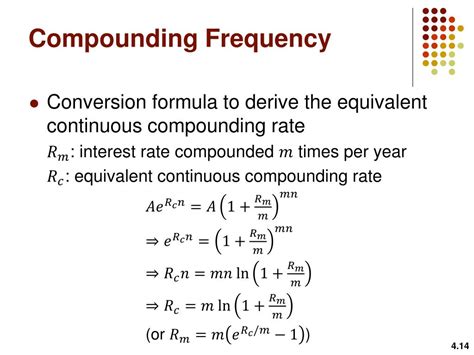

To calculate daily compound interest in Excel, you can use the formula mentioned above, adjusting the values of n and r accordingly. Since you're compounding daily, n would be 365 (for non-leap years) or 366 (for leap years), and r would be the annual interest rate divided by 365 or 366 to get the daily rate.

Here's a step-by-step guide to calculating daily compound interest in Excel:

- Open Excel and create a new spreadsheet.

- Input the principal amount (P) in one cell.

- Input the annual interest rate (r) as a decimal in another cell. For example, 5% would be 0.05.

- Determine the number of times interest is compounded per year (n). For daily compounding, this would be 365.

- Input the time period (t) in years.

- Use the compound interest formula in a new cell: =P*(1 + r/n)^(n*t).

- Press Enter to see the calculated amount.

Example Calculation

For example, if you want to calculate the amount after 5 years with a principal of $10,000, an annual interest rate of 5%, compounded daily:

- P = $10,000

- r = 0.05

- n = 365

- t = 5

The formula would be: =$10,000*(1 + 0.05/365)^(365*5).

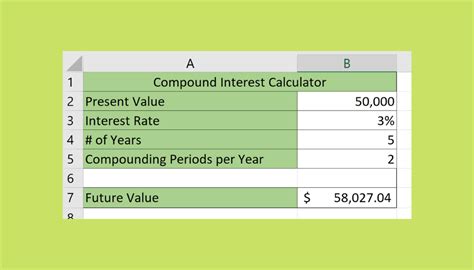

Using Excel Functions for Compound Interest

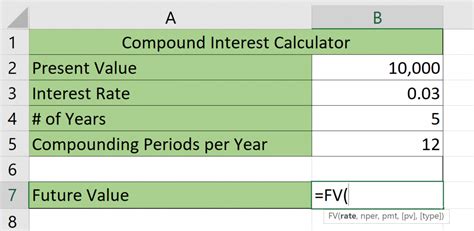

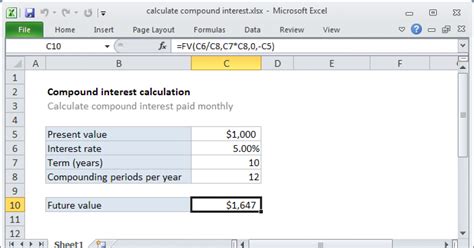

Excel also provides built-in functions that can simplify the calculation of compound interest, such as the FV (Future Value) function. The FV function calculates the future value of an investment based on a series of regular payments and a fixed interest rate.

The syntax for the FV function is FV(rate, nper, pmt, [pv], [type]), where:

- rate is the interest rate per period.

- nper is the total number of payment periods.

- pmt is the payment made each period. If there are no periodic payments, this can be 0.

- [pv] is the present value or principal. If omitted, it is assumed to be 0.

- [type] is when payments are due: 0 for end of period, 1 for beginning of period.

Practical Applications

Calculating daily compound interest has numerous practical applications:

- Investment Planning: Understanding how daily compounding can affect your investments helps in making informed decisions about where and how to invest your money.

- Loan Management: For borrowers, knowing the daily compound interest can help in planning repayments and understanding the total cost of the loan.

- Savings Strategies: It can also guide individuals in choosing the best savings accounts or strategies that maximize their returns through daily compounding.

Challenges and Considerations

While calculating daily compound interest in Excel is straightforward, there are challenges and considerations to keep in mind:

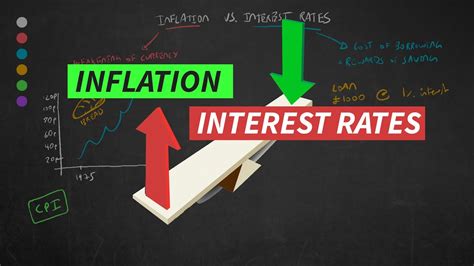

- Interest Rate Fluctuations: Changes in interest rates can significantly impact the calculations.

- Compounding Frequencies: Different compounding frequencies (daily, monthly, annually) can lead to different outcomes.

- Fees and Charges: Some accounts or investments may have fees or charges that affect the net interest earned.

Tips for Effective Use of Excel

To get the most out of Excel for calculating daily compound interest:

- Use Absolute References: When copying formulas, use absolute references (with $ signs) for cells that should not change.

- Format Cells as Percentages: Interest rates and results can be more easily understood when formatted as percentages.

- Sensitivity Analysis: Use Excel's What-If Analysis tools to see how changes in interest rates or other factors affect your results.

Gallery of Compound Interest Calculations

Compound Interest Image Gallery

Frequently Asked Questions

What is compound interest?

+Compound interest is the interest calculated on the initial principal, which also includes all the accumulated interest from previous periods.

How do I calculate daily compound interest in Excel?

+Use the formula A = P(1 + r/n)^(nt), adjusting n and r for daily compounding, or use Excel's built-in FV function.

What are the practical applications of calculating daily compound interest?

+It has applications in investment planning, loan management, and savings strategies, helping individuals make informed financial decisions.

In conclusion, calculating daily compound interest is a vital skill for anyone looking to understand the growth of their investments or the cost of their loans. With Excel, this task is made easier through the use of formulas and functions. By understanding the principles of compound interest and how to apply them in Excel, individuals can make more informed decisions about their financial resources. Whether you're an investor, a borrower, or simply looking to save, mastering the calculation of daily compound interest can significantly impact your financial future. We invite you to share your experiences, ask questions, or provide tips on how you use Excel for calculating compound interest in the comments below.