Intro

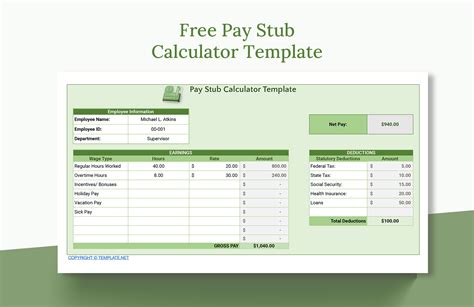

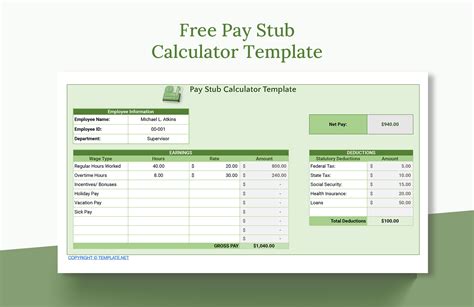

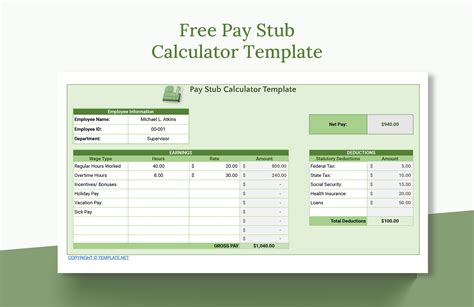

Calculate pay stubs easily with our Excel pay stub calculator template, featuring automatic payroll deductions, tax calculations, and salary breakdowns for accurate employee compensation and benefits tracking.

Pay stubs are essential documents that provide employees with a detailed breakdown of their wages, deductions, and taxes. They are typically issued by employers to their employees, either physically or digitally, and serve as proof of income and employment. With the rise of digital technologies, creating pay stubs has become more efficient and accessible. One popular tool used for this purpose is the pay stub calculator Excel template. This article will delve into the world of pay stub calculators, focusing on the Excel version, and explore its benefits, features, and how it can be used to simplify payroll processing.

The importance of accurate and timely pay stubs cannot be overstated. They not only help employees keep track of their financial records but also play a crucial role in tax compliance and benefits administration. Employers who fail to provide accurate pay stubs may face penalties and fines, emphasizing the need for a reliable and efficient pay stub generation system. This is where the pay stub calculator Excel template comes into play, offering a user-friendly and customizable solution for payroll processing.

In today's fast-paced business environment, streamlining payroll operations is crucial for maintaining efficiency and reducing costs. The pay stub calculator Excel template is designed to simplify the payroll process, enabling employers to quickly and accurately generate pay stubs for their employees. With its intuitive interface and automated calculations, this template eliminates the need for manual calculations, reducing the risk of errors and saving time. Whether you are a small business owner or a payroll professional, the pay stub calculator Excel template is an indispensable tool for managing payroll operations.

Introduction to Pay Stub Calculator Excel

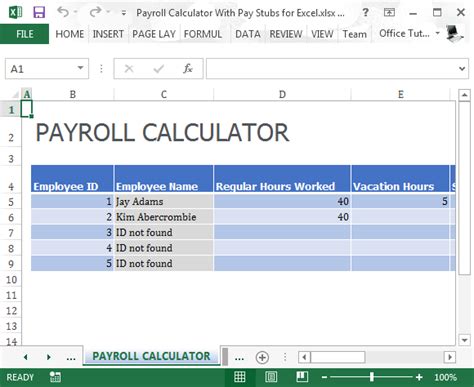

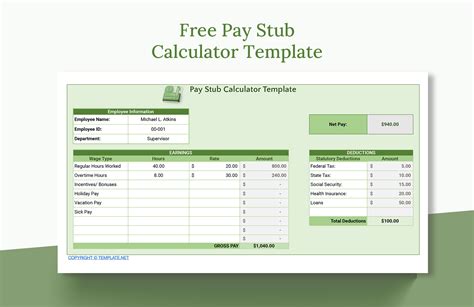

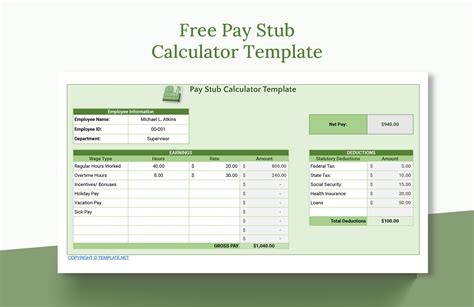

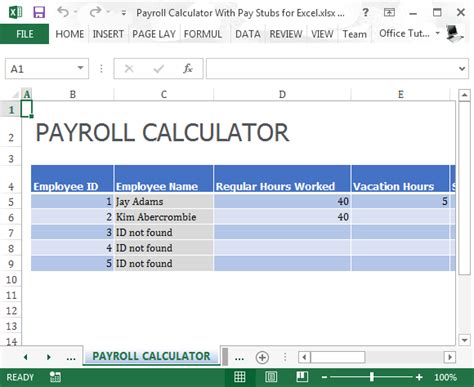

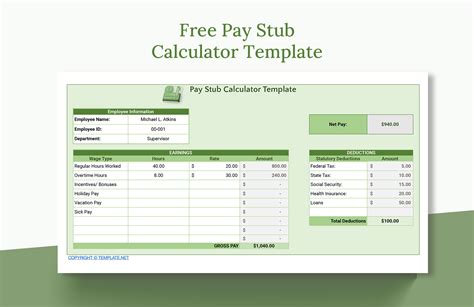

The pay stub calculator Excel template is a pre-designed spreadsheet that allows users to input employee data, wages, and deductions to generate accurate pay stubs. This template is fully customizable, enabling users to tailor it to their specific needs and requirements. With its built-in formulas and calculations, the pay stub calculator Excel template automates the payroll process, ensuring accuracy and efficiency. Whether you need to calculate gross pay, net pay, or deductions, this template has got you covered.

Benefits of Using Pay Stub Calculator Excel

The pay stub calculator Excel template offers numerous benefits, including: * Accuracy: Automated calculations reduce the risk of errors, ensuring accurate pay stubs. * Efficiency: Quick and easy generation of pay stubs saves time and streamlines payroll operations. * Customizability: Fully customizable template allows users to tailor it to their specific needs. * Cost-effectiveness: Eliminates the need for manual calculations and reduces the risk of errors, saving costs.How to Use Pay Stub Calculator Excel

Using the pay stub calculator Excel template is straightforward. Simply follow these steps:

- Download and install the template on your computer.

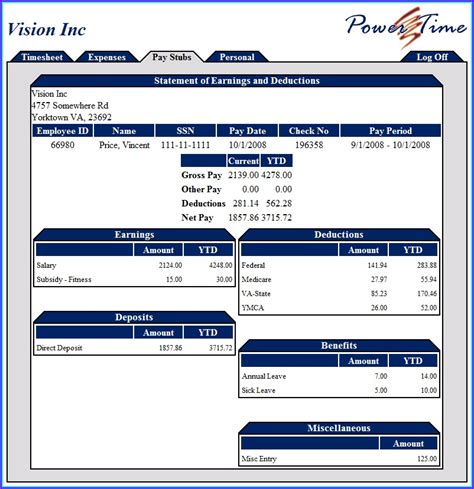

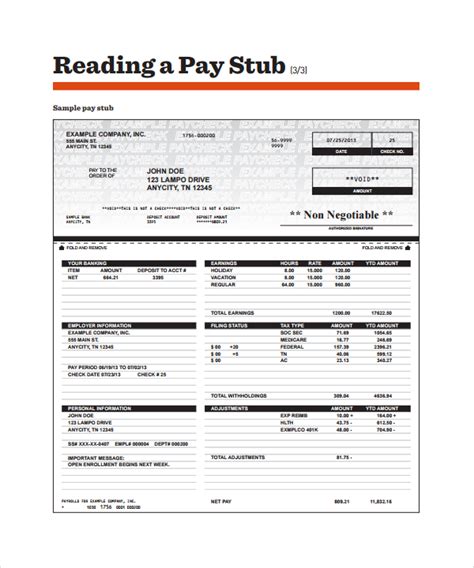

- Input employee data, including name, address, and Social Security number.

- Enter wages, including hourly rate, hours worked, and gross pay.

- Calculate deductions, including taxes, health insurance, and 401(k) contributions.

- Generate the pay stub, which will display the employee's net pay, deductions, and other relevant information.

Features of Pay Stub Calculator Excel

The pay stub calculator Excel template boasts an array of features, including: * Automated calculations: Built-in formulas and calculations ensure accuracy and efficiency. * Customizable: Fully customizable template allows users to tailor it to their specific needs. * Employee data management: Easily manage employee data, including name, address, and Social Security number. * Wage and deduction calculations: Calculate gross pay, net pay, and deductions with ease.Advantages of Pay Stub Calculator Excel Over Manual Calculations

The pay stub calculator Excel template offers several advantages over manual calculations, including:

- Accuracy: Automated calculations reduce the risk of errors, ensuring accurate pay stubs.

- Efficiency: Quick and easy generation of pay stubs saves time and streamlines payroll operations.

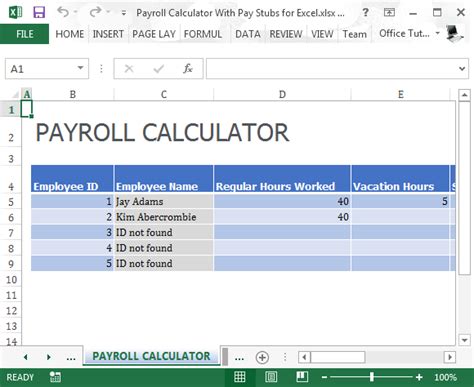

- Scalability: Easily manage large datasets and generate multiple pay stubs with ease.

- Cost-effectiveness: Eliminates the need for manual calculations and reduces the risk of errors, saving costs.

Common Mistakes to Avoid When Using Pay Stub Calculator Excel

When using the pay stub calculator Excel template, it's essential to avoid common mistakes, including: * Inaccurate employee data: Ensure that employee data is accurate and up-to-date. * Incorrect wage and deduction calculations: Double-check calculations to ensure accuracy. * Failure to update template: Regularly update the template to ensure compliance with changing tax laws and regulations.Best Practices for Using Pay Stub Calculator Excel

To get the most out of the pay stub calculator Excel template, follow these best practices:

- Regularly update the template to ensure compliance with changing tax laws and regulations.

- Ensure accurate employee data and wage and deduction calculations.

- Use the template consistently to streamline payroll operations and reduce errors.

- Consider seeking professional advice if unsure about any aspect of payroll processing.

Pay Stub Calculator Excel and Tax Compliance

The pay stub calculator Excel template is designed to ensure tax compliance, with built-in calculations for federal, state, and local taxes. However, it's essential to regularly update the template to ensure compliance with changing tax laws and regulations. Failure to do so may result in penalties and fines, emphasizing the importance of staying up-to-date with tax compliance.Pay Stub Calculator Excel and Payroll Processing

The pay stub calculator Excel template is an essential tool for payroll processing, enabling employers to quickly and accurately generate pay stubs for their employees. With its automated calculations and customizable template, this tool streamlines payroll operations, reducing errors and saving time. Whether you are a small business owner or a payroll professional, the pay stub calculator Excel template is an indispensable tool for managing payroll operations.

Pay Stub Calculator Excel and Employee Data Management

The pay stub calculator Excel template also includes features for employee data management, enabling users to easily manage employee data, including name, address, and Social Security number. This feature is essential for payroll processing, as accurate employee data is required for tax compliance and benefits administration.Pay Stub Calculator Excel Image Gallery

What is a pay stub calculator Excel template?

+A pay stub calculator Excel template is a pre-designed spreadsheet that allows users to input employee data, wages, and deductions to generate accurate pay stubs.

What are the benefits of using a pay stub calculator Excel template?

+The benefits of using a pay stub calculator Excel template include accuracy, efficiency, customizability, and cost-effectiveness.

How do I use a pay stub calculator Excel template?

+To use a pay stub calculator Excel template, simply download and install the template, input employee data, wages, and deductions, and generate the pay stub.

What features does a pay stub calculator Excel template typically include?

+A pay stub calculator Excel template typically includes automated calculations, customizable templates, employee data management, and wage and deduction calculations.

Is a pay stub calculator Excel template suitable for small businesses?

+Yes, a pay stub calculator Excel template is suitable for small businesses, as it is easy to use, customizable, and cost-effective.

In conclusion, the pay stub calculator Excel template is a valuable tool for payroll processing, offering accuracy, efficiency, and customizability. By following best practices and avoiding common mistakes, employers can ensure accurate and timely pay stubs, streamlining payroll operations and reducing errors. Whether you are a small business owner or a payroll professional, the pay stub calculator Excel template is an indispensable tool for managing payroll operations. We invite you to share your experiences with pay stub calculator Excel templates and provide feedback on how to improve this article. Please comment below and share this article with others who may benefit from this information.